The GBP/USD currency pair retreated slightly downward on Monday, though not significantly or for long. In principle, we continue to expect just one thing – a new drop in the dollar. We immediately advise traders to switch to the daily time frame and confirm that the upward trend remains intact. In recent months, the market has been in a flat phase. As we've mentioned before, flat markets are a time when major players build new positions. What kind of positions can they be forming in the current circumstances? Buying dollars? Unlikely. That means selling dollars.

If that's the case, then a new wave of the upward trend is only a matter of time. The fundamental backdrop remains not just negative for the dollar, but outright absurd. Recall that in addition to the trade war, the Federal Reserve's monetary easing, Trump's pressure on the Fed and half the world, internal strife, ongoing clashes between civilians and police or military due to new Trump initiatives (such as on immigration), controversial tax, subsidy, and spending laws—America is now experiencing a "shutdown." Democrats refused to approve the Republican budget plan for next year, so the year cannot begin until the U.S. President moderates his ambitions.

However, much has already been said about the "shutdown," and the dollar is currently reacting more to the flat market than to the shutdown. But China's "knight's move" – placing restrictions on the export of rare earth metals – is a bold step. China is the only country in the world negotiating with Washington on equal footing. It has once again made it clear it's ready to negotiate, though the list of contentious issues is long. Still, Beijing is unlikely to sign the same kind of "enslaving" deals as Japan or the EU. China also understands that the stronger their position at the negotiation table, the better. So China is doing exactly what the U.S. does – playing every trump card it has.

The U.S.'s main trump card is a single one – a wealthy, massive consumer market that China certainly doesn't want to lose. China's trump cards are weaker, but there are more of them. Most American factories, remember, are located in China, which now not only has a cheap labor force but also technology, top managers, and engineers. China has not wasted time and is closing in on the U.S. in the race for global dominance. This explains Trump's fervent desire to curb the ambitions of China by any means necessary.

In the meantime, the Fed can calmly go on vacation until the U.S. shutdown ends. The next meeting of the Fed is scheduled for October 29, and it will definitely take place. Only one question remains – on what basis will the Monetary Committee decide on the rate? The inflation report won't be published this week, and the labor and unemployment reports didn't come out last week. Of course, the Fed can lower the rate once again "in advance," since it is evident to everyone that one round of monetary easing is not enough to save the sinking labor market. But even so, it will be a very interesting meeting.

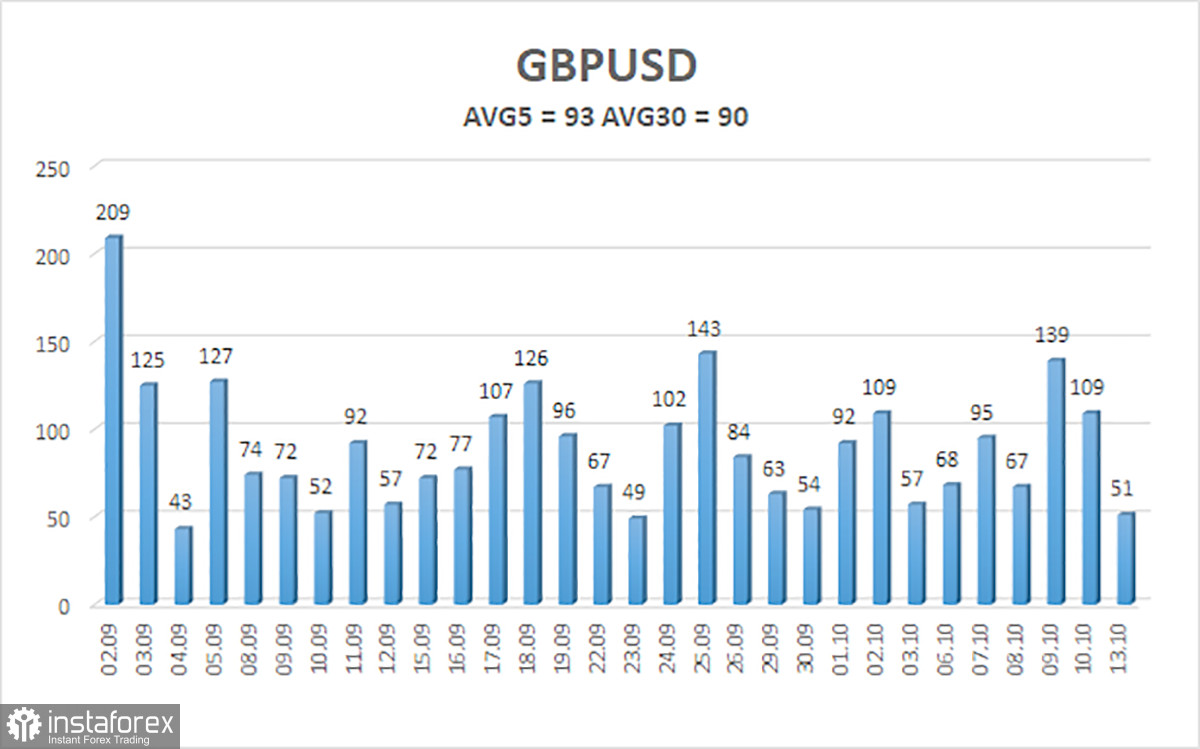

The average volatility of the GBP/USD pair over the last five trading days is 93 pips. For the pound/dollar pair, this value is "average." Therefore, on Tuesday, October 14, we expect movement within the range bounded by levels 1.3235 and 1.3421. The higher linear regression channel is pointed upward, indicating a clear uptrend. The CCI indicator has once again (for the third time) entered the oversold zone, signaling a potential resumption of the upward trend.

Nearest Support Levels:

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

Trading Recommendations:

The GBP/USD currency pair is in a correction, but its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the dollar, so we do not expect growth from the U.S. currency. Thus, long positions with targets of 1.3672 and 1.3733 remain much more relevant while the price is above the moving average. Price movement below the moving average allows for consideration of small short positions with targets at 1.3245 and 1.3235 based on technical grounds. From time to time, the U.S. dollar shows corrections (as it is now), but for a true strengthening trend, it needs real signs of the end of the trade war or other global positive factors.

Explanation of Chart Tools:

- Linear Regression Channels – help identify the current trend. If both channels point in the same direction, the trend is considered strong.

- Moving Average (20,0, smoothed) – indicates short-term direction and defines the preferred trading bias.

- Murray Levels – serve as goalposts for price movements and corrections.

- Volatility Bands (red lines) – represent the expected daily trading range based on recent volatility.

- CCI Indicator – when it enters oversold (< -250) or overbought (> +250) territory, a trend reversal is likely.