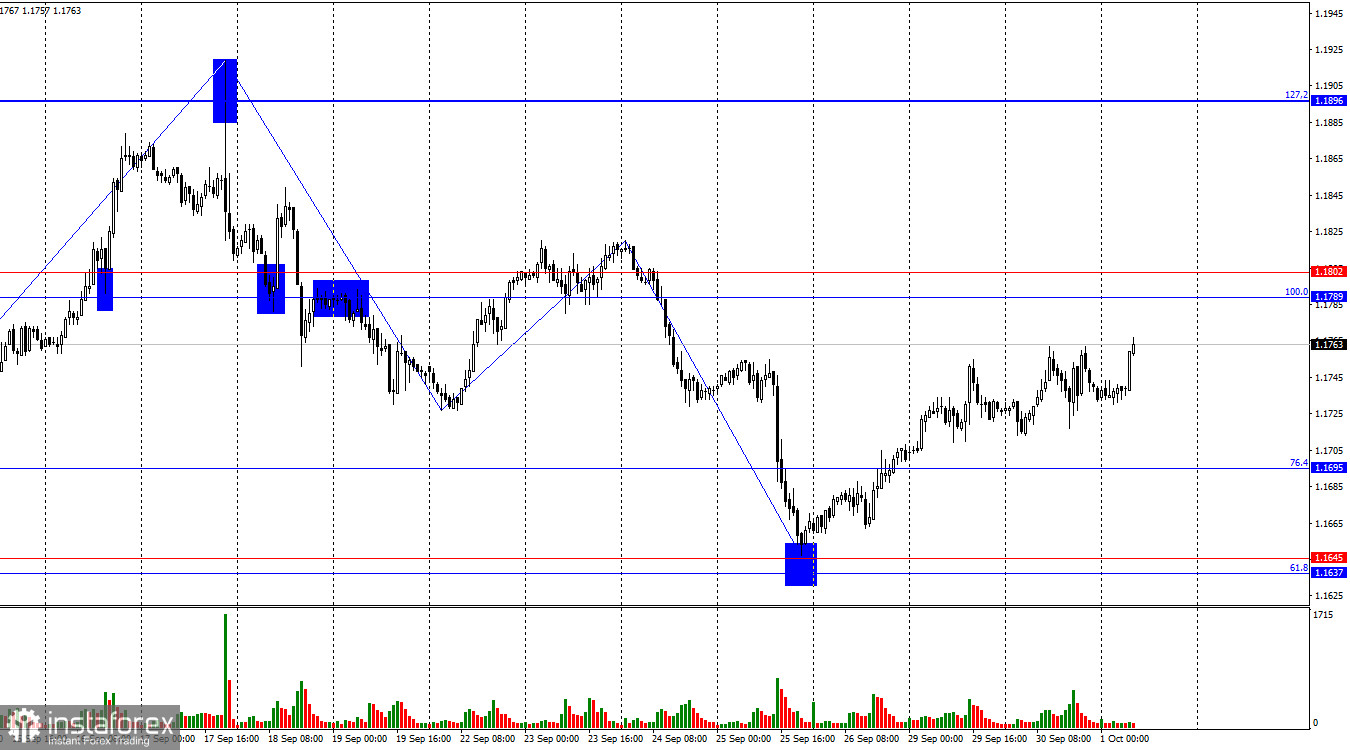

On Tuesday, the EUR/USD pair continued a modest upward move toward the resistance zone at 1.1789–1.1819. A rebound from this zone would work in favor of the U.S. dollar and a decline toward the 76.4% Fibonacci level at 1.1695. Consolidation above 1.1789–1.1819 would increase the likelihood of further growth toward the next corrective level, the 127.2% Fibonacci at 1.1896.

The wave situation on the hourly chart remains simple and clear. The last completed downward wave broke the low of the previous wave, while the new upward wave has not yet broken the previous peak. Thus, the trend is still "bearish" for now. Recent labor market data and the shifting Fed monetary policy outlook support bullish traders, so the trend may begin to change again this week. To complete the "bearish" trend, the price needs to consolidate above the last peak at 1.1819.

Tuesday was full of events, but traders largely ignored them, focusing entirely on the U.S. shutdown, which officially began today. Still, one report deserved attention — German inflation. The Consumer Price Index rose to 2.4% y/y, 0.1% higher than expected. Later today, the eurozone inflation report will be released, which may show acceleration compared to August and could also exceed forecasts. If that happens, bulls may launch a new offensive, as the ECB will shift its focus from easing to tightening monetary policy. Of course, higher inflation than 2.3–2.4% is needed for rate hikes, but everything starts small. In the UK, inflation a year ago was 1.7%, and now it stands at 3.8%. Attention should also be paid today to U.S. ISM and ADP reports.

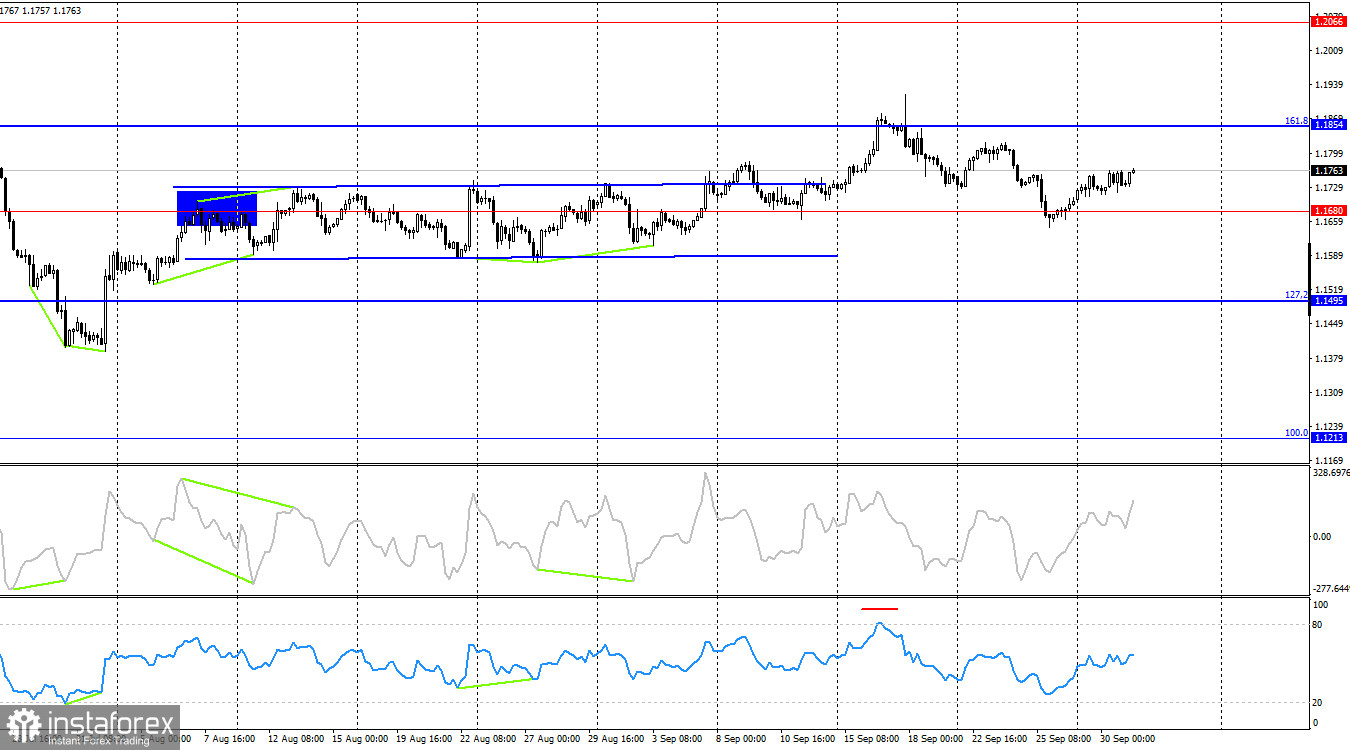

On the 4-hour chart, the pair reversed in favor of the euro around the 1.1680 level. Thus, the upward move may continue toward the 161.8% corrective level at 1.1854. Consolidation below 1.1680 would work in favor of the U.S. dollar and open the way for a decline toward the 127.2% Fibonacci level at 1.1495. No emerging divergences are observed today.

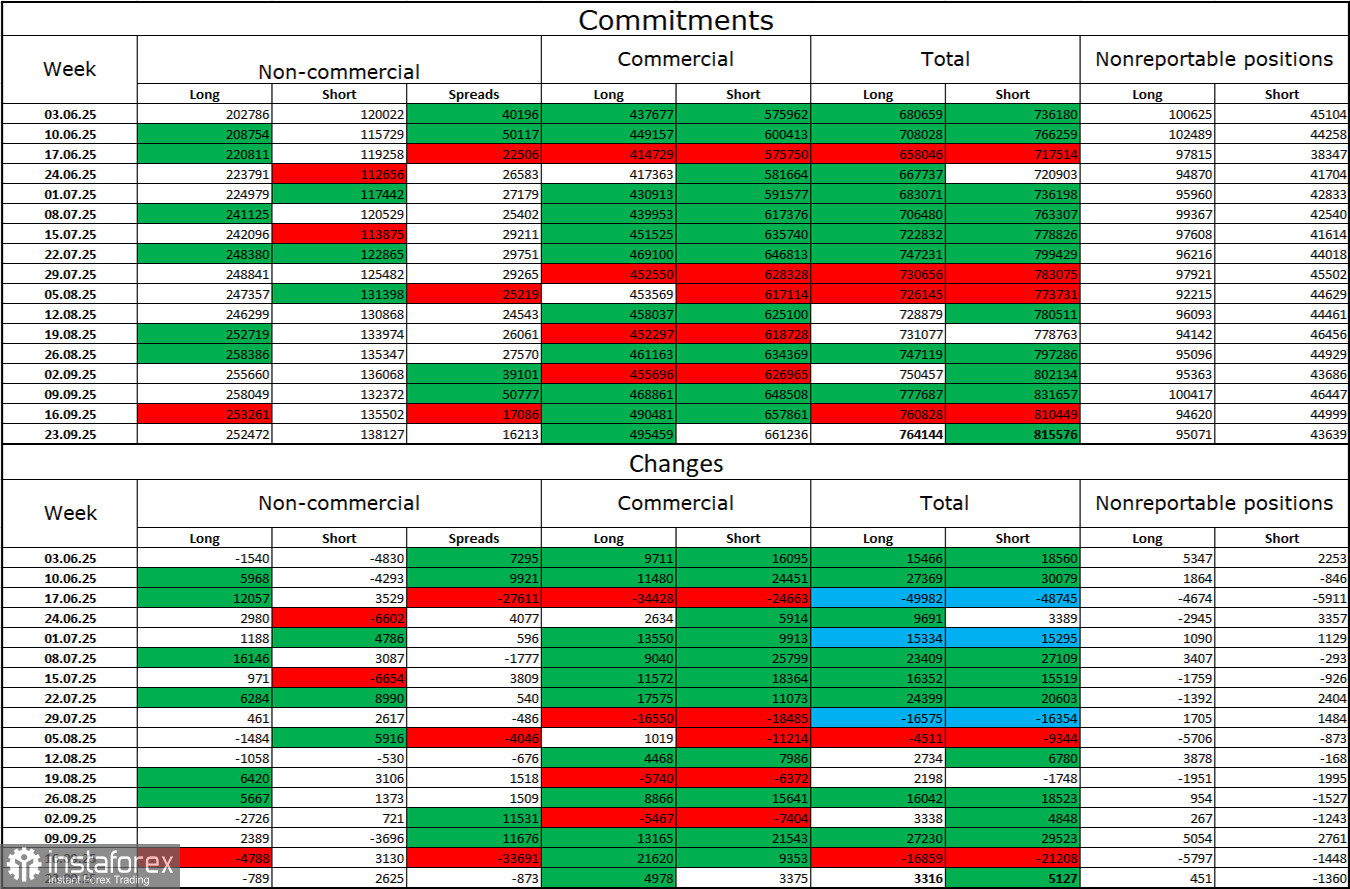

Commitments of Traders (COT) Report:

During the last reporting week, professional players closed 789 long positions and opened 2,625 short positions. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and is strengthening over time. The total number of long positions held by speculators is now 252,000, compared to 138,000 short positions. The gap is effectively twofold. In addition, note the number of green cells in the table above, which indicate strong increases in euro positions. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For thirty-three consecutive weeks, large players have been reducing short positions and adding longs. Donald Trump's policies remain the most influential factor for traders, as they may cause numerous long-term and structural problems for America. Despite several important trade agreements, many key economic indicators show declines.

News calendar for the U.S. and the Eurozone:

- Eurozone – Consumer Price Index (09:00 UTC).

- U.S. – ADP Employment Change (12:15 UTC).

- U.S. – ISM Manufacturing PMI (14:00 UTC).

The October 1 economic calendar contains three entries, each quite important. The influence of the news background on market sentiment will be present on Wednesday.

EUR/USD Forecast and Trader Tips:

Sales were possible after a close below the support level at 1.1789–1.1802 on the hourly chart, with targets at 1.1695 and 1.1637–1.1645. All targets have been reached. New sales will be possible on a rebound from the 1.1789–1.1802 level with a target at 1.1695. Buying was possible on a rebound from the 1.1637–1.1645 zone with targets at 1.1695 and 1.1789–1.1802. Today, these trades can be kept open with stop-loss moved to breakeven.

Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.