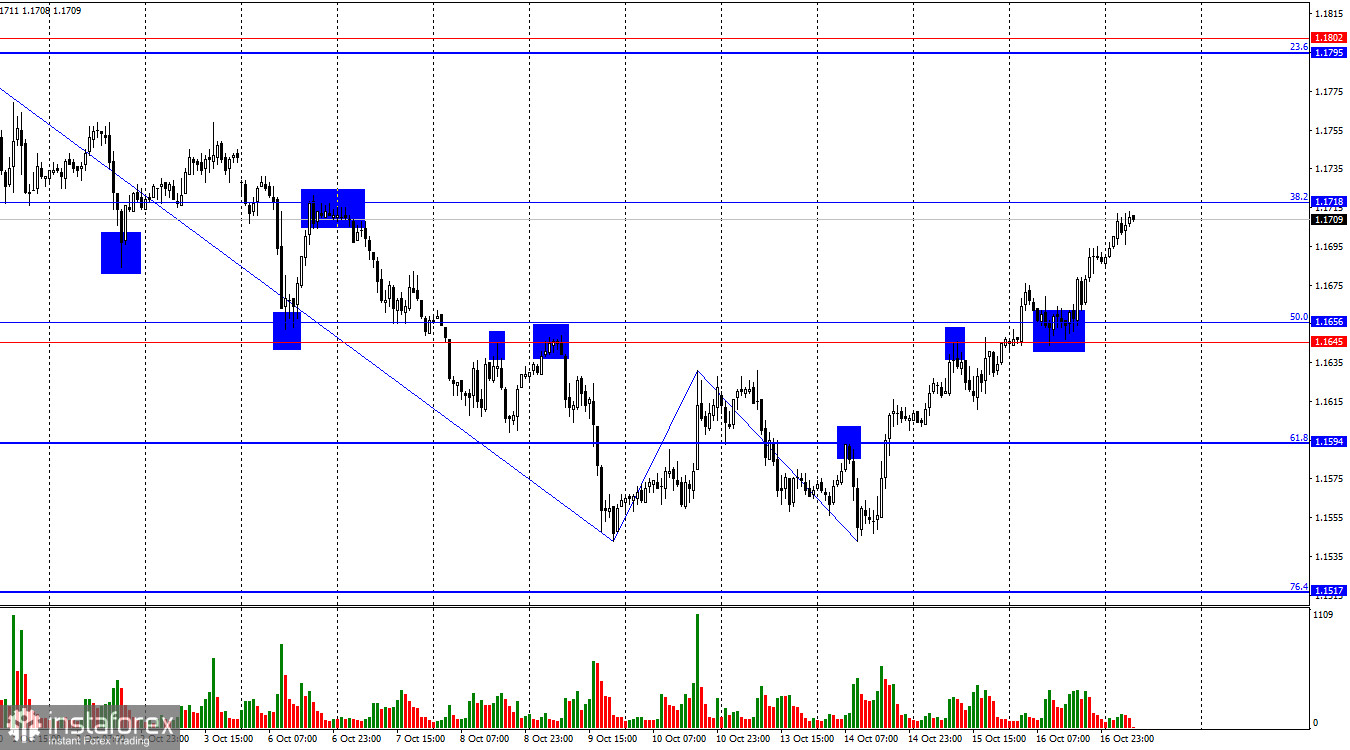

On Thursday, the EUR/USD pair rebounded from the support level of 1.1645–1.1656 and continued to rise toward the 38.2% Fibonacci retracement level at 1.1718, which could be tested today. A rebound from this level would allow traders to expect a reversal in favor of the U.S. dollar and a slight decline toward the 1.1645–1.1656 support level. A consolidation of the pair above 1.1718 would increase the chances of continued growth toward the 1.1795–1.1802 resistance level.

The wave structure on the hourly chart remains simple and clear. The last upward wave broke the previous wave's high, while the most recent completed downward wave did not break the previous low. Thus, the trend has now turned bullish. Recent labor market data, changing expectations for the Federal Reserve's monetary policy, and Trump's renewed aggression toward China all support bullish traders.

On Thursday, bulls didn't have many strong reasons to attack. However, I want to draw traders' attention to the fact that since Jerome Powell's speech on Tuesday evening, only bulls have been active, and the dollar has been falling. In my view, this is a sign of growing confidence among traders that the Federal Reserve will cut interest rates not only at the end of this month but also in December and early next year.

I'm not entirely sure this scenario will play out, since there has been no new data on U.S. inflation, unemployment, or payrolls for more than a month. The market is clearly expecting the worst—but what if that's not the case? In that situation, the FOMC might ease monetary policy more modestly than the market currently expects. However, I believe even that wouldn't save the dollar. Tensions between Donald Trump and China continue to escalate and are reaching a boiling point. Reports are already emerging of extremely high tariffs from the U.S. side and threats of a complete breakdown in relations with China. The situation for the dollar is not improving over time.

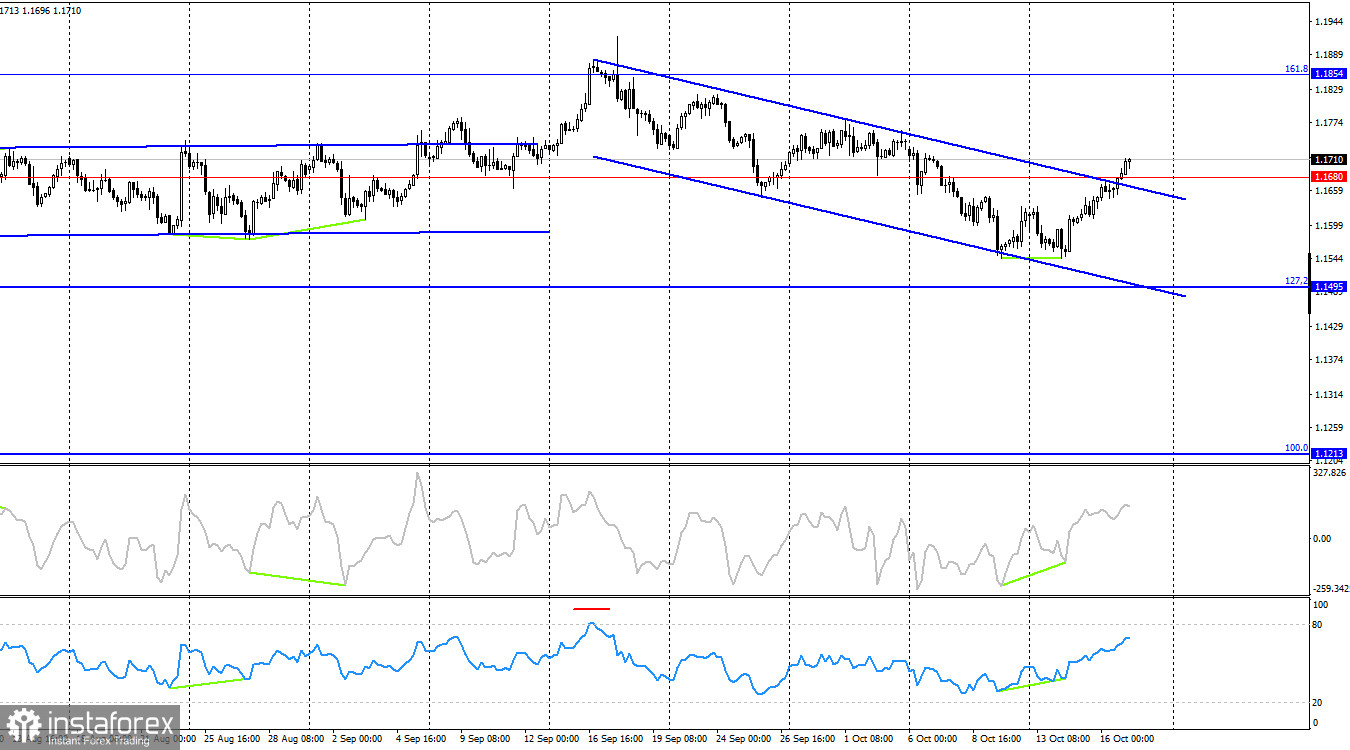

On the 4-hour chart, the pair has consolidated above the 1.1680 level and the downward trend channel after forming a bullish divergence on the CCI indicator. As a result, the upward movement may continue toward the next 161.8% Fibonacci retracement level at 1.1854.

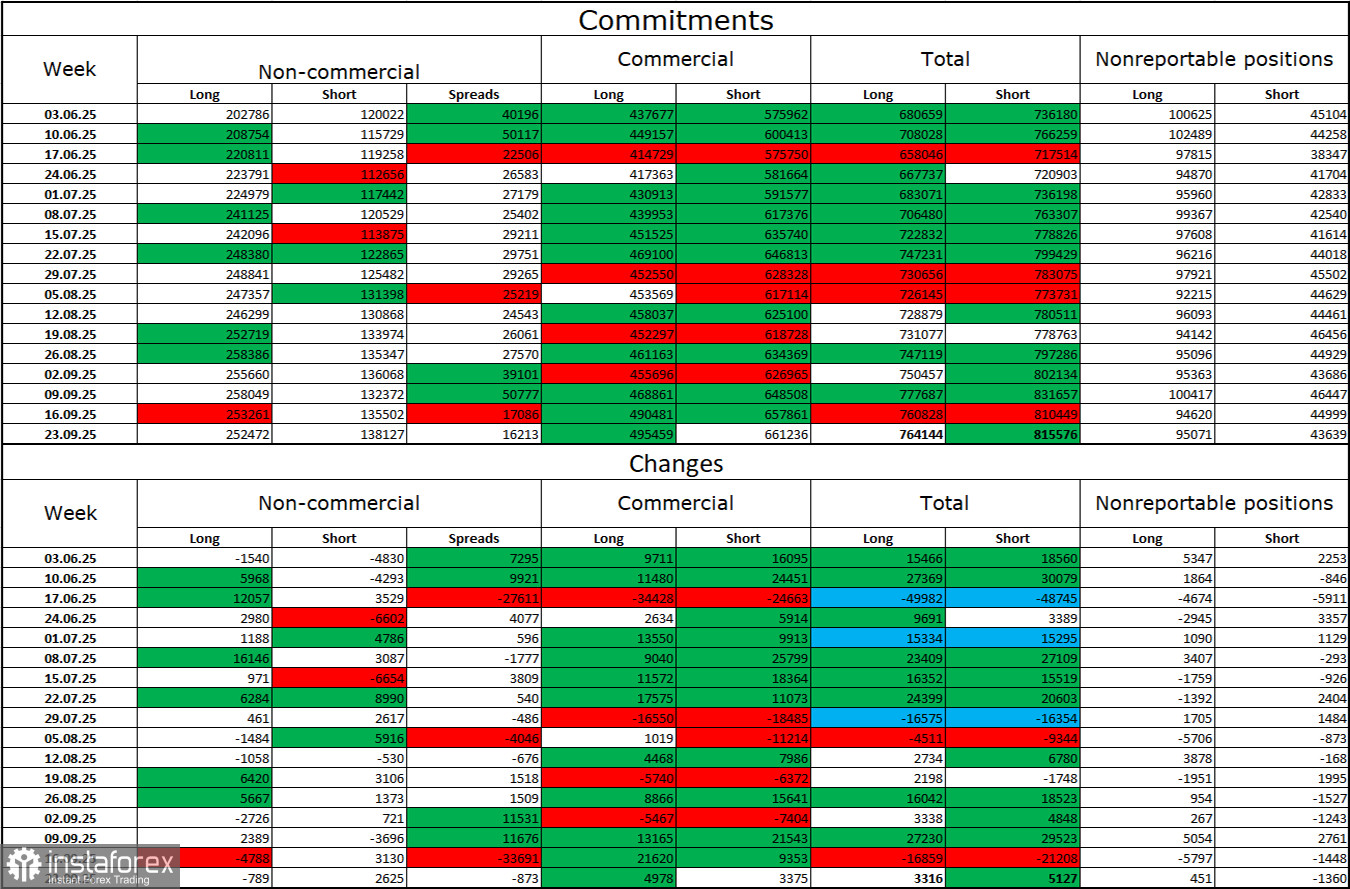

Commitments of Traders (COT) Report

During the latest reporting week, professional traders closed 789 long positions and opened 2,625 short positions. The sentiment of the non-commercial group remains bullish, largely thanks to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators now stands at 252,000, while short positions amount to 138,000 — almost a twofold gap.

Also note the large number of green cells in the table above, which reflect strong accumulation of positions in the euro. In most cases, interest in the euro is growing, while interest in the dollar is declining.

For 33 consecutive weeks, major players have been reducing short positions and increasing long positions. Donald Trump's policies remain the most significant factor for traders, as they could create a range of long-term structural problems for the U.S. economy. Despite the signing of several important trade agreements, many key economic indicators continue to show declines.

Economic Calendar for the U.S. and the Eurozone

Eurozone: Consumer Price Index (09:00 UTC).

On October 17, the economic calendar includes only one event, which is unlikely to generate much interest. Therefore, the news background will have very little impact on market sentiment on Friday.

EUR/USD Forecast and Trading Recommendations

Sell positions may be considered today in the event of a rebound from 1.1718 on the hourly chart, targeting 1.1656. Buy positions could previously be considered after a close above 1.1594, with targets at 1.1645–1.1656 — this target has been reached. Yesterday's consolidation above 1.1645–1.1656 allowed for new long positions with a target at 1.1718, which has also been nearly achieved. Today, a close above 1.1718 will allow traders to hold long positions, targeting 1.1795.

The Fibonacci grids are drawn between 1.1392–1.1919 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.