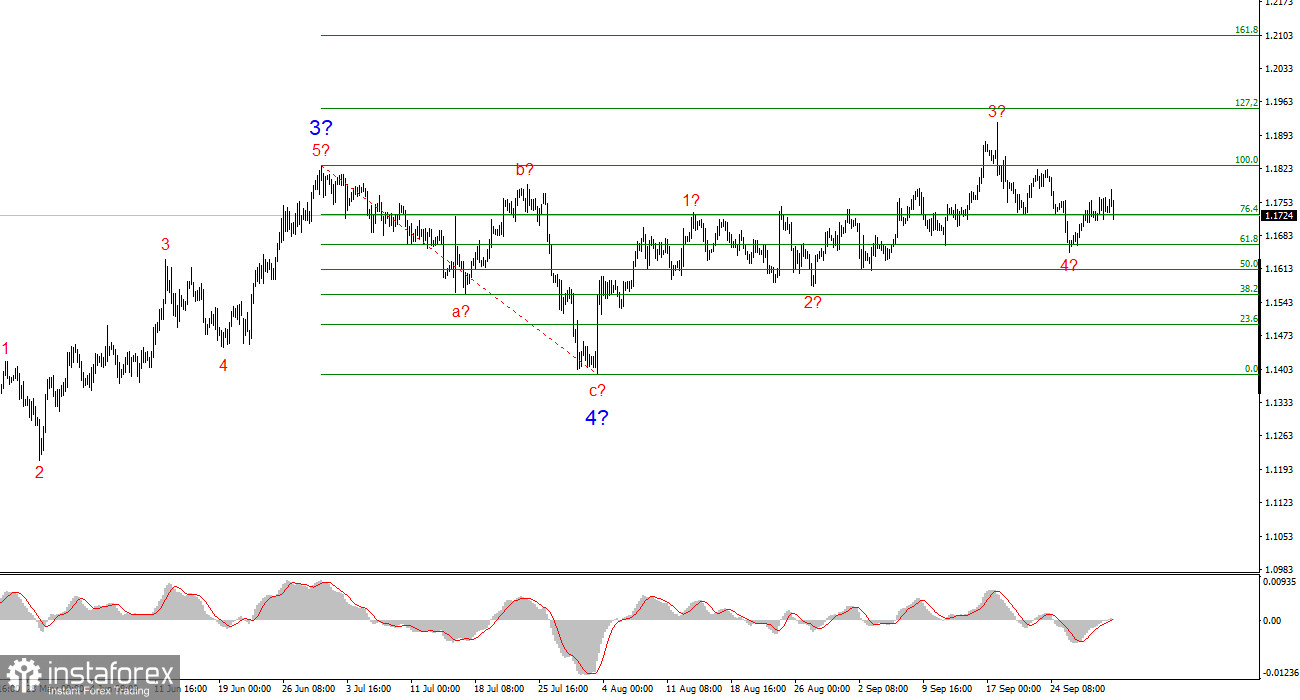

The wave structure on the 4-hour chart for EUR/USD has not changed for several months, but in recent days it has taken on a rather complex form. It is still too early to conclude that the upward section of the trend is canceled, though a more complicated wave structure in the near term is quite possible.

The formation of the upward trend section continues, and the news background largely supports not the dollar but the euro. The trade war initiated by Donald Trump continues. The confrontation with the Fed continues. The market's "dovish" expectations regarding Fed rates are growing. The market holds a very low opinion of Trump's first 6–7 months in office, despite nearly 4% GDP growth in Q2.

At this point, it can be assumed that the construction of impulse wave 5 is underway, with targets possibly extending as high as the 1.25 level. Within this wave, the internal structure is rather complex and ambiguous, but the larger scale does not raise major questions. Three upward waves can currently be identified, suggesting that the instrument is now forming wave 4 within 5, which is taking a three-wave shape and may already be complete. A stronger decline in quotes would require adjustments to the current wave count.

The EUR/USD exchange rate rose by 30–40 basis points during Wednesday ahead of the U.S. session. By the end of the day, U.S. currency losses could be much heavier. In the first half of the day, sellers found support from the eurozone inflation report, which in my view was misinterpreted by market participants. But it is what it is. And just an hour ago, the U.S. ADP employment report was released, which may turn out to be the only labor data this week.

Recall that today the U.S. officially entered a "shutdown." This means that all government agencies without "critical importance" status go into indefinite unpaid leave. In other words, they suspend operations until a budget agreement is reached for the next year. Accordingly, the U.S. Bureau of Labor Statistics is also shutting down. Therefore, Friday's Nonfarm Payrolls and unemployment rate reports will most likely not be released on schedule. To be fair, I wouldn't be 100% certain of this, as many issues are currently being decided "with a phone call from the White House." But at this moment, market participants are forced to assess the U.S. labor market only by the ADP report, which under normal circumstances is considered secondary.

The ADP report today showed September employment at -32,000 jobs. This is the weakest reading in the past 2.5 years. Of course, Nonfarm Payrolls could (or would) have been higher, but now it is not certain we will know.

General conclusions

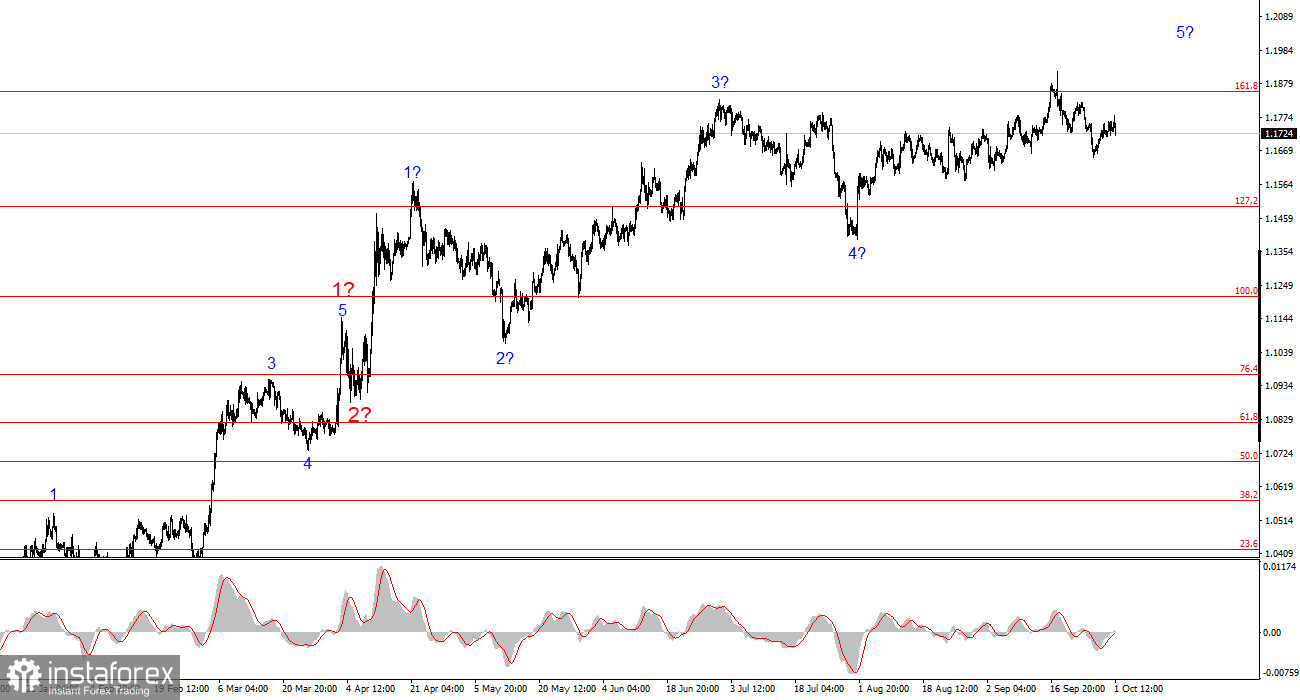

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend section. The wave structure still depends entirely on the news background linked to Trump's decisions, as well as the domestic and foreign policies of the new White House administration. Targets for the current trend section may extend up to the 1.25 level. At this stage, corrective wave 4, which may already be complete, is being formed. The upward wave structure remains intact. Therefore, in the near term, I only consider buying trades. By year-end, I expect the euro to rise to 1.2245, corresponding to the 200.0% Fibonacci level.

On a smaller scale, the entire upward section of the trend can be seen. The wave count is not the most standard, as corrective waves vary in size. For example, the senior wave 2 is smaller than the internal wave 2 within wave 3. However, this happens. I remind you that it is best to focus on clear structures on the charts, rather than forcing every single wave into the count. The upward structure now raises almost no questions.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to revisions.

- If there is no confidence in the market situation, it is better not to enter it.

- There is never 100% certainty in the direction of movement. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.