Trade Review and Tips for Trading the Japanese Yen

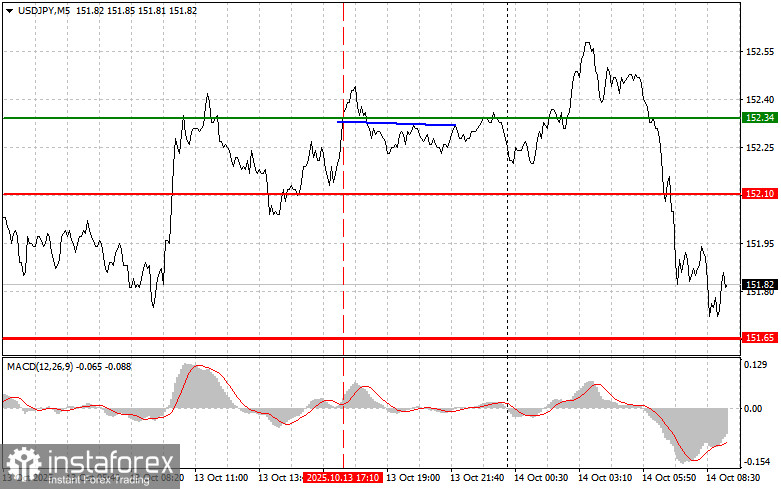

The test of the 152.34 level occurred at a time when the MACD indicator had just started to rise from the zero line, which confirmed a valid entry point for buying the dollar. However, the pair failed to gain significant upward momentum.

The dollar declined again against the yen after a minor rally the day before, which was driven by hopes of easing U.S.-China trade tensions. The optimism proved short-lived, and investors returned to more conservative assets such as the yen amid ongoing global economic uncertainty. The yen's strength stems from its status as a safe-haven currency, which traditionally attracts demand during periods of financial market turmoil. Investors view the yen as a reliable hedge against risks associated with trade wars, slowing economic growth, and geopolitical instability.

Additionally, pressure on the dollar is being exerted by domestic political factors in the United States, especially the ongoing government shutdown. The lack of macroeconomic data is weighing on traders, as it creates uncertainty about the Federal Reserve's next actions. Some economists believe the Fed may abandon plans for further interest rate cuts.

For the intraday strategy, I will rely primarily on Scenarios 1 and 2.

Buy Scenarios

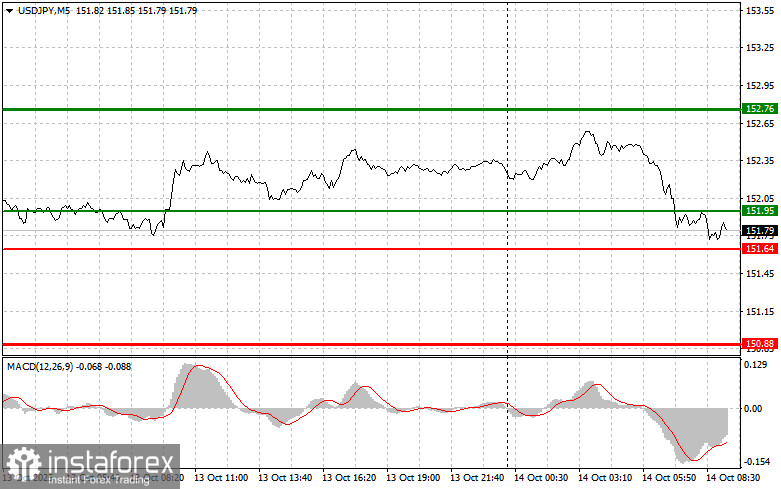

Scenario 1: I plan to buy USD/JPY today if the pair reaches the entry zone near 151.95 (green line on the chart), targeting a rise to 152.76 (thicker green line on the chart). Around the 152.76 level, I plan to close long positions and open short positions in the opposite direction, expecting a pullback of 30–35 pips. Buying the pair is more effective during corrections and deep pullbacks in USD/JPY.

Important: Before entering a buy position, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 151.62 level while the MACD indicator is in oversold territory. This would indicate limited downside potential and could lead to an upward price reversal. Growth toward the opposite levels of 151.95 and 152.76 is expected.

Sell Scenarios

Scenario 1: I plan to sell USD/JPY today only after a breakout below the 151.64 level (red line on the chart), which could cause a sharp decline in the pair. The key target for sellers would be 150.88, where I intend to exit short positions and consider buying immediately in the opposite direction, expecting a 20–25 pip rebound from this level. It is preferable to sell from as high a position as possible.

Important: Before entering a sell position, ensure that the MACD indicator is below the zero line and just beginning to move down from it.

Scenario 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 151.95 level while the MACD indicator is in overbought territory. This will likely cap the pair's upward potential and lead to a reversal downward. In this case, I expect a decline toward the opposite levels of 151.64 and 150.88.

What's on the Chart:

- Thin green line – entry-level for opening buy trades

- Thick green line – projected price for placing Take Profit or closing trades manually, as further growth above this level is unlikely

- Thin red line – entry-level for opening sell trades

- Thick red line – projected price for placing Take Profit or closing trades manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, use overbought or oversold zones as confirmation

Important. Beginner traders in the Forex market should be cautious when deciding to enter the market. Before major fundamental releases, it is best to remain out of the market to avoid sharp price swings. If trading during the news, always use stop-loss orders to minimize losses. Without proper stop-loss levels, you can quickly lose your entire deposit—especially if you don't use money management and trade with large volumes.

And remember: to trade successfully, you must follow a clear trading plan, such as the one presented above. Making spontaneous trades based on short-term price action is a losing strategy for any intraday trader.