The U.S. dollar sharply weakened against all major currencies—and with good reason.

Economists are sounding the alarm: Trump's announcement of potential 100% tariffs on Chinese goods immediately sent ripples through the currency market. The dollar experienced a sharp drop, which is bound to have significant implications for the global economy. Traders, concerned about the unpredictable consequences of a renewed trade war, rushed to shift assets into more stable currencies and gold.

The statements also demonstrate once again that Trump has not softened his stance on tariffs and continues to argue that the U.S. is losing money to China. In response, Chinese authorities have declared that while they are open to dialogue, they will mirror any imposed tariffs, further escalating the conflict and risking serious unanticipated effects on the global economy.

Additional pressure on the U.S. currency came on Friday from data showing declining inflation expectations in the United States, increasing the likelihood of a more dovish stance from the Federal Reserve.

Unfortunately, only one macroeconomic data release is expected this morning—Germany's Wholesale Price Index. No other major reports are scheduled. However, this relative calm on the macroeconomic front does not mean stagnation in financial markets. On the contrary, the lack of strong data may actually increase volatility, as markets become more sensitive to trade-related headlines and China's response.

Close attention to Germany's wholesale price index will be key to assessing inflation trends in the eurozone. A weak reading could signal deflation risks. Conversely, faster price growth may tilt the European Central Bank toward a more hawkish stance, potentially affecting the value of the euro and the outlook for European businesses.

As for the British pound, no economic reports are expected today from the U.K. either. The only scheduled event is a speech by MPC member Megan Greene. While Greene is expected to clarify the Bank of England's policy outlook, it is unlikely that she will reveal anything the market doesn't already know. Her comments on inflation risks, economic growth forecasts, and potential future interest rate cuts may affect the pound, but likely only marginally.

If data matches economists' expectations, trading should rely on the Mean Reversion strategy. If data significantly deviates—either above or below expectations—the Momentum strategy is preferred.

Momentum Strategy (Breakout Trading):

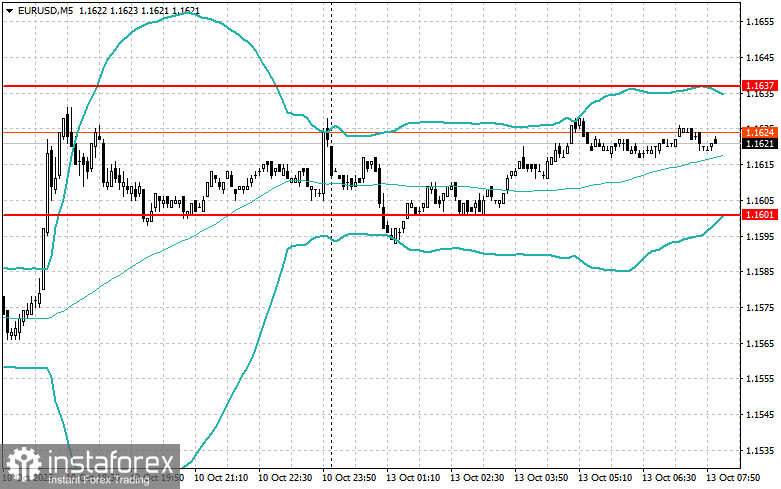

EUR/USD

- Buy on a breakout above 1.1627, targeting 1.1661 and 1.1690

- Sell on a breakout below 1.1610, targeting 1.1575 and 1.1545

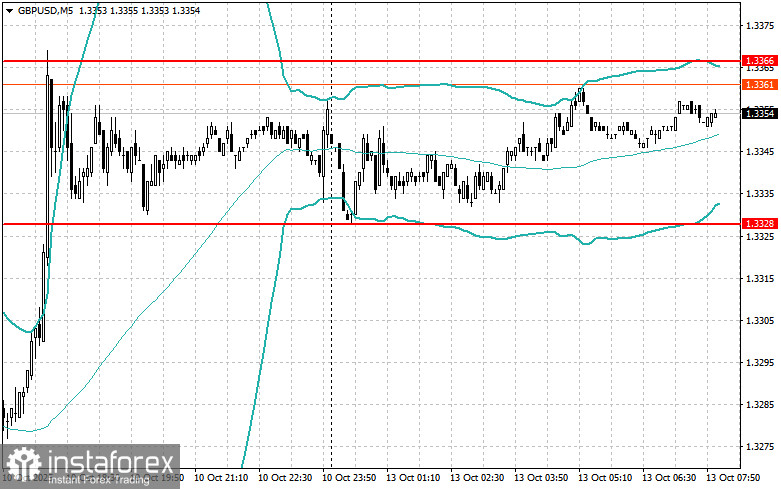

GBP/USD

- Buy on a breakout above 1.3360, targeting 1.3390 and 1.3424

- Sell on a breakout below 1.3330, targeting 1.3290 and 1.3265

USD/JPY

- Buy on a breakout above 152.10, targeting 152.40 and 152.80

- Sell on a breakout below 151.75, targeting 151.35 and 151.00

Mean Reversion Strategy (Return to Range):

EUR/USD

- Look to sell after a failed breakout above 1.1637, returning below the level

- Look to buy after a failed breakout below 1.1601, returning above the level

GBP/USD

- Look to sell after a failed breakout above 1.3366, returning below the level

- Look to buy after a failed breakout below 1.3328, returning above the level

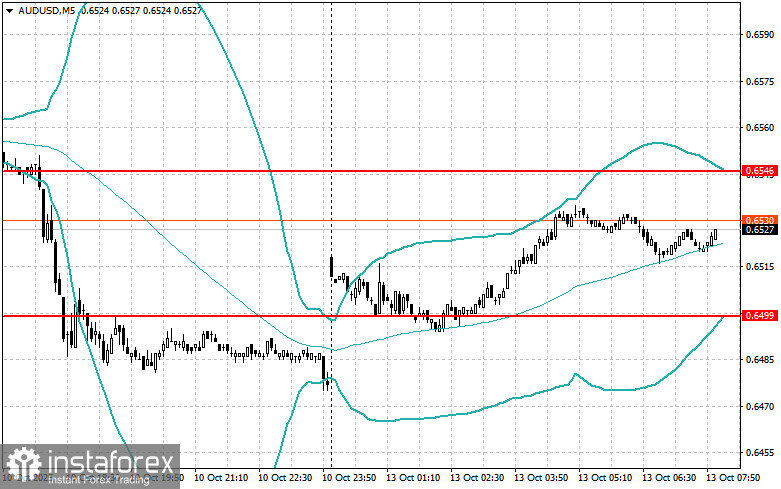

AUD/USD

- Look to sell after a failed breakout above 0.6546, returning below the level

- Look to buy after a failed breakout below 0.6499, returning above the level

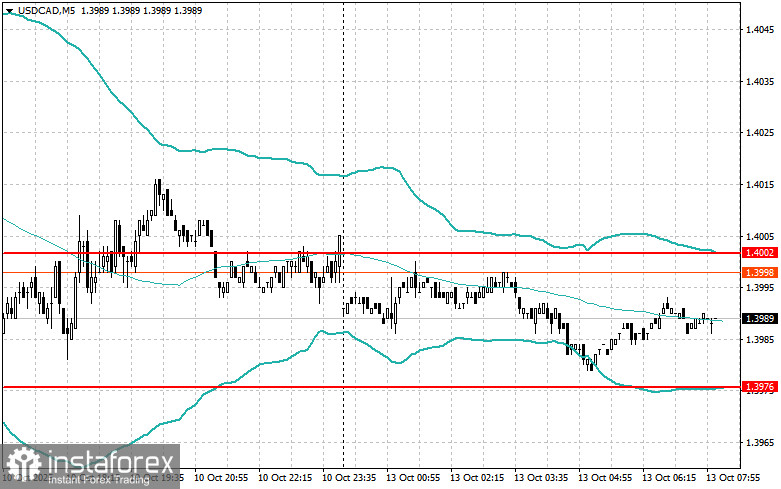

USD/CAD

- Look to sell after a failed breakout above 1.4002, returning below the level

- Look to buy after a failed breakout below 1.3976, returning above the level