Macroeconomic Report Analysis:

Several macroeconomic reports are scheduled for release on Wednesday. The most important among them are the U.S. ISM Manufacturing PMI and euro area inflation. It's worth noting that although inflation no longer has a major direct impact on ECB monetary policy decisions, a high reading could significantly reduce the likelihood of further rate cuts — and perhaps even increase the chance of future rate hikes. Therefore, high inflation in the eurozone is considered a positive factor for the euro.

The ISM Manufacturing PMI is a critical standalone indicator. Also scheduled for release in the U.S. is the ADP employment report. However, traders tend to place greater importance on the Nonfarm Payrolls report.

Fundamental Events Analysis:

A few fundamental events are scheduled for Wednesday — mostly speeches by ECB officials. However, it's worth noting that ECB and Fed representatives gave several interviews on Monday and Tuesday, which had virtually no impact on the movement of major currency pairs. As such, today's speeches are also unlikely to trigger meaningful moves in the euro. The market is in a state of waiting — waiting for developments in the government shutdown and for the release of U.S. labor and unemployment data.

General Conclusions:

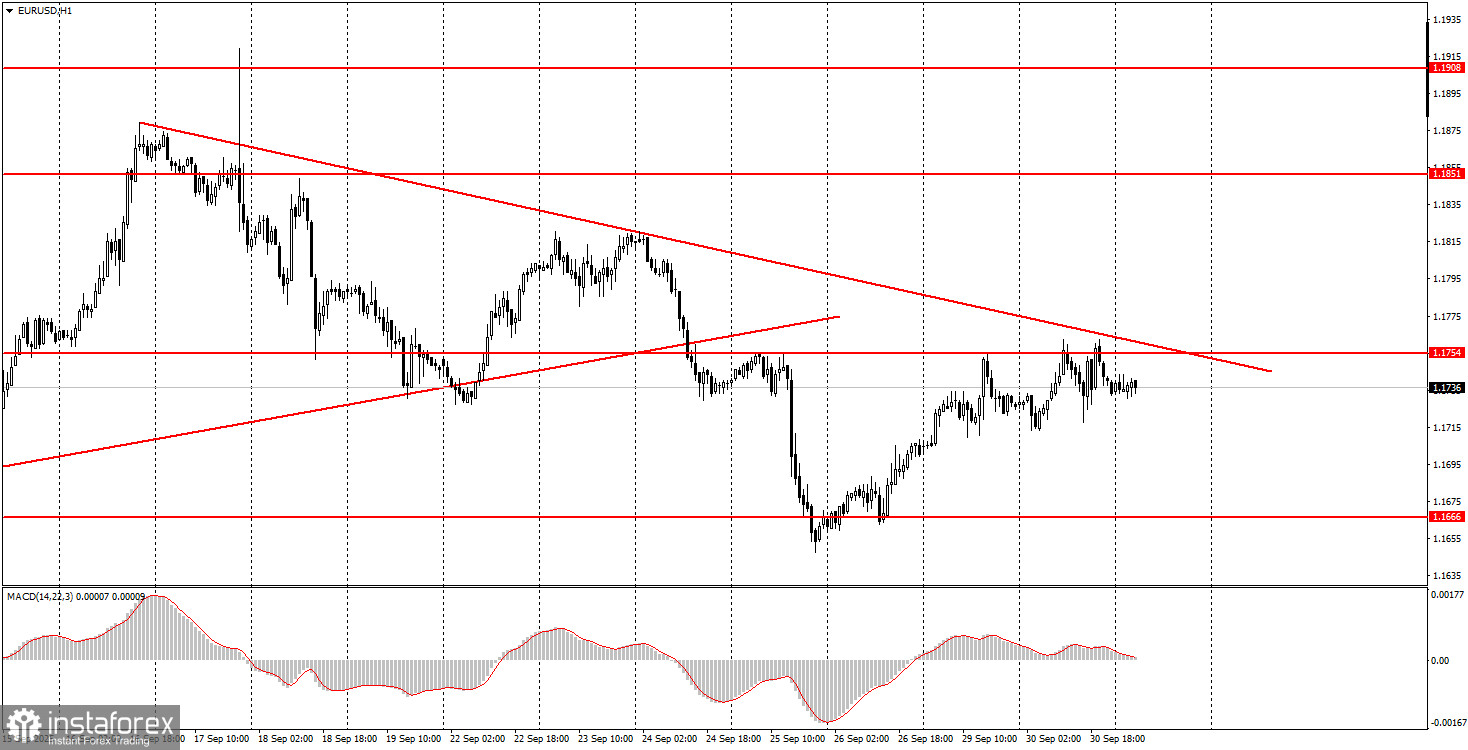

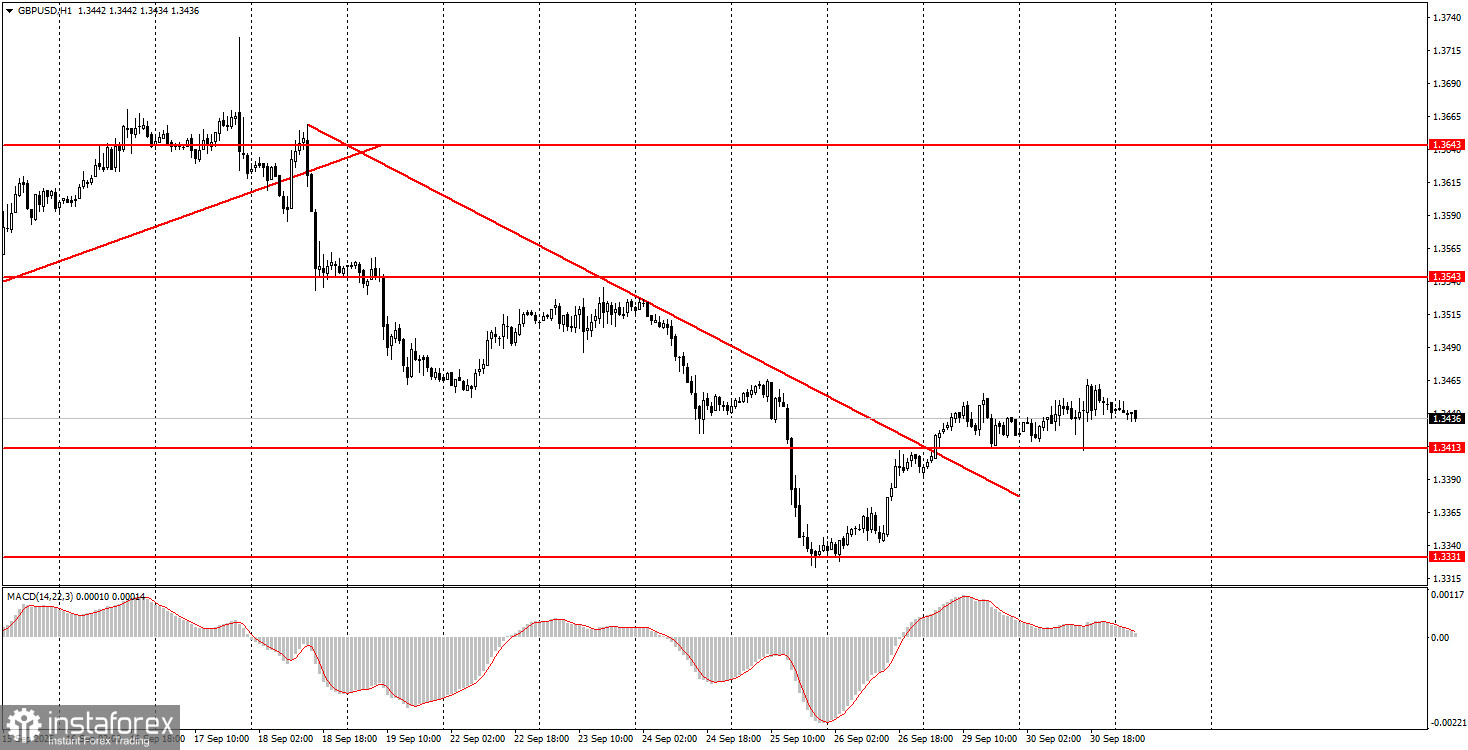

On the third trading day of the week, both currency pairs (EUR/USD and GBP/USD) may move in either direction, as significant macroeconomic data is scheduled for release. GBP/USD has completed its downward trend, and with high probability, the euro has also concluded its bearish phase (though it has not yet broken through its trendline).

For the euro, the pivotal area is 1.1745–1.1754, from which price has bounced four times already. For the pound, important areas for trade entries are 1.3413–1.3421 and 1.3466–1.3475.

Key Trading System Rules:

- The strength of a signal is determined by how quickly the signal forms (rejection or breakout of a level). The shorter the time, the stronger the signal.

- If false signals triggered two or more trades at the same level, all subsequent signals from that level should be ignored.

- During a flat (sideways market), false signals are common or nonexistent. Either way, it's best to stop trading at the first sign of range-bound movements.

- Trades should be opened between the start of the European session and the middle of the U.S. session. All trades must be manually closed after that time.

- On the 1H time frame, MACD indicator signals should be used only during trending markets and when supported by a trendline or channel.

- If two levels are too close to each other (5 to 20 pips apart), treat them as a single support or resistance zone.

- Once a trade moves 15-20 pips in the desired direction, the Stop Loss should be moved to breakeven.

Key Chart Elements:

Support and resistance price levels: Targets to consider when opening buy or sell trades. Potential take-profit levels can be placed near them.

Red lines: Trendlines or channels indicating the current market direction and preferred trading bias.

MACD (14,22,3) indicator: Histogram and signal line used as a secondary signal generator.

Important speeches and news reports (always listed in economic calendars) can have a strong impact on currency movement. Therefore, during such releases, it is advisable to either trade with extreme caution or exit the market altogether to avoid sharp reversals against the prior trend.

Note for beginners: Not every trade can be profitable. Developing a clear strategy and adhering to solid money management principles is the key to long-term success in forex trading.