Trade Review and USD/JPY Trading Tips

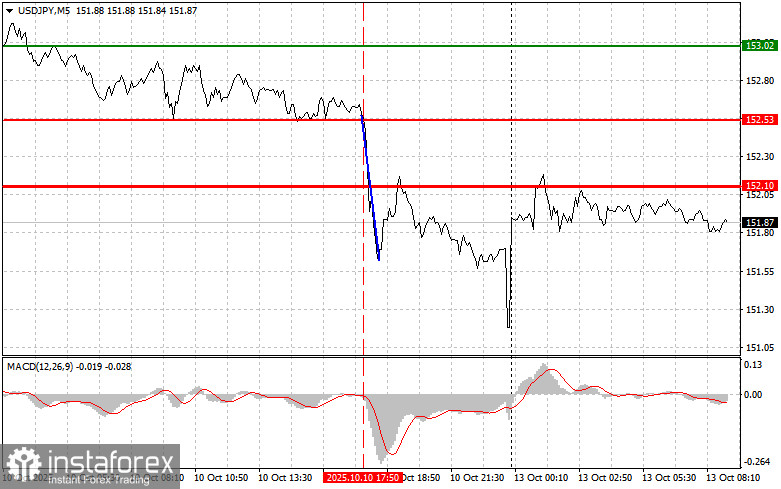

A test of the 152.52 level occurred when the MACD indicator began moving downward from the zero line, confirming a valid entry point for selling the dollar, which resulted in an 80-pip drop in the pair.

The Japanese yen surged sharply, while the dollar declined after Donald Trump announced he is once again considering 100% tariffs on Chinese goods. This sudden spike in the yen—traditionally regarded as a "safe haven" currency—visibly reflected the fear that gripped global markets in response to the president's unexpected announcement.

Investors, fearing another wave of global economic turbulence, rushed to seek safe refuge. The yen, due to its reputation for stability and low volatility, became one of the preferred choices.

The sharp decline in the dollar underscored the vulnerability of the U.S. economy in the face of a potential trade war. The threat of 100% tariffs on Chinese goods not only harms the competitiveness of U.S. companies but also invites retaliatory measures from Beijing that could severely impact American export industries.

The situation is further complicated by the unpredictability of Trump's announcements, which often stem from political maneuvering rather than sound economic rationale. This adds an extra layer of difficulty for investors and businesses forced to strategize amid total uncertainty.

The main question now is whether world leaders will be able to contain the trade tensions or whether we're on the threshold of a new era dominated by protectionism and economic chaos.

As for today's intraday strategy, I will focus primarily on implementing scenarios №1 and №2.

Buy Scenarios

- Scenario №1: I plan to buy USD/JPY today upon reaching the entry point around 152.04 (thin green line on the chart), with a target of rising to 152.56 (thicker green line on the chart). At 152.56, I intend to close long positions and open short positions in the opposite direction, targeting a 30–35 pip correction from the level. It's best to approach buying on corrections and significant pullbacks in USD/JPY.

- Important: Before opening a buy trade, ensure the MACD indicator is above the zero line and has just begun rising from it.

- Scenario №2: I also plan to buy USD/JPY today if there are two consecutive tests of the 151.77 level, while the MACD indicator is in the oversold zone. This would limit the downside potential and could lead to an upward reversal. The expected targets would then be 152.04 and 152.56.

Sell Scenarios

- Scenario №1: I plan to sell USD/JPY today only after a confirmed break below the 151.77 level (thin red line on the chart), which could trigger a rapid decline in the pair. The key target for sellers will be the 151.41 level, where I intend to exit short positions and immediately open long positions in the opposite direction, expecting a 20–25 pip correction from the level.

- Important: Before opening a sell trade, ensure the MACD indicator is below the zero line and has just started declining from it.

- Scenario №2: I also plan to sell USD/JPY today in case of two consecutive tests of the 152.04 level, while the MACD indicator is in the overbought zone. This would restrict the bullish potential and could result in a reversal downward. The expected downside targets in this case would be 151.77 and 151.41.

What's on the Chart:

- Thin green line – entry price level for buying the trading instrument

- Thick green line – approximate level for placing Take Profit or manually locking in gains, as a further rise above this level is unlikely

- Thin red line – entry price level for selling the trading instrument

- Thick red line – approximate level for placing Take Profit or manually locking in gains, as further decline beyond this point is unlikely

- MACD indicator – when entering the market, be guided by its position in the overbought or oversold zones

Important: Beginner forex traders should be extremely cautious with entry decisions. Before major fundamental reports, it's best to remain out of the market to avoid exposure to abrupt price swings. If you do decide to trade during high-impact events, always place stop-loss orders to minimize losses. Without them, your account balance can deplete quickly, especially if you neglect proper money management and trade large volumes.

And remember, successful trading requires a clear plan—like the one presented above. Spontaneous decision-making based solely on the current market situation is an inherently losing strategy for intraday traders.