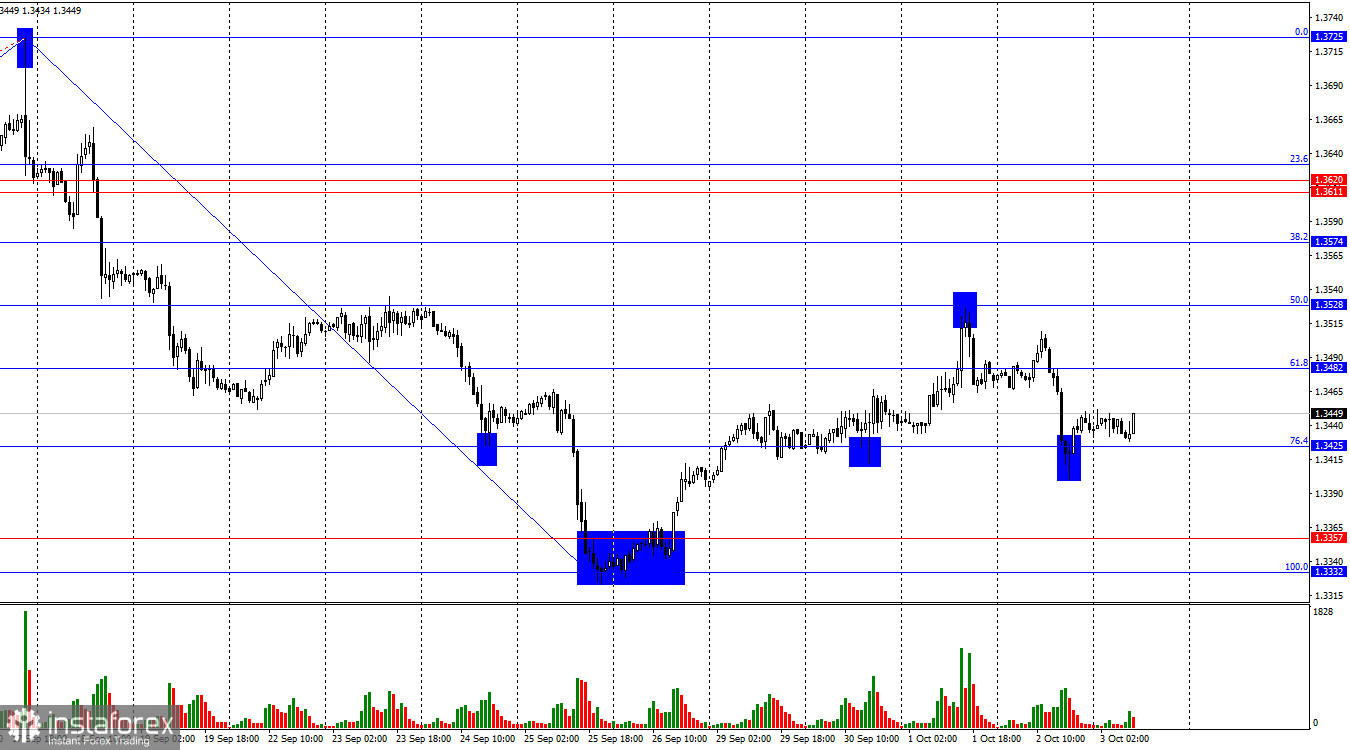

The wave structure remains "bearish." The last completed downward wave broke the previous low, while the new upward wave has not yet broken the last peak. The news background for the pound has been negative over the past two weeks, but I believe it has already been fully priced in by traders. This week, the background is negative for the dollar instead. To cancel the "bearish" trend, the pair needs to rise another 250 pips, but I think we'll see signs of a shift to a "bullish" trend much earlier.

On Thursday, there was no news background, but for the dollar, this is rather positive than negative. Let me remind you that this week the U.S. government and all federal institutions went on leave due to the "shutdown," and the only labor market report, ADP, showed a very weak figure. Thus, the absence of news on Thursday was good for the dollar, which it took advantage of. Most likely, today's cancellation of the Nonfarm Payrolls and unemployment rate releases is also good news for the U.S. currency. Few expect strong readings from the U.S. labor market right now. Therefore, today's reports, had they been released on schedule, would most likely have triggered a new attack from the bulls. Such an attack may occur even without the reports, but at least this way the dollar has some chance. Friday began with bull activity, but the only important events today are the ISM Services PMI and the speech by Bank of England Governor Andrew Bailey. I don't think the dollar is saved, but with payrolls and unemployment data, the situation might have been even worse.

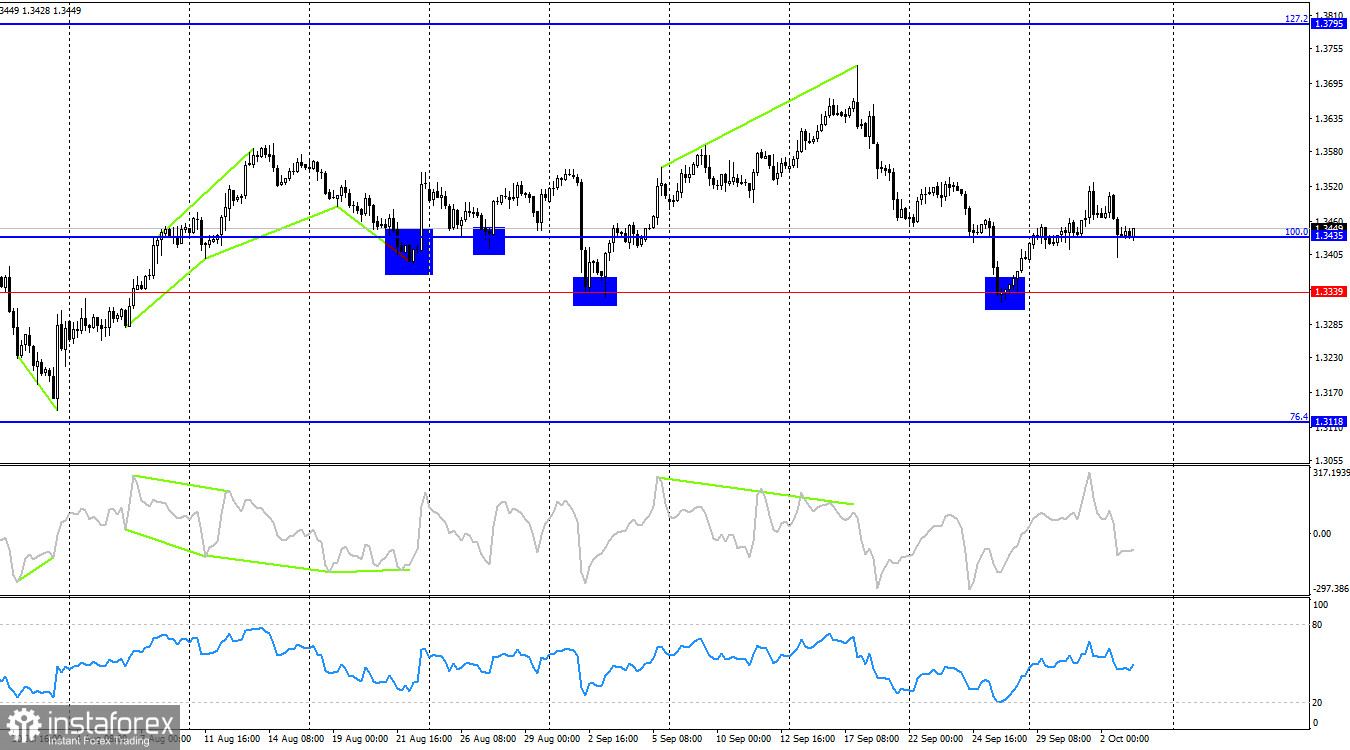

On the 4-hour chart, the pair rebounded from the 1.3339 level and turned in favor of the British pound. A close above the 100.0% Fibonacci level at 1.3435 – increases the probability of continued growth toward the 127.2% retracement level at 1.3795. Today, no emerging divergences are observed in any indicator. A new decline in the pound can be expected only after a close below 1.3339.

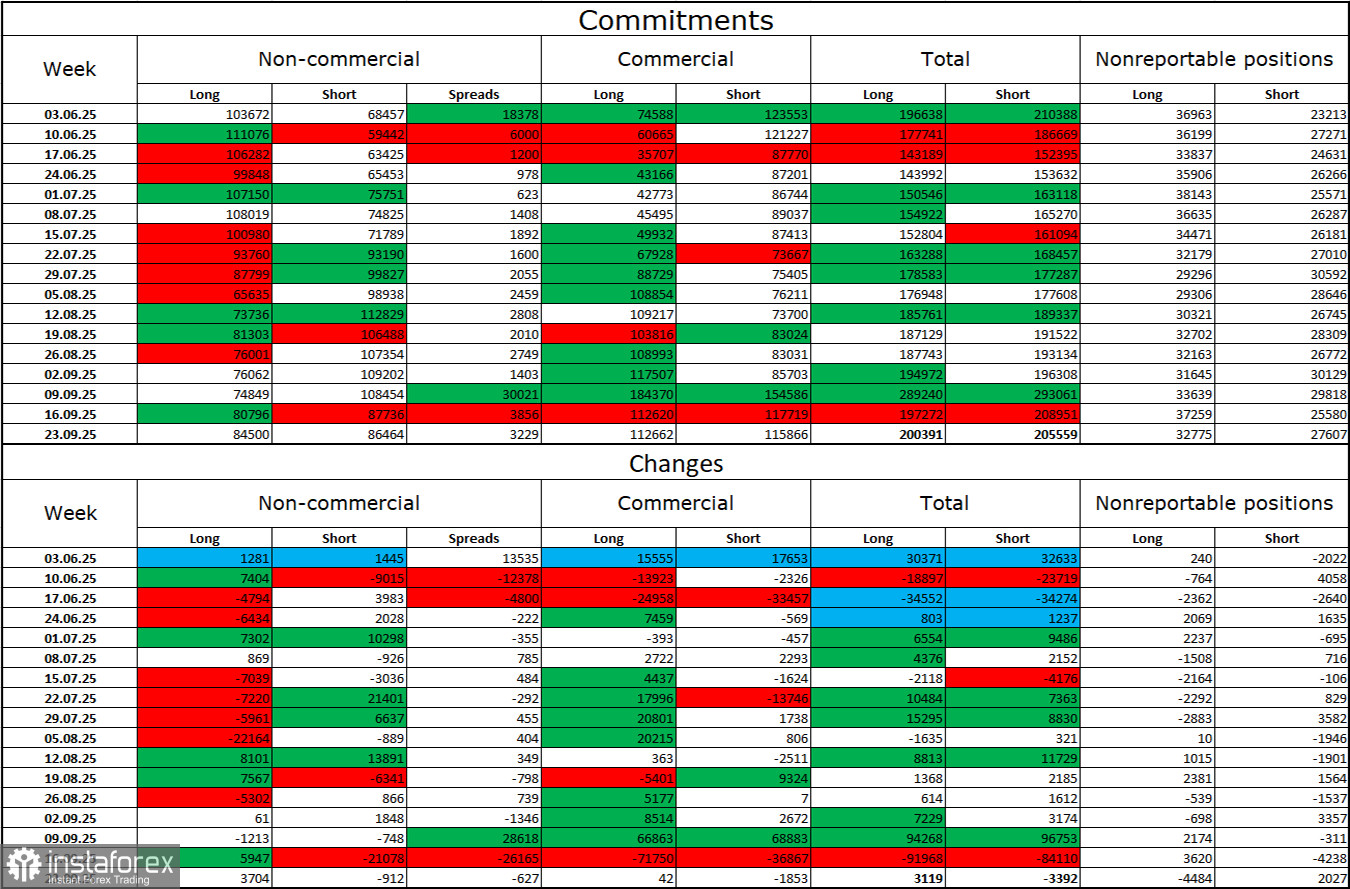

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more "bullish" over the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The gap between the number of long and short positions is now roughly 85,000 vs. 86,000. Bullish traders are once again tipping the balance in their favor.

In my view, the pound still has downward potential, but with each new month the U.S. dollar looks weaker and weaker. Previously, traders worried about Donald Trump's protectionist policies, without fully understanding the consequences. Now, they may be concerned about the results of those policies: a possible recession, the constant introduction of new tariffs, and Trump's confrontation with the Fed, which could result in the regulator becoming "politically controlled" by the White House. Thus, the pound now looks much less dangerous than the U.S. currency.

News Calendar for the U.S. and the U.K.:

- U.S. – Nonfarm Payrolls change (12:30 UTC).

- U.S. – Unemployment rate (12:30 UTC).

- U.S. – Average hourly earnings change (12:30 UTC).

- U.K. – Speech by Bank of England Governor Andrew Bailey (13:20 UTC).

- U.S. – ISM Services PMI (14:00 UTC).

On October 3, the economic calendar contains five important entries, three of which will most likely not be available to traders. Nevertheless, the influence of the news background on market sentiment on Friday is expected to be strong in any case.

GBP/USD Forecast and Trading Advice:

Sales of the pair were possible after a rebound from the 1.3528 level with targets at 1.3482 and 1.3425 on the hourly chart. Both targets have been reached. New sales – on rebounds from 1.3428, 1.3528, or after a close below 1.3425. Purchases could have been considered after a rebound from 1.3425 with targets at 1.3482 and 1.3528. These trades can still be held open, with stop-loss moved to breakeven.

Fibonacci grids are built from 1.3332–1.3725 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.