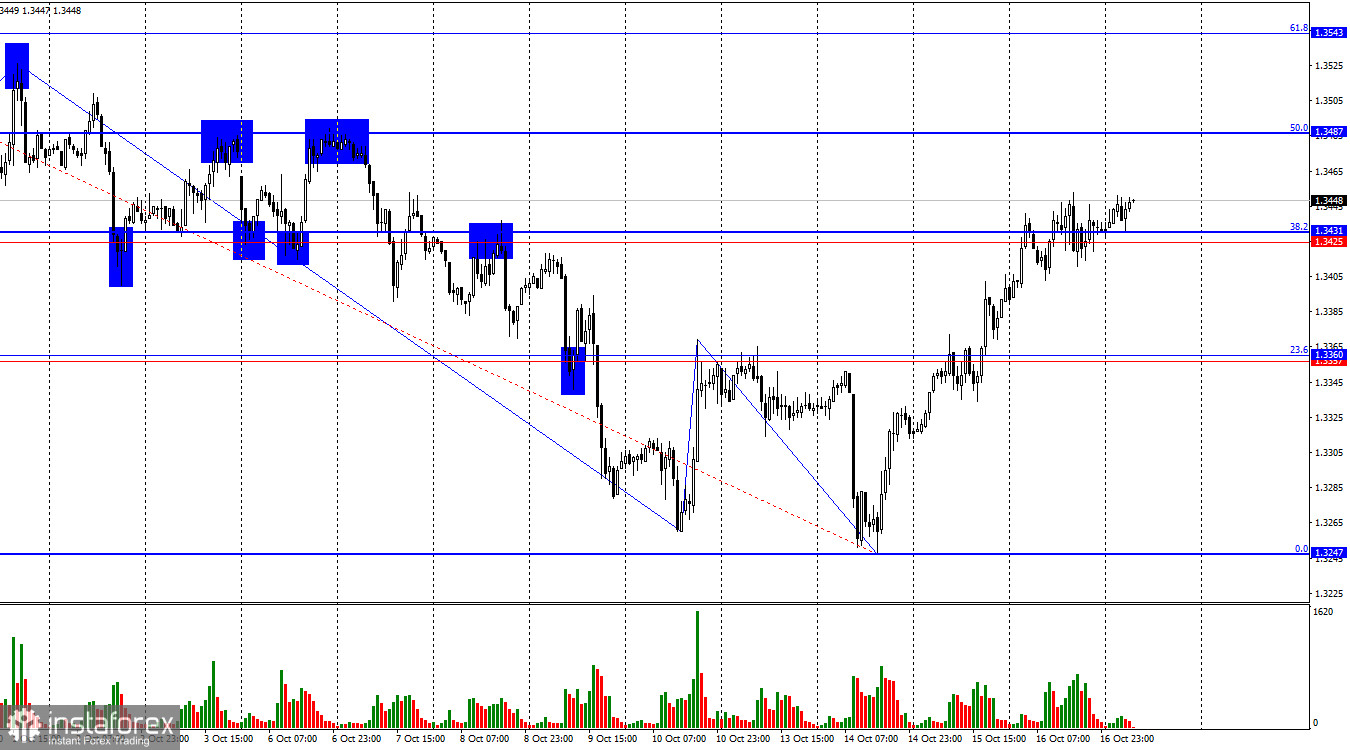

The wave pattern turned bullish almost overnight. The last completed downward wave broke the previous low, but the most recent upward wave broke the previous peak. The news background in recent weeks has been negative for the U.S. dollar, but bullish traders had not taken advantage of the opportunities to advance — until now. They are finally beginning to spread their wings.

Yesterday, the UK released important reports on industrial production and GDP for August. The British economy grew by 0.1% month-on-month, in line with market expectations. Industrial production rose by 0.4%, exceeding forecasts. However, bullish traders did not use these rather positive figures to strengthen the pound's position. Trading activity during the day was quite low, but that should not be misleading — the bulls continue to attack. The trend has turned upward, and it will be very difficult for the dollar to resume growth amid the current information background.

Let me remind you that the main market event right now is the standoff between Donald Trump and China. The U.S. president is threatening to raise tariffs to their highest levels unless Beijing abandons its plans to tighten control over the export of rare earth metals. The planned meeting between Donald Trump and Xi Jinping in early November is at risk of being canceled. The temporary trade truce between the two countries expires in mid-November. If the meeting between the Chinese and U.S. leaders does not take place, we are likely to see a new escalation of the trade war. For the U.S. dollar, this is a reason to continue falling even now. By the end of the month, the FOMC is 99% likely to ease monetary policy, which is also a negative factor for the American currency.

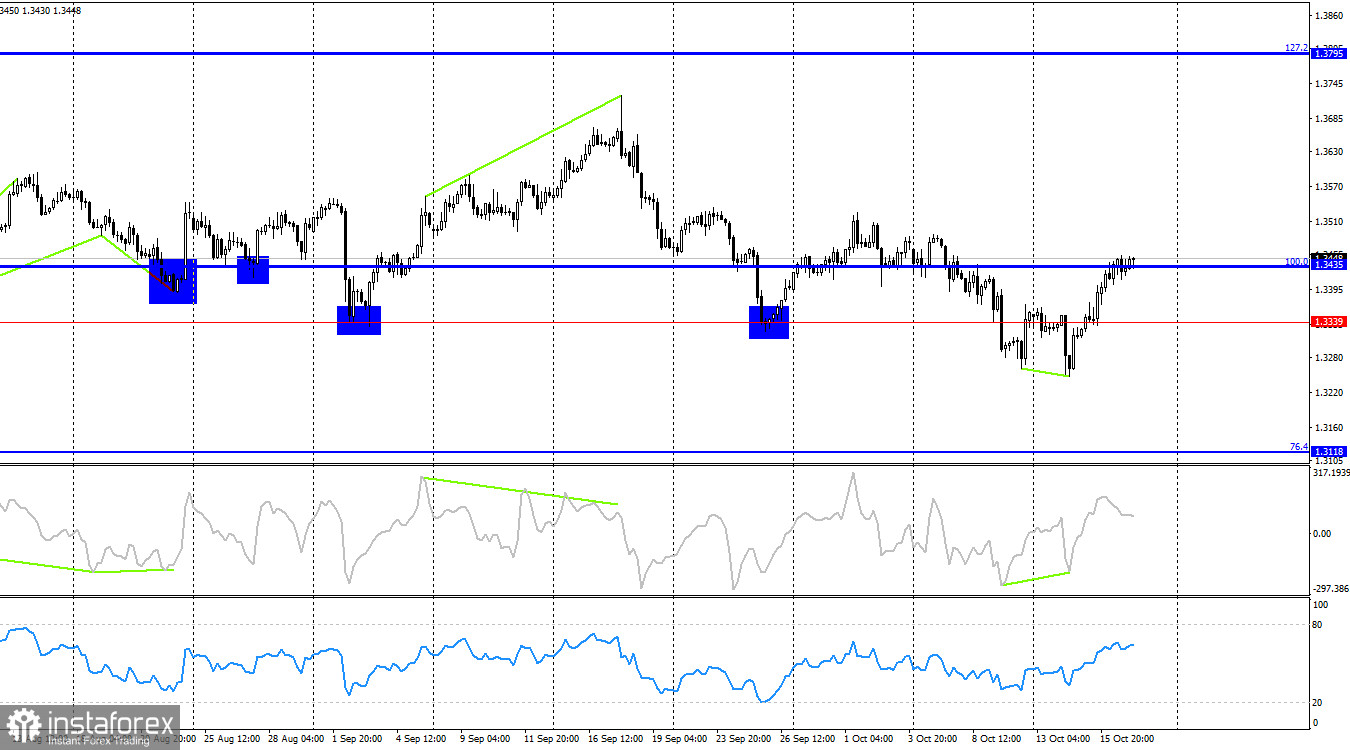

On the 4-hour chart, the pair reversed in favor of the pound after forming a bullish divergence on the CCI indicator, followed by growth toward the 100.0% retracement level at 1.3435. A rebound from this level would allow traders to expect a reversal in favor of the U.S. dollar and a moderate decline toward 1.3339. A consolidation above this level would increase the likelihood of continued growth toward the next Fibonacci level of 127.2% at 1.3795. There are no emerging divergences on any indicator today.

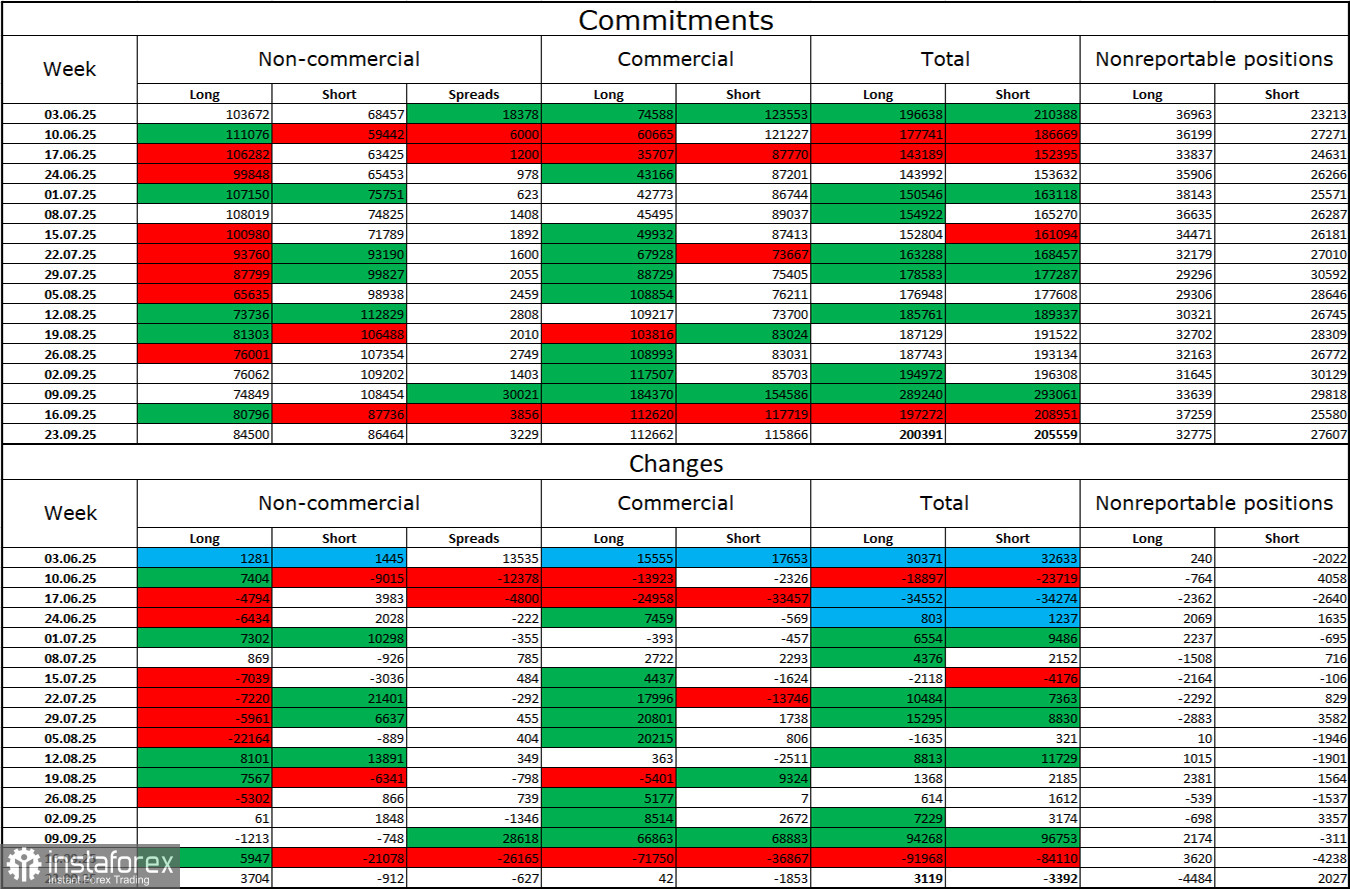

Commitments of Traders (COT) Report

The sentiment among non-commercial traders became more bullish over the past reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions fell by 912. The gap between long and short positions now stands at approximately 85,000 vs. 86,000. Bullish traders are once again tipping the scales in their favor.

In my view, the pound still faces potential downward risks, but with each passing month, the U.S. dollar looks increasingly weak. If earlier traders were worried about Donald Trump's protectionist policies, unsure of their outcomes, now they are beginning to worry about the consequences of those policies: a possible recession, the constant introduction of new tariffs, and Trump's conflict with the Federal Reserve, which could make the regulator politically dependent on the White House. Thus, the pound now appears far less vulnerable than the U.S. currency.

Economic Calendar for the U.S. and the U.K.

On October 17, the economic calendar contains no notable events. Therefore, the information background will not influence market sentiment on Friday.

GBP/USD Forecast and Trading Recommendations

Sell positions may be considered if the pair closes below the 1.3425–1.3431 level on the hourly chart, targeting 1.3360. Buy positions could be considered if the pair closes above the 1.3425–1.3431 level, targeting 1.3487.

The Fibonacci grids are built between 1.3725–1.3247 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.