Never stand in the path of an enraged bull. You can debate overvalued stocks, a cooling U.S. labor market and economy, or the inefficiency of investments in artificial intelligence technologies all you want. But going against the S&P 500 crowd that consistently buys the dips is financial suicide. They need any excuse to jump back in—and such an excuse came in the form of comments from White House officials.

Treasury Secretary Scott Bessent stated that the proposed 100% tariffs against China may not actually be implemented and that there is still time for negotiations. Prior to this, Donald Trump mentioned on social media that everything would be fine with China. According to Morgan Stanley, if the trade dispute is not resolved by November, the S&P 500 risks a decline of 8–11%. Unsurprisingly, early signs of de-escalation have brought the bulls back into the market.

S&P 500 Performance and Morgan Stanley Forecasts

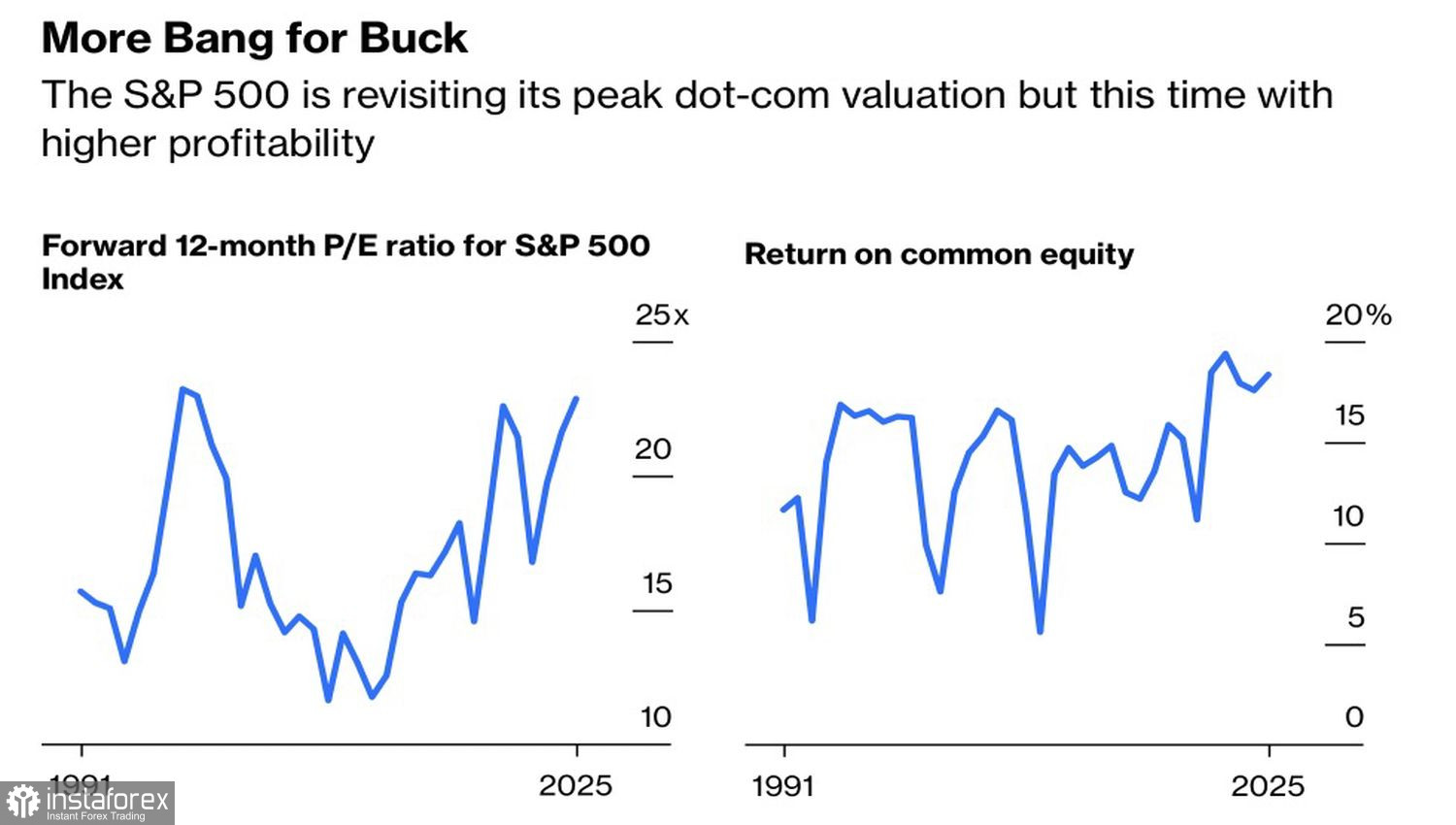

Buyers have various reasons to expect the broad-market index rally to continue. Despite the highest P/E valuations since the dot-com bubble, Wall Street experts forecast average earnings growth of 16% in 2026 for 95% of S&P 500 companies. For the "Magnificent Seven" and Broadcom, projections stand at 21%. These eight companies collectively make up 37% of the index's total market capitalization.

Return on equity has averaged 18% over the past four years, the highest level since 1991. Among the eight largest firms, this figure reaches 68%—double that of the best companies during the dot-com crisis.

S&P 500 Companies: P/E Ratios and Return on Equity Trends

Despite talks of a trade war, realistically, nobody wants one. China is interested in a meeting between Donald Trump and Xi Jinping, while the White House is focused on sustaining the equity market rally and avoiding distractions from the president's peacemaking image in relation to the Middle East conflict.

The U.S. economy remains strong. Wall Street Journal analysts anticipate GDP growth of 1.7% in 2025, and Bloomberg's surveyed experts forecast 1.8%. Notable Federal Open Market Committee officials John Williams and Christopher Waller have called for a reduction in the federal funds rate amid a cooling labor market. They are now joined by the new president of the Federal Reserve Bank of Philadelphia, Anna Paulson.

When we consider the expectations of positive earnings from banks at the start of the third-quarter earnings season, it becomes clear that the S&P 500's recent dip presented a compelling buying opportunity for U.S. equities. The key is that trade-war threats prove to be nothing more than a blank shot in the air.

On the technical side, bulls managed to swiftly return the broad-market index to fair value at 6655 on the daily chart. A successful breakout above this level would form the basis for new long positions. Conversely, a rejection could strengthen the risk of consolidation within the S&P 500 and potentially prompt a correction to the current upward trend.