Trade Analysis and Recommendations on the Japanese Yen

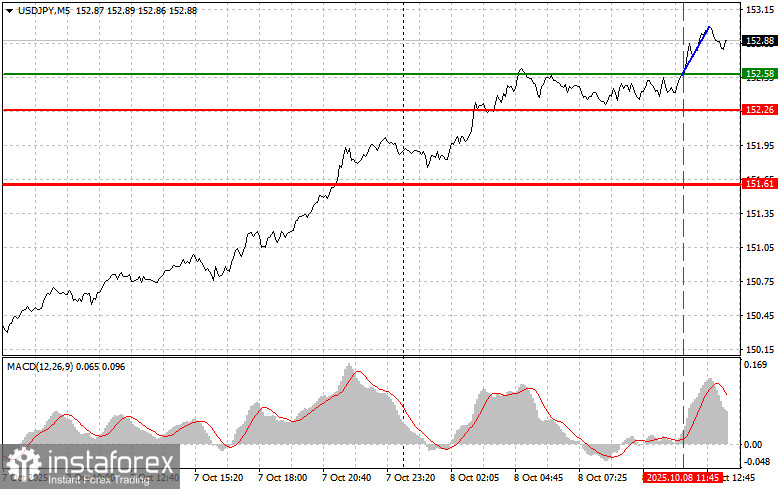

The price test of 152.58 in the first half of the day occurred at a moment when the MACD was just beginning to move upward from the zero mark, which confirmed the correct entry point for buying the dollar in continuation of the bullish trend. As a result, the pair rose by 35 points.

The market is preparing for important interviews. Traders will pay special attention to the statements of FOMC members Michael S. Barr and Neel Kashkari. Equally important will be the publication of the September Fed meeting minutes, where for the first time this year a decision was made to cut interest rates. The minutes will likely outline the reasons that pushed the regulator to this decision and will also highlight future prospects.

Statements by Barr and Kashkari will also be of particular interest. In the current environment, it is crucial for regulators to strike a balance between supporting the labor market and controlling inflation. Their comments will provide insight into the Fed's readiness for further monetary easing. If a dovish tone is absent, the dollar may continue to rise against the yen, similar to yesterday's trend.

As for intraday strategy, I will rely mainly on Scenario #1 and Scenario #2.

Buy Signal

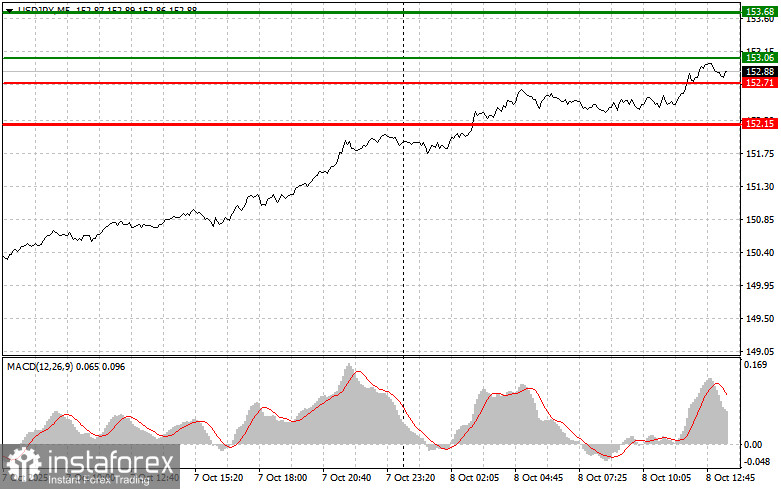

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 153.06 (green line on the chart), targeting growth to 153.68 (thicker green line on the chart). Around 153.68, I will exit long positions and open short ones in the opposite direction (aiming for a 30–35 point move in the opposite direction). Further growth of the pair can be expected in continuation of the morning trend. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of 152.71, at the moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth can be expected to the opposite levels of 153.06 and 153.68.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY after it breaks below 152.71 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 152.15, where I will close short positions and immediately open long ones in the opposite direction (aiming for a 20–25 point move in the opposite direction). Pressure on the pair may return if the Fed representatives adopt a dovish stance. Important! Before selling, make sure the MACD indicator is below zero and just starting to fall from it.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of 153.06, at the moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline can be expected to the opposite levels of 152.71 and 152.15.

Chart Notes

- Thin green line – entry price for buying the instrument.

- Thick green line – expected price where Take Profit can be set, or where profits can be manually fixed, since further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – expected price where Take Profit can be set, or where profits can be manually fixed, since further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders must be extremely cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one I've presented above. Spontaneous trading decisions based on the current market situation are an inherently losing intraday trading strategy.