Trade Review and Advice on Trading the Euro

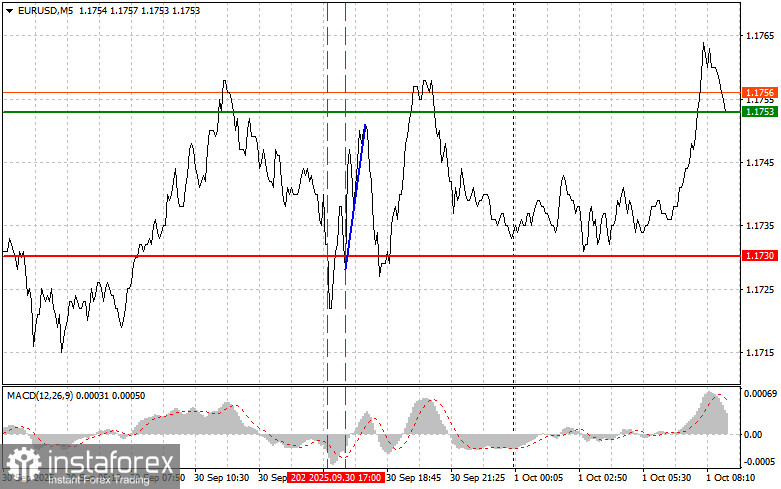

The test of the 1.1730 price level occurred at a time when the MACD indicator had already moved significantly below the zero line, which limited the downside potential of the pair. For this reason, I chose not to sell the euro. The second test of this level coincided with the MACD entering the oversold zone, which triggered the realization of Scenario #2 (Buy) and resulted in a 25-pip upward move.

Yesterday's unexpected drop in the U.S. Consumer Confidence Index for September, as reported by The Conference Board, led to a notable decline in the dollar and a corresponding move higher in the euro. The reported value of 94.2 points came in well below economists' expectations, which had called for a more optimistic reading. This sudden deterioration in sentiment raised concerns about the future of the U.S. economy and was reflected broadly in the weakening dollar.

The drop in consumer confidence can be attributed to a combination of factors, including elevated inflation, high interest rates, and ongoing geopolitical instability. These pressures are weighing on consumer sentiment and their willingness to spend—factors which could slow economic growth in the periods ahead.

Today brings a wave of macroeconomic data that may have a tangible impact on financial markets. Key releases include the euro area's Manufacturing PMI and Consumer Price Index (CPI). Disappointing outcomes from these releases could amplify existing concerns about the eurozone's economic outlook. Additionally, markets will pay close attention to a speech from Bundesbank President Joachim Nagel. His remarks on the current economic landscape, inflation expectations, and the ECB's monetary policy plans may influence the euro's trajectory and overall investor sentiment.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

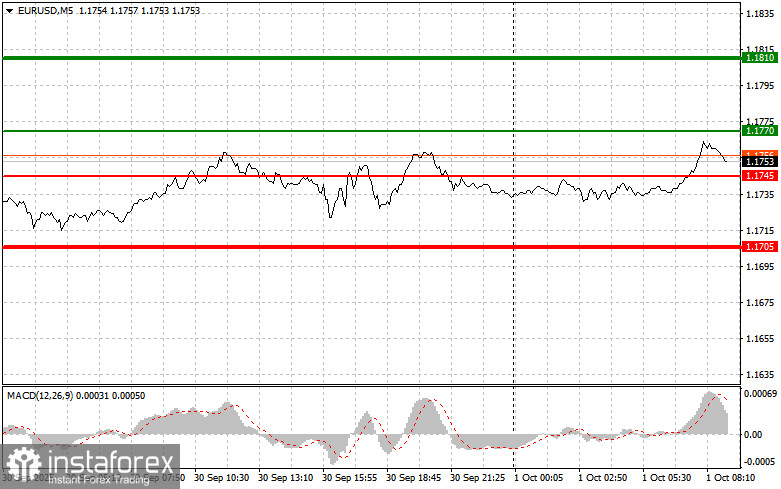

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1770 level (indicated by the green line on the chart), with the upside target at 1.1810. At 1.1810, I plan to exit long trades and initiate sell positions in the opposite direction, counting on a 30–35 pip retracement. A bullish euro outlook is valid only if ECB officials take a firm, hawkish stance. Important! Before buying, ensure the MACD indicator is above the zero level and is just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1745 level while the MACD indicator is in the oversold zone. This would limit the downside potential and could trigger a market reversal to the upside. In this scenario, I expect the pair to rise toward 1.1770 and 1.1810.

Sell Scenario

Scenario #1: I plan to sell the euro after a return to the 1.1745 level (red line on the chart). The downside target in this case is 1.1705, where I would exit short trades and consider switching to long setups in the opposite direction (expecting a 20–25 pip rebound from the level). Selling may become relevant again if today's data from the eurozone disappoints. Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I will also consider selling the euro today if the price tests the 1.1770 level twice in a row while the MACD indicator is in the overbought zone. This would cap the upside potential and could trigger a downward market reversal. In that case, I expect the pair to fall toward 1.1745 and then down to 1.1705.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.