Yesterday, Bitcoin showed a solid recovery after a sharp decline toward the $110,000 level. However, the cryptocurrency market remains under significant pressure. Ethereum also posted gains, although the sustainability of further recovery remains uncertain.

In a public statement, the head of the International Monetary Fund (IMF) said it is time for countries to acknowledge the obvious—fiat currency is becoming digital. The organization supports the growth of central bank digital currencies (CBDCs) but cautions against using Bitcoin and other unbacked cryptocurrencies as reserve assets. This statement marks a logical continuation of the IMF's efforts over recent years to study the impact of digital economy developments on the global financial system.

Specifically, the IMF has voiced support for the development of CBDCs, noting their potential to increase the efficiency of payment systems, reduce transaction costs, and expand financial accessibility.

However, this support does not extend to all digital assets. The IMF warns against using Bitcoin and similar unbacked cryptocurrencies as reserve holdings. Its rationale focuses on the high volatility, speculative nature, and insufficient regulatory clarity surrounding these assets. The organization fears that incorporating such cryptocurrencies into national financial systems could pose a threat to macroeconomic stability. The market's sharp drop on October 10 alone reinforces these concerns. The IMF's remarks underscore the need for clearly defined digital asset frameworks and a cautious approach to integrating them into the global financial system. Despite this, the cryptocurrency market is expected to continue its dynamic growth.

As for intraday strategies, the focus remains on taking advantage of significant pullbacks in Bitcoin and Ethereum in anticipation of continued medium-term bullish momentum.

Below are the trading scenarios for short-term strategies.

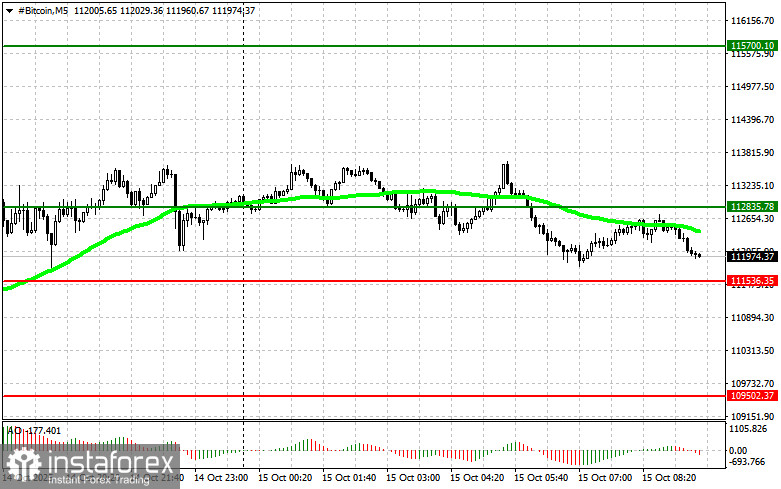

Bitcoin

Buy Scenario

Scenario 1: Buy Bitcoin at an entry point around $113,000 with a target of $114,400. Consider exiting the long position at $114,400 and reversing into a short position. Before entering a breakout buy, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is above the zero line.

Scenario 2: Buy Bitcoin from the lower boundary at $112,100 if there is no bearish confirmation of a breakout below that level. Target levels for the rebound are $113,000 and $114,400.

Sell Scenario

Scenario 1: Sell Bitcoin at an entry point around $112,100 with a target near $110,700. Exit the short position at $110,700 and consider buying on a bounce. Before selling on a breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Bitcoin from the upper boundary at $113,000 if there is no bullish confirmation of a breakout above that level. Target levels for the decline are $112,100 and $110,700.

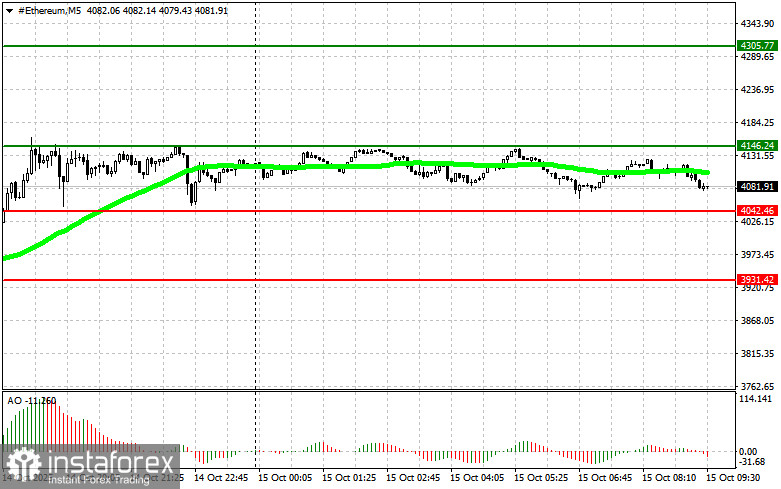

Ethereum

Buy Scenario

Scenario 1: Buy Ethereum at an entry point around $4,098 with a target of $4,180. Exit at $4,180 and consider initiating a short position on a reversal. Before buying on a breakout, confirm that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy Ethereum from the lower boundary at $4,030 if there is no bearish confirmation of a breakdown. Target levels are $4,098 and $4,180.

Sell Scenario

Scenario 1: Sell Ethereum at an entry point around $4,030 with a target near $3,935. Exit the short at $3,935 and consider a buy on a rebound. Before selling on a breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Ethereum from the upper boundary at $4,098 if there is no bullish confirmation of a breakout. Target levels for the decline are $4,030 and $3,935.