The U.S. dollar collapsed against the euro, pound, and other assets following yesterday's interview with Jerome Powell.

The Chairman of the Federal Reserve, Jerome Powell, indicated that the U.S. central bank intends to lower the key interest rate by another 25 basis points, likely as early as the end of October. This statement served as a trigger for widespread dollar selling across global markets, as investors adjusted their expectations for future monetary policy easing.

Powell noted that the U.S. economy continues to show resilience, but risks related to slowing employment growth and ongoing trade tensions require caution and may justify further policy accommodation. According to him, a 25-basis-point rate cut is intended to support economic growth.

In the first half of the day, market participants will be watching the release of the French Consumer Price Index and Eurozone industrial production data for August. The European Central Bank will carefully analyze these reports to gauge inflation pressure and the trajectory of regional economic growth.

France's Consumer Price Index, a key inflation metric, will show how effectively the country is managing rising prices. Higher-than-expected figures could signal accelerating inflation, although many economists are forecasting a decline in price pressure.

Industrial production data for the Eurozone is also important. It reflects the health of the manufacturing sector, which is a key driver of economic growth. A decline in production could suggest an economic slowdown, potentially prompting the ECB to consider renewed stimulus measures.

As for the pound, no UK economic reports are scheduled for today. However, speeches are expected from Sir David Ramsden, Deputy Governor for Markets and Banking at the Bank of England, and Sarah Breeden, member of the Financial Policy Committee. Ramsden's remarks will be particularly important in the context of current market volatility and ongoing inflation-related concerns. He is expected to give an update on the UK banking sector, credit risks, and the BoE's actions to maintain financial stability. Sarah Breeden will likely focus on broader macroeconomic risks.

If incoming data aligns with economists' forecasts, it is best to apply a Mean Reversion strategy. If the data significantly exceeds or falls short of expectations, a Momentum strategy is more appropriate.

Momentum Strategy (Breakout-Based):

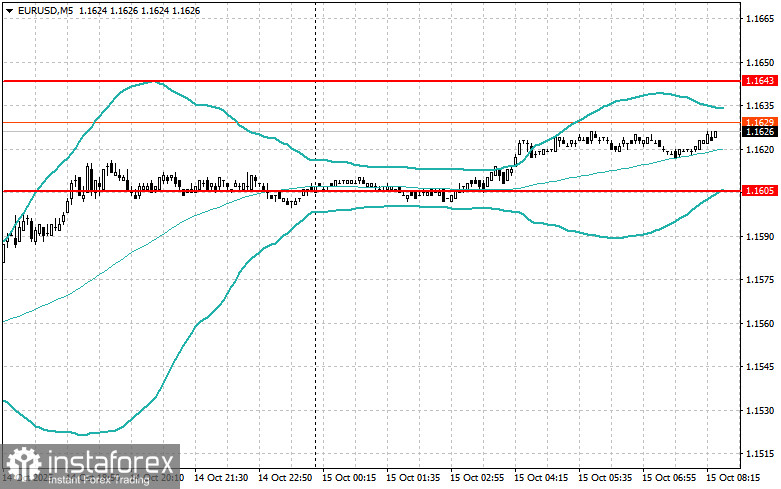

EUR/USD

- Buy on a breakout above 1.1627 with targets at 1.1661 and 1.1691

- Sell on a breakout below 1.1600 with targets at 1.1575 and 1.1545

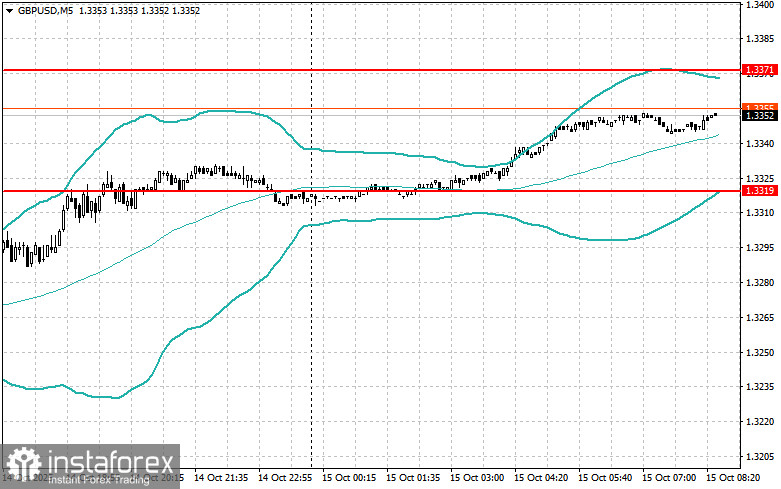

GBP/USD

- Buy on a breakout above 1.3360 with targets at 1.3390 and 1.3424

- Sell on a breakout below 1.3325 with targets at 1.3290 and 1.3265

USD/JPY

- Buy on a breakout above 151.35 with targets at 151.75 and 152.10

- Sell on a breakout below 151.00 with targets at 150.65 and 150.35

Mean Reversion Strategy (Reversal-Based):

EUR/USD

- Look for selling opportunities after a failed breakout above 1.1643, on a return below this level

- Look for buying opportunities after a failed breakout below 1.1605, on a return to this level

GBP/USD

- Look for selling opportunities after a failed breakout above 1.3371, on a return below this level

- Look for buying opportunities after a failed breakout below 1.3319, on a return to this level

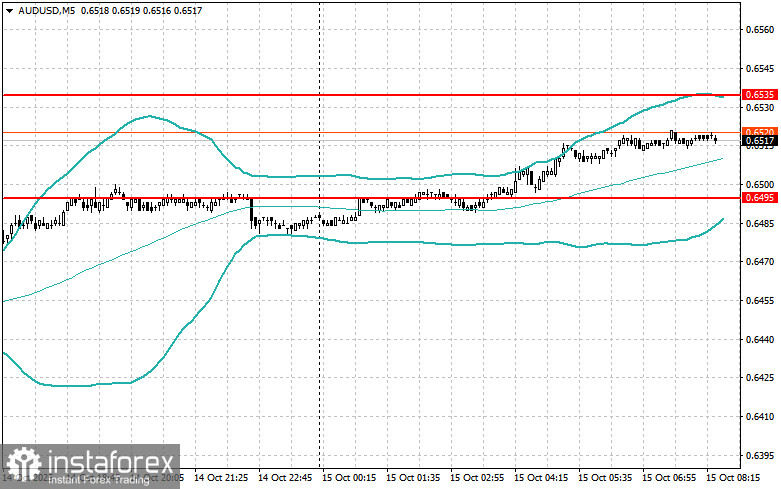

AUD/USD

- Look for selling opportunities after a failed breakout above 0.6535, on a return below this level

- Look for buying opportunities after a failed breakout below 0.6495, on a return to this level

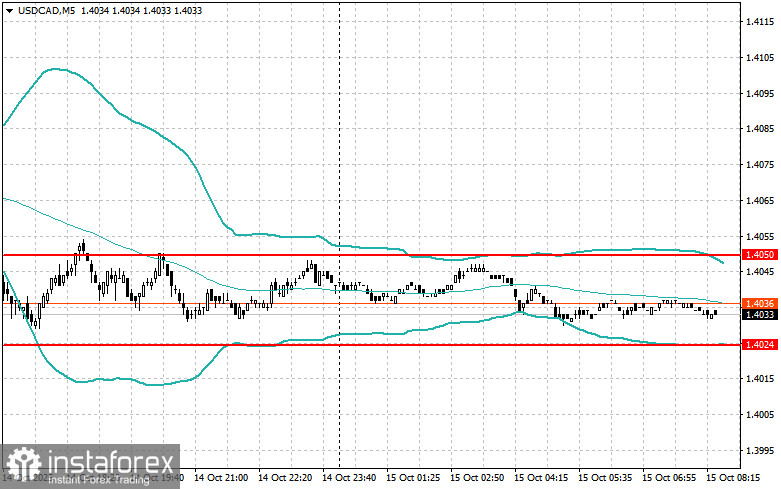

USD/CAD

- Look for selling opportunities after a failed breakout above 1.4050, on a return below this level

- Look for buying opportunities after a failed breakout below 1.4024, on a return to this level