Review of Tuesday's Trades:

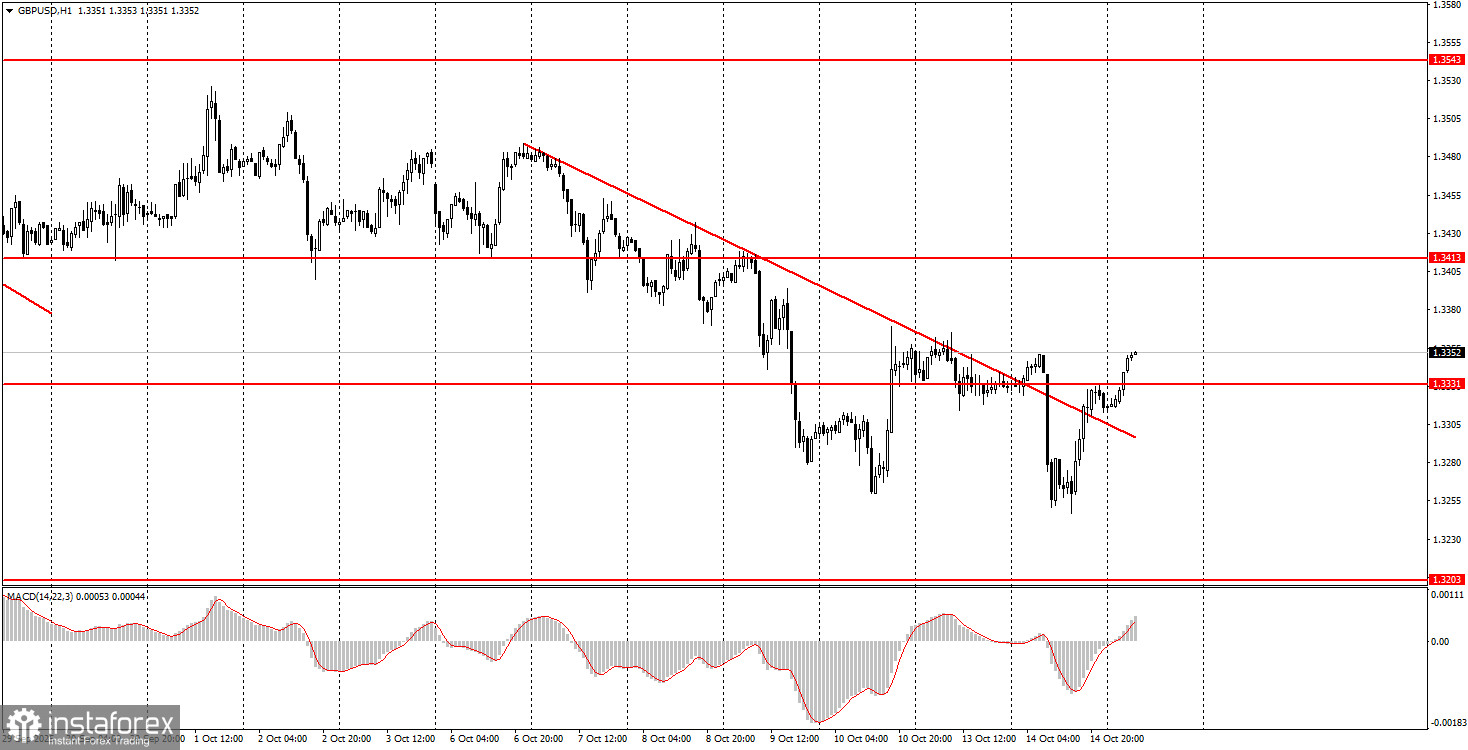

1-Hour GBP/USD Chart

On Tuesday, the GBP/USD pair moved both upward and downward. However, the British pound had additional reasons to decline early in the session. In the morning, the UK released reports on unemployment and jobless claims, which triggered a sell-off in the pound. Contrary to forecasts and expectations, the unemployment rate increased by 0.1%, and the number of newly unemployed rose by 26,000—significantly above projections. As a result, the decline in sterling was entirely justified.

In the second half of the day, Jerome Powell offered some relief for the pound. Once again, he stated that the Federal Reserve has no specific plans to cut interest rates and that decisions will be based solely on incoming macroeconomic data. A bit later, Donald Trump threatened to stop importing vegetable oil from China, which hurt the U.S. dollar and contributed to its fall. Overall, we expect a continued decline in the dollar, particularly after the descending trendline was broken.

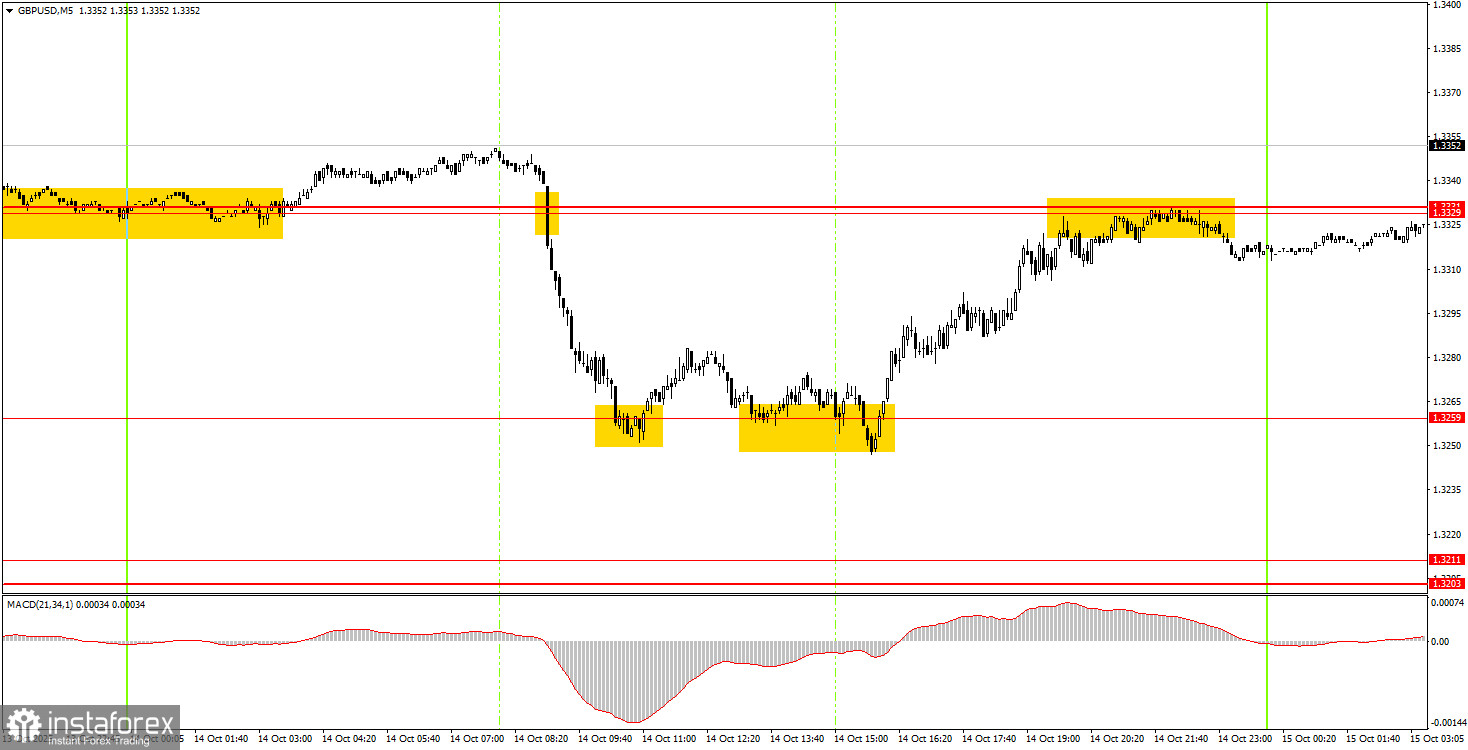

5-Minute GBP/USD Chart

On the 5-minute timeframe, GBP/USD produced more trading signals than EUR/USD and showed higher volatility. In the early morning, a sell signal was generated around the 1.3329–1.3331 zone. After that, the pair moved down to 1.3259. That support level triggered at least three rebounds throughout the day, and by its end, the pair had returned to the 1.3329–1.3331 area. Therefore, beginner traders could have executed two trades, both of which ended with a profit.

How to Trade on Wednesday:

On the hourly timeframe, GBP/USD continues to form a downward trend, which in our view is long overdue for completion. As previously mentioned, there are no strong reasons for the U.S. dollar to rise over the medium term, so we still anticipate a return to an upward movement. The market remains in a peculiar state. The British pound continues to fall, but there is no clear justification for the decline—outside of technical factors. Much of the current movement appears irrational.

On Wednesday, the GBP/USD pair may attempt a continued upward correction, as the trendline has already been broken. A confirmed breakout above the 1.3329–1.3331 zone also opens the path for initiating long positions with a target at 1.3413.

On the 5-minute TF, you can now trade at levels 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3682, and 1.3763. For Wednesday, there are no major economic releases scheduled in the UK or U.S., so we may see a flat market or low-volatility price action during the day.

Core Trading System Rules:

- Signal strength is based on how quickly a clear signal forms—a bounce or breakout. The faster the formation, the stronger the signal.

- If a level has produced two or more false signals recently, ignore future signals from that level.

- In a sideways (flat) market, many false signals may occur—or none at all. It's best to stop trading if a flat pattern becomes evident.

- Trades should be opened between the start of the European trading session and the middle of the U.S. session. All trades should be closed manually afterward.

- Trades on the hourly timeframe using MACD signals should only be made when there's good volatility and trend confirmation via trendlines or channels.

- If two levels are within 5 to 20 pips of one another, they should be treated as a single support/resistance area.

- Once the price moves 20 pips in the right direction, stop loss should be moved to breakeven.

Chart Elements:

- Support and resistance levels (targets for buy/sell trades, suitable for setting Take Profit)

- Red lines: trendlines or channels indicating the current trend or directional bias

- MACD (14,22,3) histogram and signal line — used as a supplemental signal generator

Important Note:

Major speeches and reports (always listed in the news calendar) can have a significant impact on currency pair movements. During such events, it is best to trade with maximum caution or exit the market entirely to avoid getting caught in sharp price reversals.

Beginner traders should remember:

Not every trade will be profitable. Developing a sound strategy and utilizing proper money management are key to success over the long run.