Trade Analysis and Euro Trading Tips

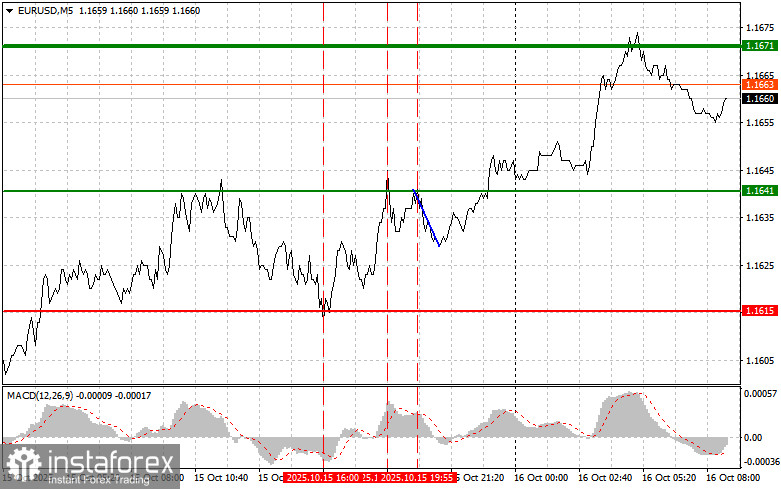

The test of the 1.1615 price level occurred while the MACD indicator had already moved significantly lower from the zero line, which limited the pair's downward potential. The euro then rose, but at the moment the price reached 1.1641, MACD had also climbed well above the zero mark. Therefore, I opted not to buy and instead waited for the realization of Sell Scenario No. 2, which helped to extract about 10 pips of profit from the market.

Hints from Federal Reserve officials about the need to ease interest rates triggered a wave of dollar selling, strengthening the euro's position. Market participants interpreted these signals as a sign of a softer monetary policy expected in the near future, which traditionally hurts the value of the U.S. currency.

Today will be marked by the release of several important economic reports and statements, which will undoubtedly create fluctuations in the currency markets. In the first half of the day, the eurozone trade balance and Italy's consumer price index will be published. Later, during the U.S. session, a speech by ECB President Christine Lagarde is scheduled.

The eurozone trade balance report will help assess the competitiveness of European companies and the overall health of the region's economy. A trade surplus indicates resilience in an economy that can produce goods and services in demand on the global market. Conversely, a deficit may point to insufficient domestic demand and the need to support export sectors.

Italy's consumer price index is a key inflation indicator for the eurozone's third-largest economy. An increase in the index may lead the ECB to adopt a more cautious stance on rates, whereas a decrease could allow for more economic stimulus.

Christine Lagarde's speech will be the central event of the day. Investors will closely analyze her remarks, looking for clues about the central bank's future policies. She is expected to touch on inflation trends, economic forecasts, and possible measures to support the eurozone economy. Her tone may have a noticeable impact on the euro's value and market sentiment in general.

In terms of intraday strategy, I will focus more on executing Scenarios No. 1 and No. 2.

Buy Scenarios

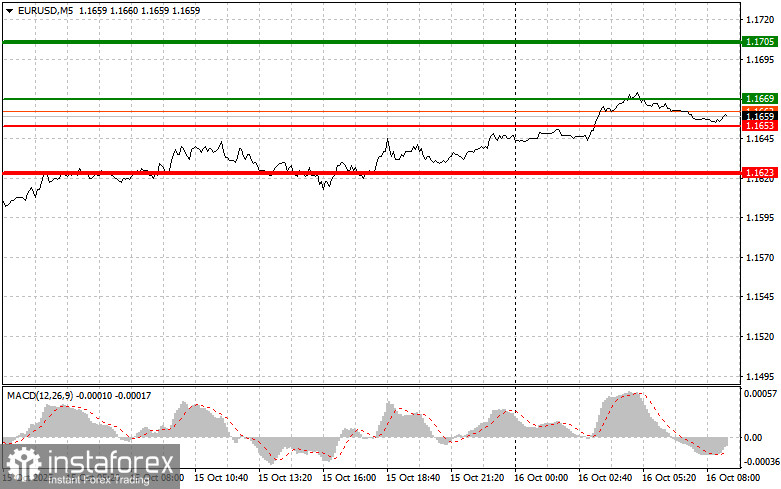

Scenario No. 1: I plan to buy the euro today if the price reaches the area around 1.1669 (green line on the chart), targeting a rise to 1.1705. At the 1.1705 level, I intend to exit the market and sell immediately on the rebound, expecting a move of 30–35 pips from the entry point. Euro growth should only be anticipated if the economic data is favorable. Note: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I will also consider buying the euro today if there are two consecutive tests of the 1.1653 price level, provided that the MACD indicator is in the oversold zone. This would limit the pair's downside and lead to an upward reversal. A rise toward the 1.1669 and 1.1705 levels can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1653 level (red line on the chart). The target will be 1.1623, where I intend to exit the trade and buy back immediately on the rebound, aiming for a reverse move of 20–25 pips. Downward pressure on the pair is unlikely to return today. Note: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1669 level, provided that the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A drop to the 1.1653 and 1.1623 levels is expected.

Chart Indicators Explanation

The thin green line represents the entry price for buying the trading instrument.

The thick green line indicates the anticipated price where Take Profit orders can be placed or profits manually secured, as further growth above this level is unlikely.

The thin red line marks the entry price for selling the trading instrument.

The thick red line indicates the expected price where Take Profit orders can be placed or profits manually secured, as a further decline below this level is unlikely.

The MACD indicator should be used when entering trades by focusing on overbought and oversold zones.

Note: Beginner traders in the Forex market must make entry decisions with great caution. Before the release of key fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price fluctuations. If you choose to trade during news events, always set stop-loss orders to minimize losses. Trading without stop-loss orders can quickly wipe out your deposit, especially if you don't apply money management and operate with large volumes.

And remember, for successful trading, you must have a clear trading plan—like the one presented above. Making spontaneous trading decisions based on current market conditions is an inherently losing strategy for intraday traders.