Review of Tuesday's Trades:

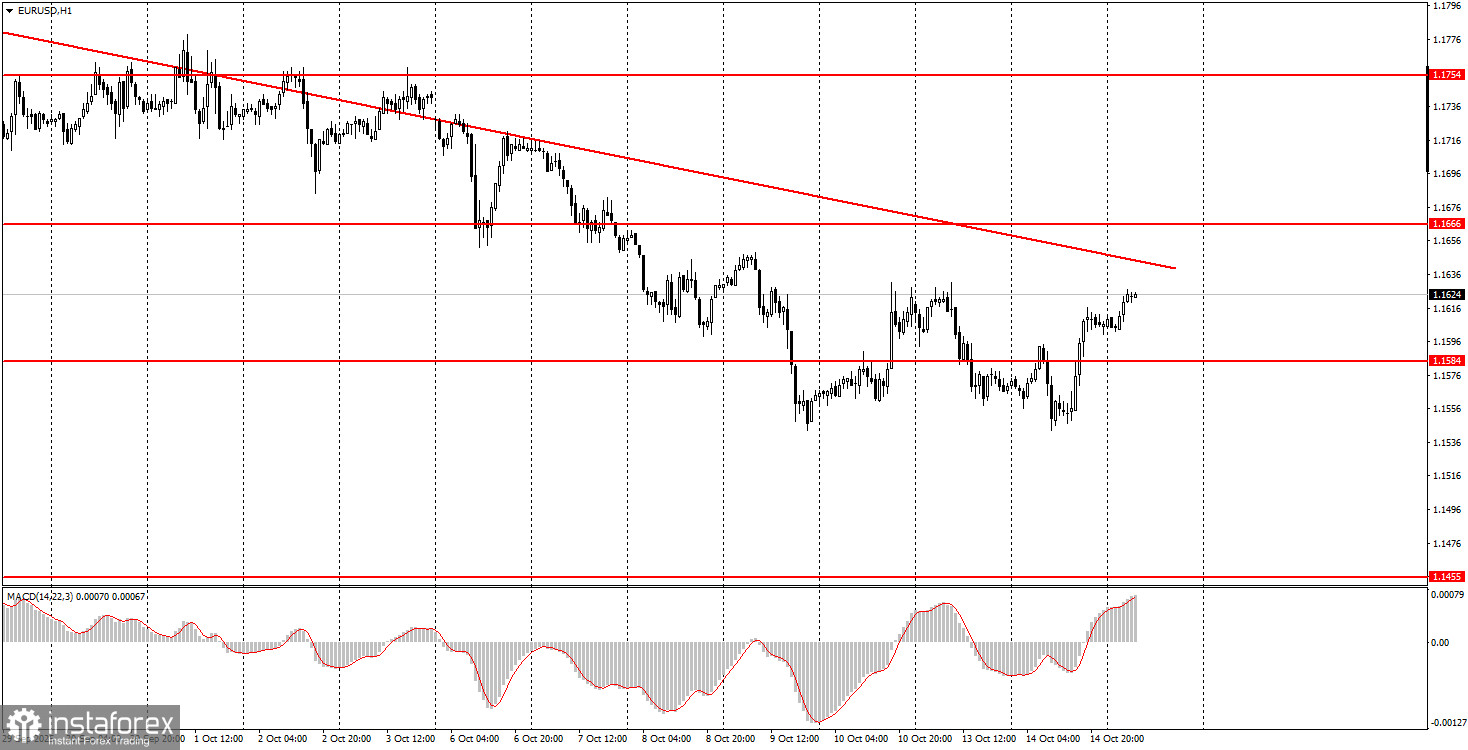

1-Hour EUR/USD Chart

On Tuesday, the EUR/USD pair managed to trade in both directions. In the morning, the euro came under pressure due to weaker-than-expected ZEW economic sentiment indices from both Germany and the Eurozone. In the second half of the day, the U.S. dollar faced pressure due to public remarks by Jerome Powell and Donald Trump.

Chair Powell once again stated that the Federal Reserve will make decisions based solely on macroeconomic data and also signaled the end of the quantitative tightening program. Both statements could be interpreted in multiple ways. The market still lacks confidence in whether we will see one or two rate cuts this year, though it leans toward two.

At the same time, Donald Trump stated that the U.S. can produce its own vegetable oil domestically instead of importing it from China—an announcement that could easily be construed as another escalation in the ongoing trade conflict. In our view, the dollar doesn't need these comments to continue declining, but technically, a descending trendline is still in place, suggesting that the current dollar strength may be part of a broader sideways channel on the daily timeframe.

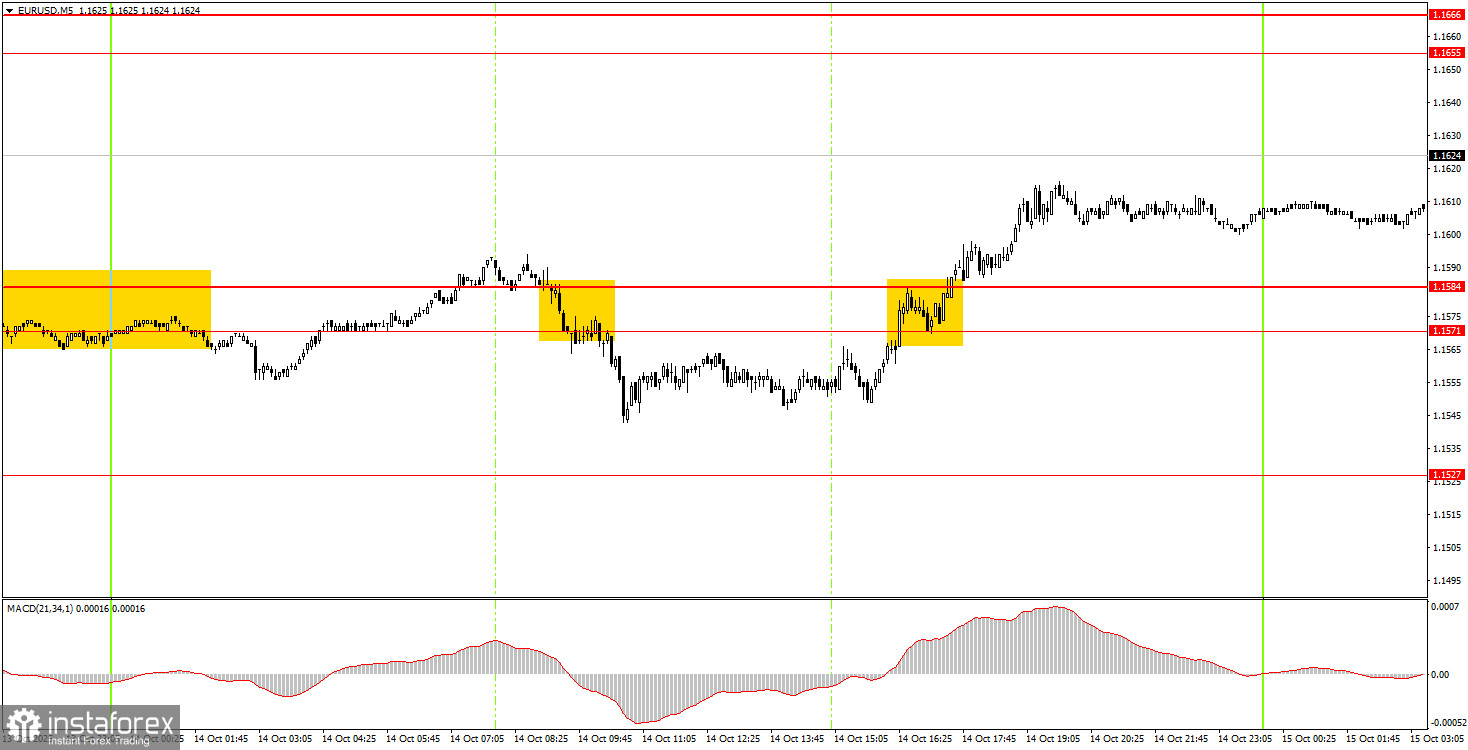

5-Minute EUR/USD Chart

Two trading signals were formed on the 5-minute chart on Tuesday. First, the pair broke below the 1.1571–1.1584 range, moving down about 19 pips. Later, the price broke back through the same area from below and rose about 20 pips. Thus, beginner traders could have placed two trades—either of which would have avoided losses. If the second position had been closed manually, it could have yielded a modest profit of around 20 pips.

How to Trade on Wednesday:

On the hourly chart, the EUR/USD pair broke through the trendline several times, driven by somewhat questionable news catalysts. We regard the current movement as entirely illogical. The overall fundamental and macroeconomic backdrop remains negative for the U.S. dollar, which is why we do not expect meaningful long-term dollar strength. As before, we believe the greenback can rely only on short-term technical corrections, which we continue to observe now.

On Wednesday, the EUR/USD pair may move in either direction. Logic is scarcely present in current movements, and there's a fair amount of chaos. A correction may begin following the prolonged recent decline, especially given that Trump has announced another round of tariffs on China. Guessing, however, makes little sense. It is far more effective to follow and execute valid trading signals on the 5-minute chart.

On the 5-minute TF, consider the levels 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527, 1.1571-1.1584, 1.1655-1.1666, 1.1745-1.1754, 1.1808, 1.1851, 1.1908, 1.1970-1.1988. The only major data point scheduled in the Eurozone for Wednesday is the industrial production report. The U.S. macroeconomic calendar remains empty due to the government shutdown.

Core Trading System Rules:

- Signal strength is based on how quickly a clear signal forms—a bounce or breakout. The faster the formation, the stronger the signal.

- If a level has produced two or more false signals recently, ignore future signals from that level.

- In a sideways (flat) market, many false signals may occur—or none at all. It's best to stop trading if a flat pattern becomes evident.

- Trades should be opened between the start of the European trading session and the middle of the U.S. session. All trades should be closed manually afterward.

- Trades on the hourly timeframe using MACD signals should only be made when there's good volatility and trend confirmation via trendlines or channels.

- If two levels are within 5 to 20 pips of one another, they should be treated as a single support/resistance area.

- Once the price moves 15 pips in the right direction, stop loss should be moved to breakeven.

Chart Elements:

- Support and resistance levels (targets for buy/sell trades, suitable for setting Take Profit)

- Red lines: trendlines or channels indicating the current trend or directional bias

- MACD (14,22,3) histogram and signal line — used as a supplemental signal generator

Important Note:

Major speeches and reports (always listed in the news calendar) can have a significant impact on currency pair movements. During such events, it is best to trade with maximum caution or exit the market entirely to avoid getting caught in sharp price reversals.

Beginner traders should remember:

Not every trade will be profitable. Developing a sound strategy and utilizing proper money management are key to success over the long run.