Analysis of Trades and Tips for Trading the European Currency

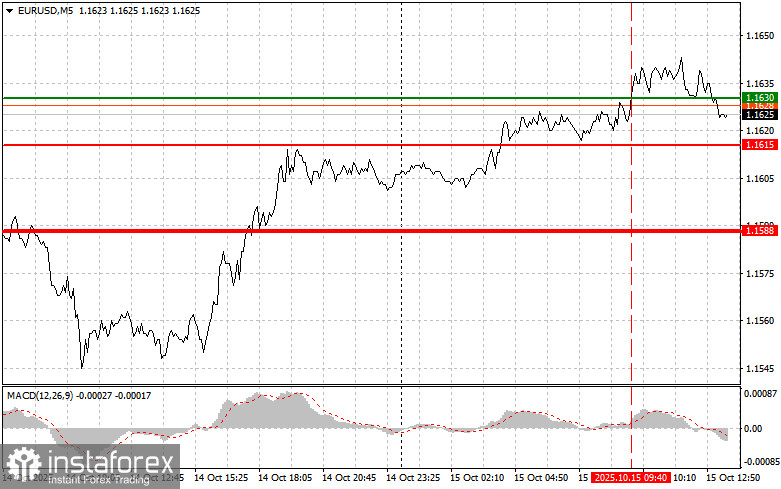

The price test of 1.1630 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro.

The decline in industrial output in the eurozone countries, though expected, turned out to be less significant than analysts had predicted, allowing the European currency to maintain a positive trend against the U.S. dollar. However, the pair also did not see any major growth. The euro's rate was influenced in two ways: on the one hand, industrial figures that were better than expected supported the currency; on the other hand, the ongoing contraction puts the ECB in a more difficult position.

This afternoon, the release of the Empire Manufacturing Index will be a separate event, but the main focus of market participants will be on speeches by Federal Reserve representatives — Christopher Waller and Jeffrey Schmid. Considering the dovish tone of the Fed Chair's speech yesterday, it's unlikely that we'll hear anything new from Waller and Schmid today. The Empire Manufacturing Index will have even less impact on the market. Disappointing figures will only once again confirm the Fed's correct stance on further rate cuts, which will weaken the dollar.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

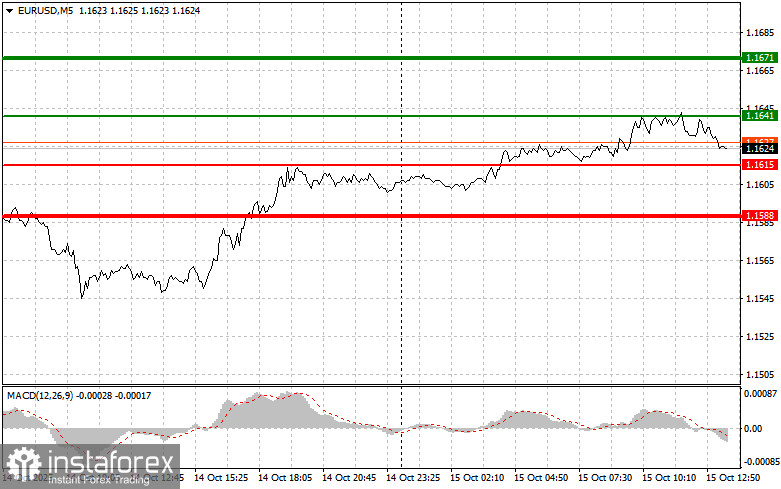

Scenario #1: Today, you can buy the euro when the price reaches around 1.1641 (green line on the chart), targeting growth to the level of 1.1671. At 1.1671, I plan to exit the market and also sell the euro in the opposite direction, aiming for a movement of 30–35 points from the entry point. A euro rise today can be expected only after dovish statements from Fed representatives.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1615 price level, at the moment when the MACD is in the oversold area. This will limit the pair's downward potential and lead to a reversal of the market upward. Growth can be expected to the opposite levels of 1.1641 and 1.1671.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the level of 1.1615 (red line on the chart). The target will be 1.1588, where I intend to exit the market and immediately buy in the opposite direction (expecting a movement of 20–25 points in the opposite direction from this level). Downward pressure on the pair is unlikely to return today.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1641 price level, at the moment when the MACD is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal of the market. A decline can be expected to the opposite levels of 1.1615 and 1.1588.

What's on the Chart:

- Thin green line – entry price where you can buy the trading instrument;

- Thick green line – the projected price where you can set Take Profit or manually fix profit, since further growth above this level is unlikely;

- Thin red line – entry price where you can sell the trading instrument;

- Thick red line – the projected price where you can set Take Profit or manually fix profit, since further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important Note

Beginner traders in the Forex market should make entry decisions with great caution. Before the release of important fundamental reports, it's best to stay out of the market to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly — especially if you don't use money management and trade large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.