Trade Review and Advice on Trading the British Pound

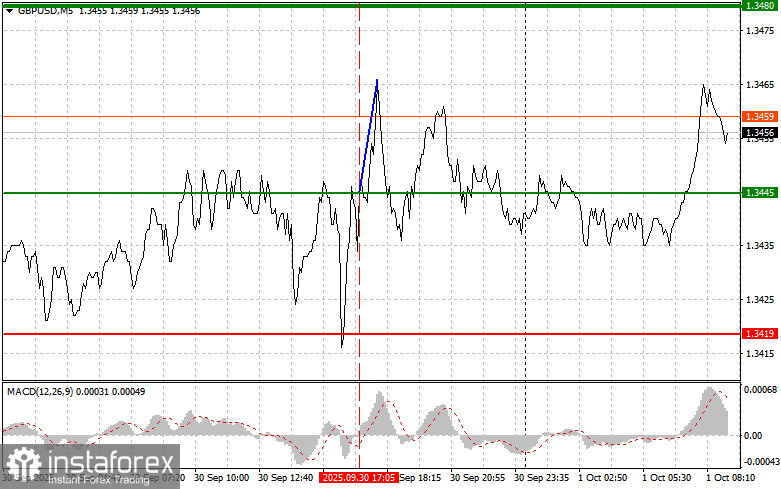

The test of the 1.3445 level occurred at a moment when the MACD indicator had just started moving upward from the zero line — a confirmation of a valid entry point for buying the pound, which resulted in a 20-pip gain.

Today, the British pound continued to rise during the Asian session, benefiting from additional pressure on the U.S. dollar due to the ongoing government shutdown. This shutdown, caused by a lack of consensus on government spending for the upcoming fiscal year, has triggered a wave of concern among investors, prompting them to shift away from dollar-denominated assets in search of safer havens. The pound took advantage of the situation and strengthened as the dollar weakened.

Focus now shifts to the release of the UK Manufacturing PMI, an indicator closely monitored by analysts and economists. Given the recent mixed performance of the manufacturing sector, today's report is significant for assessing future momentum. Strong PMI readings would help support the pound and signal economic resilience, while weaker data could amplify concerns about a looming recession.

Additionally, today's release of the Bank of England Monetary Policy Committee (MPC) meeting minutes will provide investors with comprehensive insights into the rationale behind recent policy decisions. Special attention will be paid to remarks on inflation, growth outlook, and risks to financial stability.

Rounding out the morning agenda is a speech by Catherine L. Mann, a member of the BoE's MPC. Her comments could provide valuable insight into the BoE's stance on monetary policy going forward. Traders will be analyzing her words closely for clues on when the central bank might pause rate hikes or even consider cutting rates.

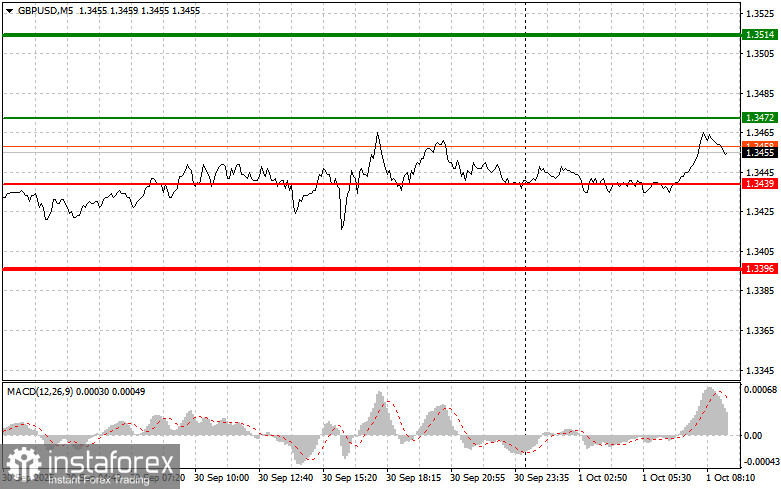

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

- Scenario #1: Today, I plan to buy the pound at around 1.3472 (indicated by the green line on the chart), targeting a move toward 1.3514 (represented by the thicker green line). Near the 1.3514 level, I plan to exit long positions and open short positions in the opposite direction, expecting a pullback of about 30–35 pips. Pound strength is likely to continue following strong data. Important! Before entering a buy trade, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

- Scenario #2: I also plan to buy the pound today if the price tests the 1.3439 level twice in a row while the MACD is in oversold territory. This would signal limited downside potential and likely trigger a bullish reversal. A rebound from here could lead the pair to 1.3472 and 1.3514.

Sell Scenario

- Scenario #1: I plan to sell the pound after a break below 1.3439 (red line on the chart), which may lead to a swift downward move. The key target for sellers will be 1.3396, where I plan to exit short positions and immediately open buys for a potential 20–25 pip rebound from that level. Sellers may seize control at any time. Important! Before entering a short position, confirm that the MACD indicator is below the zero line and just beginning to decline from it.

- Scenario #2: I also plan to sell the pound today if the price tests 1.3472 twice while the MACD is in overbought territory. This would signal capped upside potential and set up a possible reversal to the downside. In this case, a slide toward 1.3439 and 1.3396 may follow.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.