Bitcoin has reached a new all-time high, hitting $125,710 over the weekend. Ethereum also rose, though not as significantly.

This explosive growth marks the culmination of several weeks of steady accumulation by big players in support of the broader uptrend. A key driver behind the rally is growing global awareness of the instability of fiat currencies, with investors turning to BTC as digital insurance against fiat devaluation.

Bitcoin's new high reflects a broader awakening and increasing trust in a new monetary system. This isn't just hype around another tech breakthrough, but rather a fundamental revaluation of financial principles. As the pioneer of decentralized currencies, Bitcoin offers an alternative to traditional state-controlled monetary systems, which are increasingly viewed as opaque and vulnerable to manipulation.

The surge to new highs demonstrates rising investor awareness of the need to diversify assets and seek tools that can protect wealth from inflation and political instability. The ongoing U.S. government shutdown has become yet another reason for global investors to view Bitcoin not only as a profit-making vehicle but also as a long-term capital preservation asset.

I will continue to rely on major pullbacks in both Bitcoin and Ethereum as buying opportunities, assuming the medium-term bull market remains intact.

Below are short-term trading scenarios for both assets.

Bitcoin

Buy Scenarios

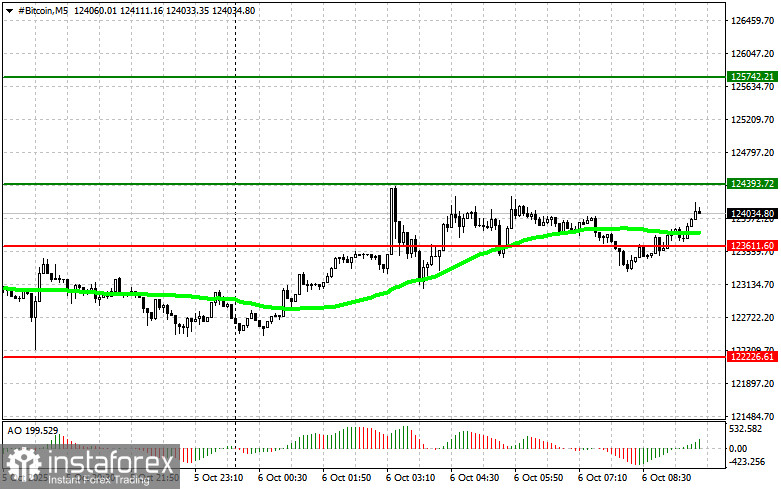

Scenario 1: I plan to buy Bitcoin today at the entry zone around $124,400, targeting growth toward $125,700. At $125,700, I will exit the long position and open a sell trade on a bounce. Before entering a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario 2: An alternative buy setup is from the lower support at $123,600, if no market reaction follows a break below, with targets back at $124,400 and $125,700.

Sell Scenarios

Scenario 1: I plan to sell Bitcoin today at the $123,600 level, targeting a drop to $122,200. Around $122,200, I will exit the short and open a long position on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: A sell opportunity may also occur from around $124,400, if the market fails to break through upward. Target zones would be $123,600 and $122,200.

Ethereum

Buy Scenarios

Scenario 1: I plan to buy Ethereum today at $4,581, targeting a move up to $4,639. Around $4,639, I will exit the long position and sell on a bounce. Before entering on a breakout, confirm that the 50-day moving average is below the current price and the Awesome Oscillator is positive.

Scenario 2: A buy opportunity may arise at $4,536 if the market does not react after a break below. In this case, I will target a return to $4,581 and $4,639.

Sell Scenarios

Scenario 1: I plan to sell Ethereum at $4,536, aiming for a drop to $4,466. I will exit the short and look to buy on a bounce at that level. Before entry, verify that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario 2: I will also consider selling from $4,581 if the market fails to sustain a breakout, with targets at $4,536 and $4,466.