How will the dollar react to the shutdown? So far, the market isn't jumping the gun—it's not rushing ahead of the train. However, economists have reviewed historical price data and found that during the last three government shutdowns, the dollar has inevitably declined. The decline didn't start immediately—it kicked in over time and even continued after the shutdowns ended. In simpler terms, a shutdown is like a time-delayed landmine for the U.S. dollar.

Take the previous shutdown, for example, which ironically happened under Trump's first term in 2018–2019. It was the longest government shutdown in U.S. history, lasting 35 days. During that time, the dollar lost about 2% of its value. That might not sound catastrophic, but back then, there weren't nearly as many other forces weighing down the dollar on the forex market. Today, the shutdown is far from the dollar's biggest problem.

The looming issue of future monetary policy easing by the Federal Reserve promises even greater losses for the dollar. The still-escalating trade war is poised to further erode the value of the U.S. currency. And if Trump continues to criticize the FOMC and attempts to fire every official who doesn't want to cut rates, the dollar will continue to drop. The shutdown is merely the cherry on a three-tiered cake—each layer pulling the dollar lower in the coming years. One of the many cherries, to be sure, since other, less prominent factors are also gnawing away at demand for the greenback.

Among them: the labor market, business activity, and the unemployment rate—all of which are slated for release this week. But due to the government shutdown, this data might never see the light of day. Investors would be justified in interpreting this uncertainty as yet another reason to sell the U.S. dollar. Markets hate uncertainty—and during Trump's presidency, uncertainty is arguably the hallmark of the administration. Now imagine a situation where even key economic data stops coming out. How would markets, or even the Fed, gauge the state of the U.S. economy—especially the labor market, which is critical for shaping FOMC policy? In my view, traders may prefer to err on the side of caution and sell off the dollar until Trump finds common ground with the Democrats.

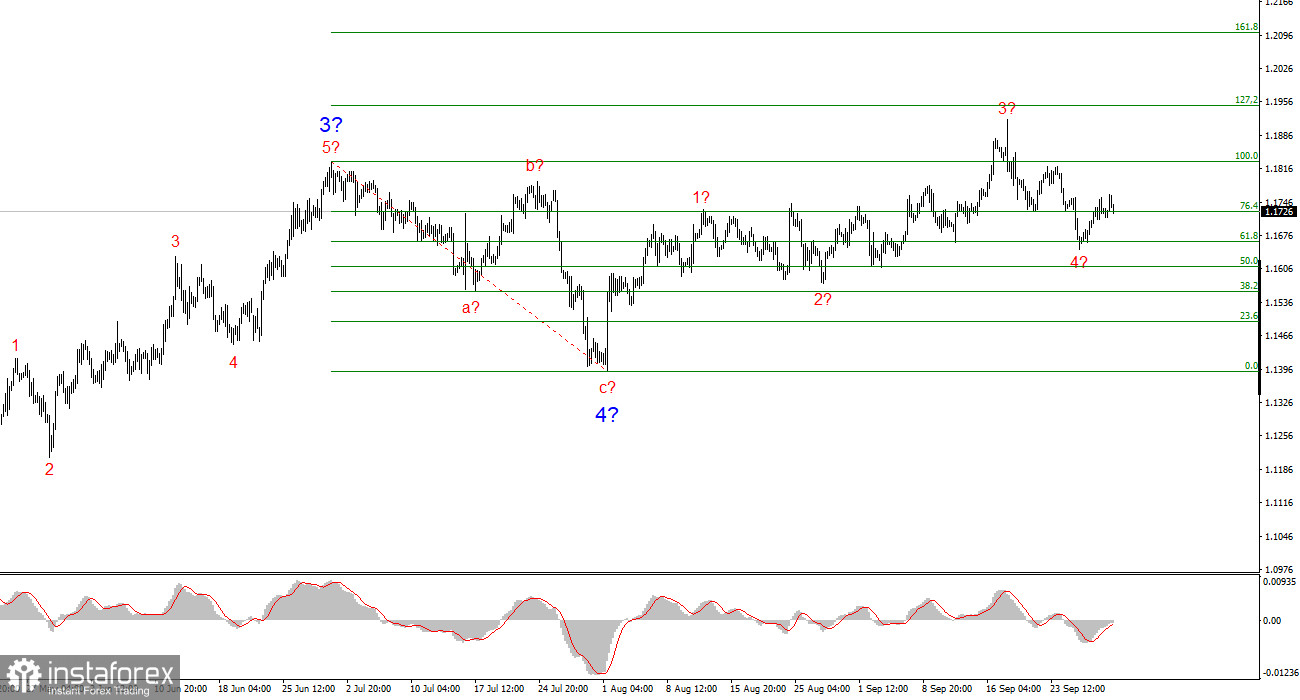

Wave Pattern on EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. The wave layout remains entirely dependent on the news backdrop tied to Trump's decisions, as well as the internal and external politics of the new White House administration. The current trend segment could extend as far as the 1.25 area. At the moment, a corrective wave four is unfolding, which may already be complete. The upward wave structure remains intact. Therefore, in the near term, I'm only considering buying opportunities. By the end of the year, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci.

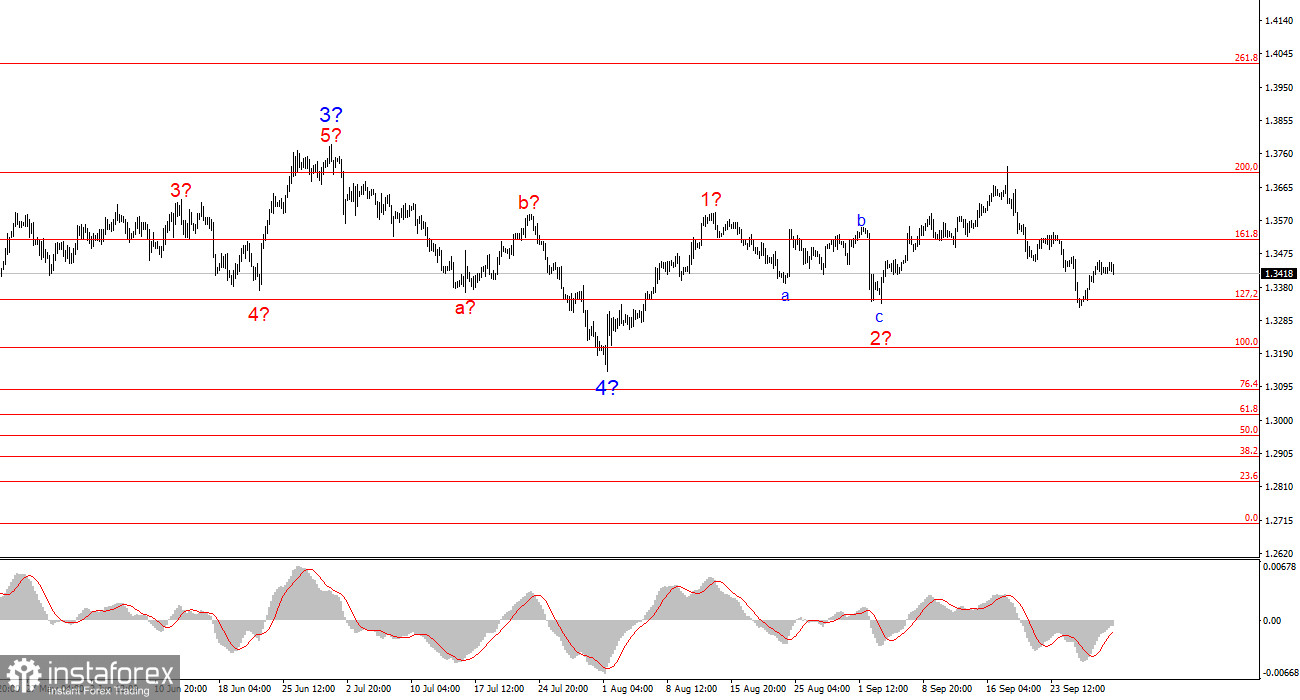

Wave Pattern on GBP/USD:

The wave pattern on GBP/USD has changed. We are still dealing with an upward, impulsive segment of the trend, but its internal structure is becoming harder to read. If wave 4 takes the form of a complex three-wave pattern, the structure will normalize, but even in that case, wave four would be far more complex and extended than wave 2. In my opinion, the best reference point right now is 1.3341, which corresponds to the 127.2% Fibonacci level. Two failed attempts to break this mark may indicate the market's readiness for new buying momentum.

Key Principles of My Market Analysis:

- Wave structures should be simple and clear. Complex structures are harder to trade and often signal a shift.

- If you're uncertain about what's happening in the market, it's better to stay on the sidelines.

- There is no 100% certainty in market direction, and it will never exist. Always use protective stop-loss orders.

- Wave analysis can and should be combined with other forms of analysis and trading strategies.