Trade Analysis and Recommendations on the British Pound

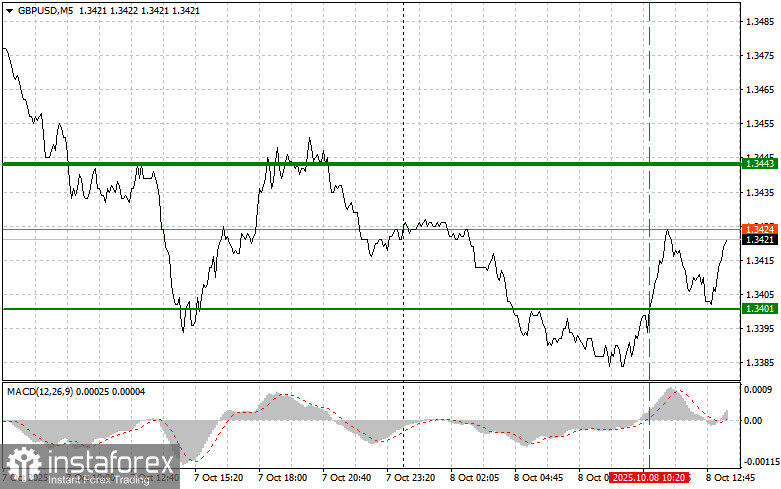

The price test of 1.3401 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound.

The release of the Bank of England meeting minutes supported the pound. The language of the press release was extremely cautious: no hints of a reassessment of the current monetary policy and not a single mention of upcoming interest rate cuts. Such a neutral tone, combined with detailed statistics on inflation expectations, created a sense of stability, which was immediately reflected in the currency markets.

Ahead, a fairly large number of interviews and speeches from Federal Reserve representatives are expected. Attention should be paid to statements by FOMC members Michael S. Barr and Neel Kashkari. In addition, traders need to review the September FOMC meeting minutes. The rate cut in September signals a shift in the Fed's monetary policy approach. The minutes will undoubtedly reveal the reasons that led the regulator to this decision, as well as outline future prospects. The details of the discussion, the arguments "for" and "against," and economic forecasts will provide valuable insights for traders seeking to understand the trajectory of the U.S. economy and, consequently, the movement of financial assets.

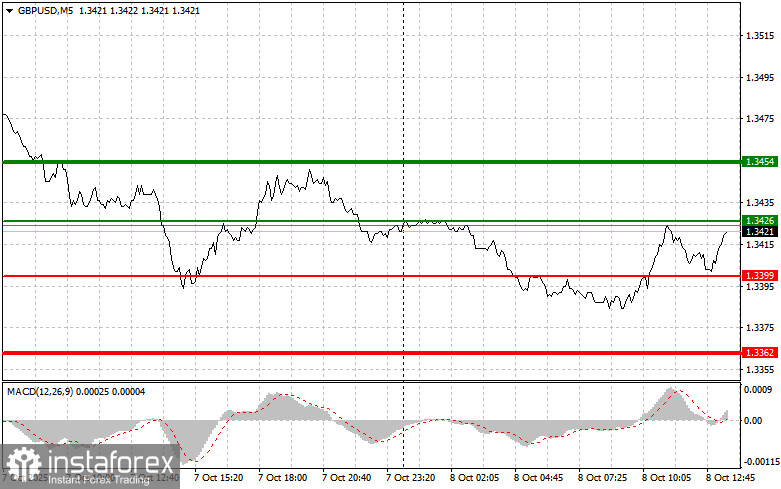

As for intraday strategy, I will rely mainly on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at an entry point around 1.3426 (green line on the chart), targeting growth to 1.3454 (thicker green line on the chart). Around 1.3454, I will close long positions and open short ones in the opposite direction (aiming for a 30–35 point move in the opposite direction). A strong rise in the pound today can only be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of 1.3399, at the moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Growth can be expected to the opposite levels of 1.3426 and 1.3454.

Sell Signal

Scenario #1: Today, I plan to sell the pound after it breaks below 1.3399 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 1.3362, where I will close short positions and immediately open long ones in the opposite direction (aiming for a 20–25 point move in the opposite direction). The pound may fall sharply in the second half of the day. Important! Before selling, make sure the MACD indicator is below zero and just starting to fall from it.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of 1.3426, at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline can be expected to the opposite levels of 1.3399 and 1.3362.

Chart Notes

- Thin green line – entry price for buying the instrument.

- Thick green line – expected price where Take Profit can be set, or where profits can be manually fixed, since further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – expected price where Take Profit can be set, or where profits can be manually fixed, since further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to take into account overbought and oversold zones.

Important: Beginner Forex traders must be extremely cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one I've presented above. Spontaneous trading decisions based on the current market situation are an inherently losing intraday trading strategy.