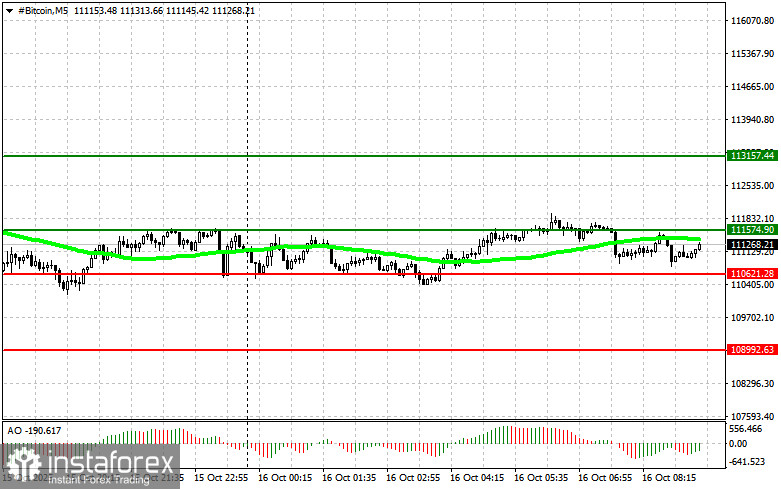

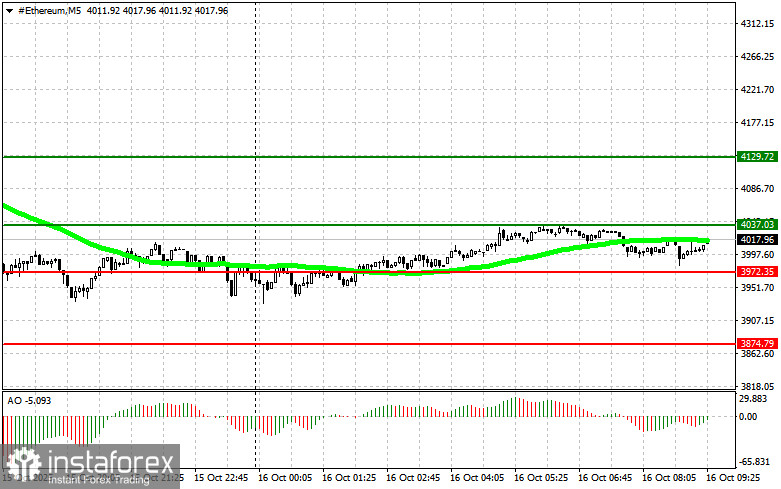

Bitcoin remains in the $110,000–$111,000 range—an area that is technically very significant. A breakout below this level could trigger a more active sell-off of the cryptocurrency down toward $106,000, bringing it dangerously close to the $100,000 range. A test of that range would represent a critical moment for the entire cryptocurrency market. Ethereum has also declined sharply, barely holding above the $4,000 level. A move below this mark could result in a significantly more aggressive sell-off.

While traders continue to battle for direction, news has emerged that the Bank of England plans to introduce temporary limits on the size of holdings and transactions in stablecoins. The proposed individual cap is expected to fall within the range of 10,000 to 20,000 British pounds. According to government officials, these measures are not intended to block the use of stablecoins but rather to ensure their controlled integration into the country's financial system.

In the central bank's view, this step is necessary to protect consumers and ensure financial stability in the context of a rapidly evolving crypto market. These restrictions are likely to remain in place until comprehensive legislation covering digital assets is developed in the United Kingdom.

The BoE's decision drew a mixed response from the crypto community. Supporters of regulation welcomed the initiative as a necessary move toward the legitimization of stablecoins and reducing investor risks. On the other hand, critics voiced concern that such limitations could stifle innovation and deter users from the crypto market.

Regardless of differing opinions, the BoE's actions reflect the growing concern among global regulators about the potential risks posed by cryptocurrencies and their push to implement stricter rules to protect consumers and maintain financial stability.

Regarding intraday strategy in the cryptocurrency market, I will continue to act on any major dips in Bitcoin and Ethereum, relying on the expectation of a sustained medium-term bull market that remains intact.

In terms of short-term trading, the strategies and conditions are outlined below.

Bitcoin

Buy Scenario

Scenario 1: I will buy Bitcoin today upon reaching the entry point around $111,500, targeting a rise to $113,100. Around $113,100, I will exit the long position and sell immediately on the rebound. Before buying on the breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario 2: Bitcoin can also be bought from the lower boundary of $110,600 if there is no market reaction confirming a downward breakout, aiming for a return to $111,500 and $113,100.

Sell Scenario

Scenario 1: I will sell Bitcoin today upon reaching the entry point around $110,600, targeting a drop to $108,900. Around $108,900, I will exit the position and buy immediately on the rebound. Before selling on the breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario 2: Bitcoin can also be sold from the upper boundary of $111,500 if there is no market reaction confirming an upward breakout, aiming for a return to $110,600 and $108,900.

Ethereum

Buy Scenario

Scenario 1: I will buy Ethereum today upon reaching the entry point around $4,037, targeting a rise to $4,129. Around $4,129, I will exit the long position and sell immediately on the rebound. Before buying on the breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario 2: Ethereum can also be bought from the lower boundary of $3,972 if there is no market reaction confirming a downward breakout, aiming for a return to $4,037 and $4,129.

Sell Scenario

Scenario 1: I will sell Ethereum today upon reaching the entry point around $3,972, targeting a drop to $3,874. Around $3,874, I will exit the position and buy immediately on the rebound. Before selling on the breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario 2: Ethereum can also be sold from the upper boundary of $4,037 if there is no market reaction confirming an upward breakout, aiming for a return to $3,972 and $3,874.