Macroeconomic Report Analysis:

Very few macroeconomic reports are scheduled for Wednesday. The only notable report is industrial production in the Eurozone, which is once again unlikely to impress traders with a strong result. However, expectations for this indicator are already quite low, so exceeding them may be relatively easy. No other significant reports are expected throughout the day.

Fundamental Event Overview:

Several fundamental events are scheduled for Wednesday, but several important points should be noted straight away. Jerome Powell and Christine Lagarde have both spoken frequently in recent weeks. As a result, the market now has a clear understanding of what to expect from the European Central Bank and the Federal Reserve in the near term. The U.S. government shutdown continues, meaning key macroeconomic indicators are not being published. Without new data, Fed officials have little basis to alter their communication or policy stance. The ECB has likely concluded its monetary policy easing cycle, as it has successfully brought inflation down to its target level. The Bank of England is also likely to enter a prolonged pause in its easing cycle, as inflation in the UK currently exceeds the target by nearly twofold. Therefore, no significant policy shifts or major announcements are expected from central bank officials at this time.

General Conclusions:

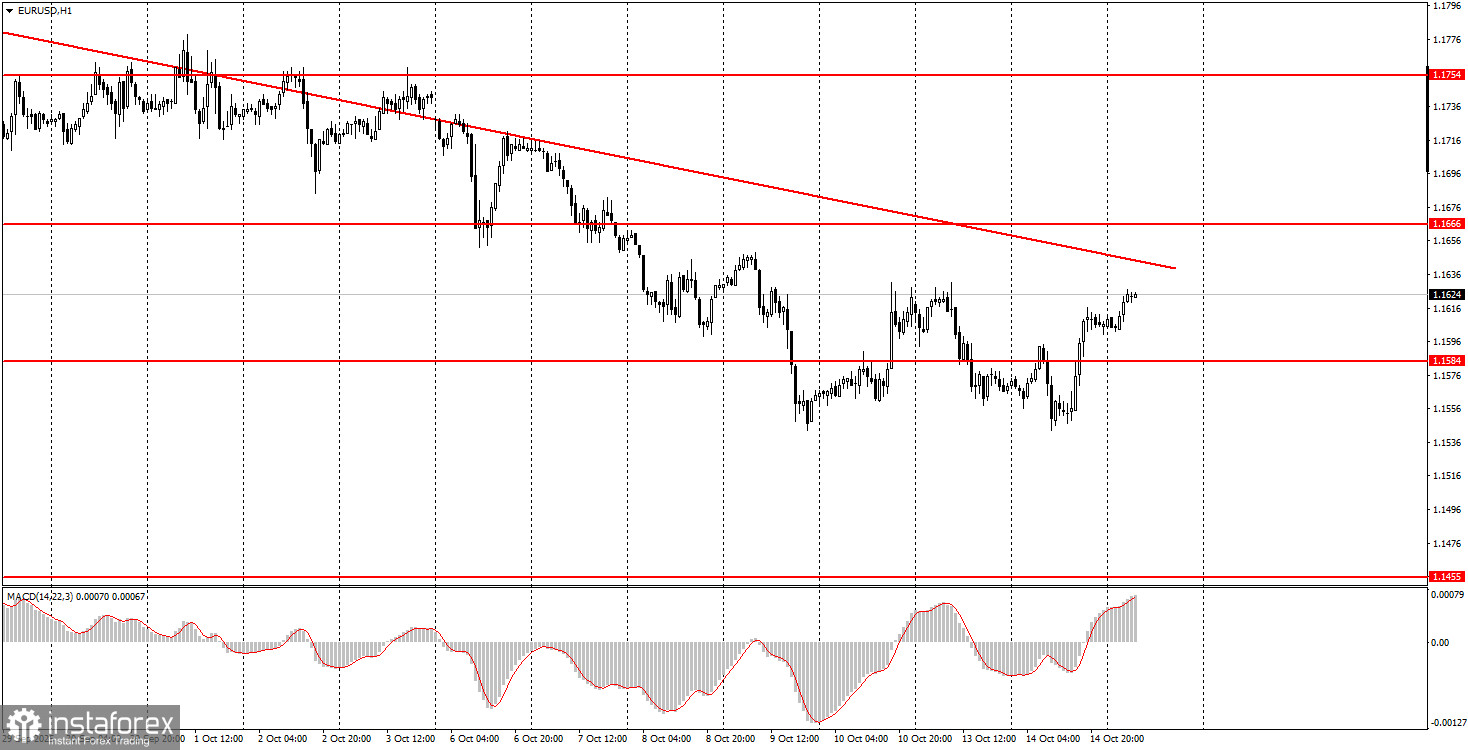

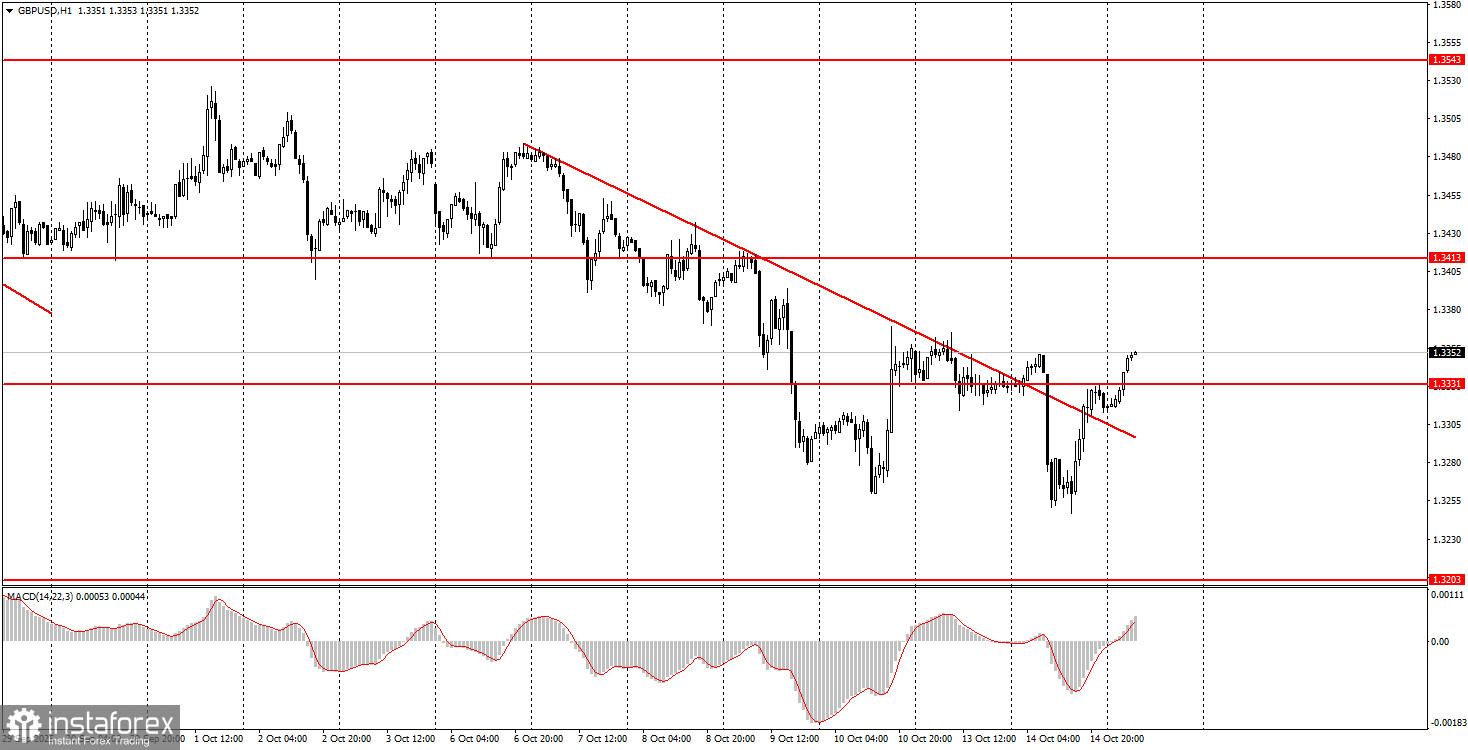

On the third trading day of the week, both EUR/USD and GBP/USD may continue to move erratically and illogically. So far, we have observed declines in both pairs that are difficult to explain from a fundamental perspective. Today, the euro may resume growth and target the 1.1655–1.1666 area, as it has now consolidated above the 1.1571–1.1584 zone. The British pound may also continue its recovery after consolidating above the trendline and the 1.3329–1.3331 resistance area, aiming for the 1.3413–1.3421 target zone.

Core Trading System Rules:

- Signal strength is based on how quickly a clear signal forms—a bounce or breakout. The faster the formation, the stronger the signal.

- If a level has produced two or more false signals recently, ignore future signals from that level.

- In a sideways (flat) market, many false signals may occur—or none at all. It's best to stop trading if a flat pattern becomes evident.

- Trades should be opened between the start of the European trading session and the middle of the U.S. session. All trades should be closed manually afterward.

- Trades on the hourly timeframe using MACD signals should only be made when there's good volatility and trend confirmation via trendlines or channels.

- If two levels are within 5 to 20 pips of one another, they should be treated as a single support/resistance area.

- Once the price moves 15-20 pips in the right direction, stop loss should be moved to breakeven.

Chart Elements:

- Support and resistance levels (targets for buy/sell trades, suitable for setting Take Profit)

- Red lines: trendlines or channels indicating the current trend or directional bias

- MACD (14,22,3) histogram and signal line — used as a supplemental signal generator

Important Note:

Major speeches and reports (always listed in the news calendar) can have a significant impact on currency pair movements. During such events, it is best to trade with maximum caution or exit the market entirely to avoid getting caught in sharp price reversals.

Beginner traders should remember:

Not every trade will be profitable. Developing a sound strategy and utilizing proper money management are key to success over the long run.