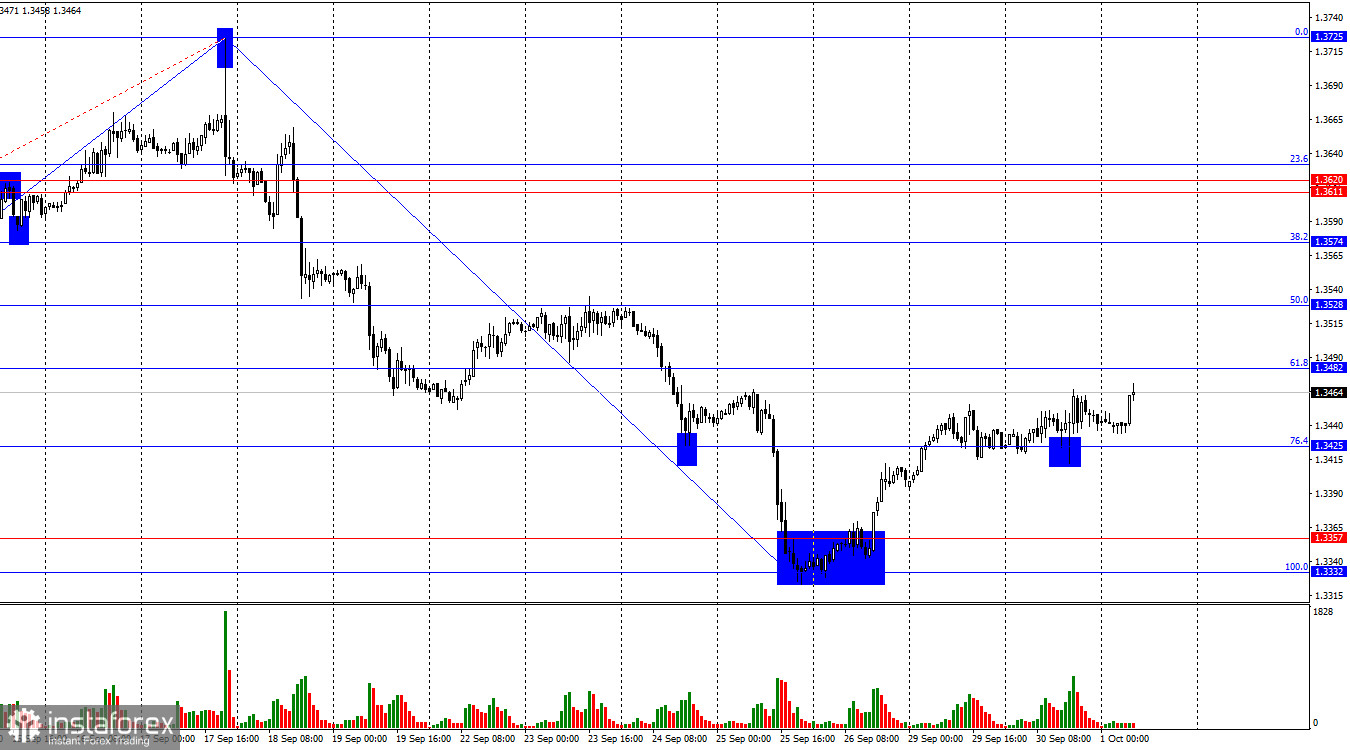

On the hourly chart, the GBP/USD pair on Tuesday continued a very sluggish upward move after consolidating above the 76.4% Fibonacci level at 1.3425. Thus, the pound's growth may continue today towards the next corrective levels at 1.3482 and 1.3528. Consolidation below 1.3425 or a rebound from 1.3482 would work in favor of the U.S. dollar and a pullback toward the nearest levels.

The wave structure remains "bearish." The last completed downward wave broke the previous low, while the new upward wave has not yet broken the last high. The news background for the pound over the past two weeks has been negative, but I believe traders have already fully priced it in. This week, however, the negative background may shift to the dollar. To cancel the "bearish" trend, the pair needs to rise another 300 points, but I think we will see signs of a trend reversal to "bullish" much earlier.

On Tuesday, the UK released its inflation report, which did not encourage bullish traders to launch a new attack. The British economy grew by 0.3% q/q and 1.4% y/y. The annual figure came in above expectations, so the pound could have strengthened slightly. Meanwhile, the U.S. shutdown began today, widely discussed in recent days. Republicans failed to reach an agreement with Democrats on extending funding for at least another two months, which resulted in many government services halting operations and employees being sent on unpaid leave. For the dollar, this is yet another reason to keep falling, but over the next three days traders will closely monitor U.S. economic data. It remains unclear whether these will even be published, since statistical agencies are also affected by the shutdown. However, the absence of data is also bad news for the dollar, as traders will expect the worst, which may lead to new selling of the U.S. currency.

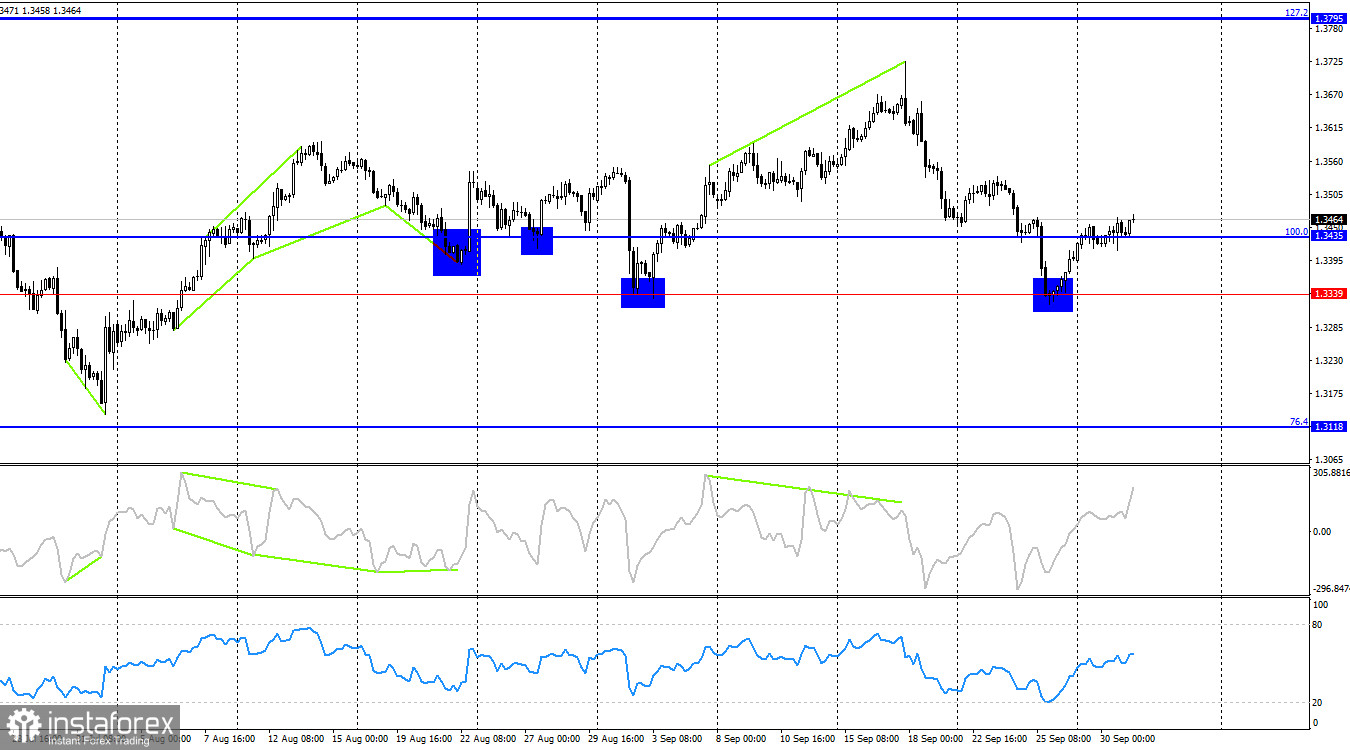

On the 4-hour chart, the pair rebounded from the 1.3339 level and turned in favor of the British pound. Consolidation above the 100.0% Fibonacci level at 1.3435 – increases the likelihood of further growth toward the 127.2% corrective level at 1.3795. No emerging divergences are observed today on any indicator. A new decline in the pound can be expected only after consolidation below 1.3339.

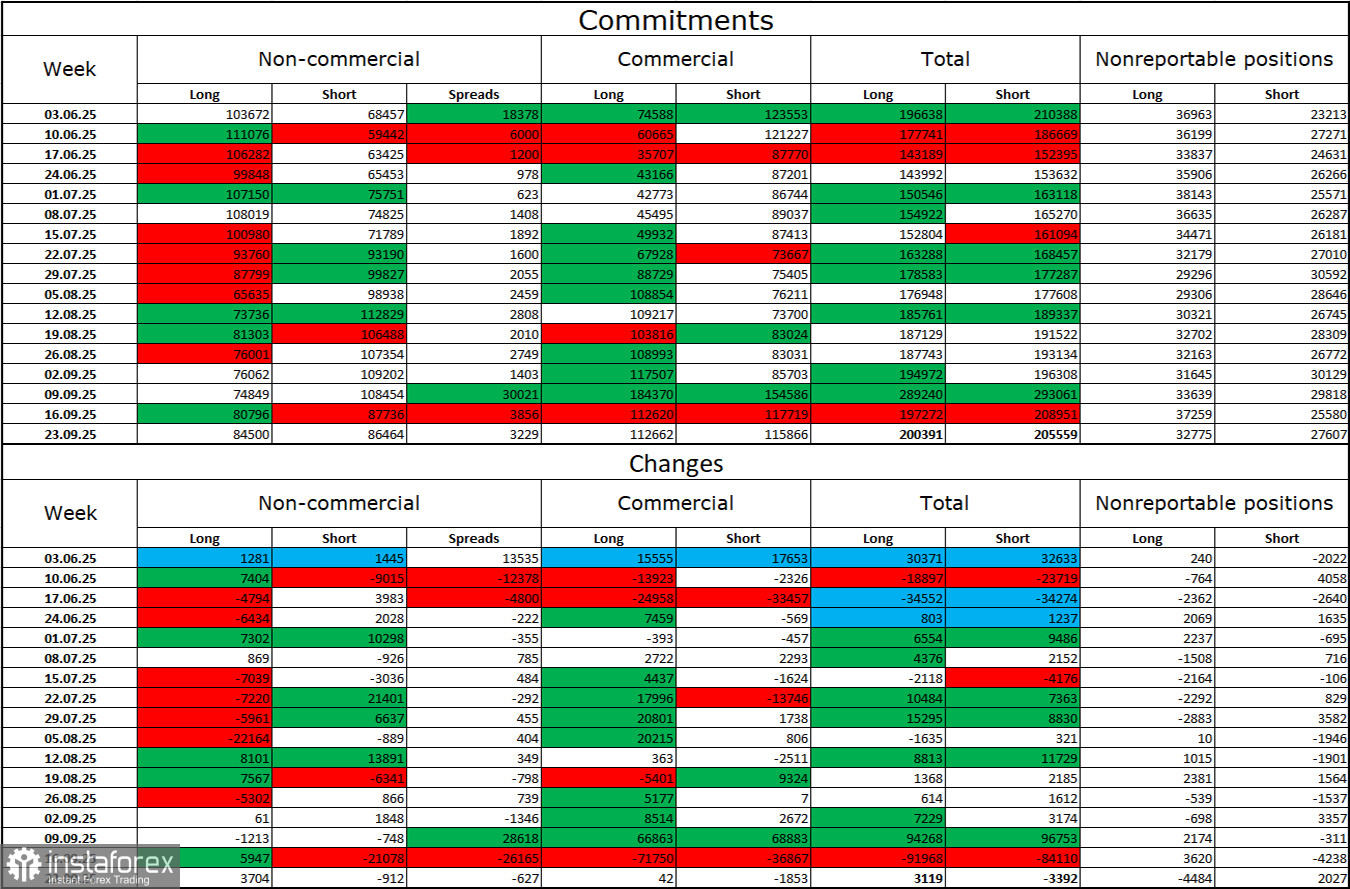

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" in the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between long and short positions now stands at approximately 85,000 versus 86,000. Bullish traders are once again tipping the balance in their favor.

In my view, the pound still retains downward prospects, but with each passing month the U.S. dollar looks weaker and weaker. Previously, traders worried about Donald Trump's protectionist policies without fully understanding the results they might bring. Now they may be concerned about the consequences of that policy: a possible recession, the constant introduction of new tariffs, Trump's battles with the Fed, which could leave the regulator "politically controlled" by the White House. Thus, the pound now appears far less risky than the U.S. currency.

News calendar for the U.S. and the UK:

- U.S. – ADP Employment Change (12:15 UTC).

- U.S. – ISM Manufacturing PMI (14:00 UTC).

The October 1 economic calendar contains two entries, each fairly important. The impact of the news background on market sentiment will be present on Wednesday, particularly in the second half of the day.

GBP/USD Forecast and Trading Advice:

Selling the pair is possible today if the hourly close occurs below 1.3425, targeting 1.3332–1.3357, or in case of a rebound from 1.3482. Buying could be considered from the 1.3332–1.3357 zone with targets at 1.3425, 1.3482, and 1.3528. These trades may be kept open today with a stop-loss moved to breakeven.

Fibonacci grids are built from 1.3332–1.3725 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.