For the fourth consecutive day, the USD/CHF pair has been declining — marking the fifth negative session in the past six days. Spot prices have fallen below the round level of 0.7900 and appear poised for further losses amid the prevailing bearish trend for the U.S. dollar. The U.S. Dollar Index, which tracks the greenback's performance against a basket of major currencies, has fallen to its lowest level in more than a week.

This decline comes amid dovish expectations surrounding Federal Reserve policy and the prolonged U.S. government shutdown. Analysts suggest that investors have fully priced in two future Fed rate cuts — one in October and another in December. Meanwhile, on Thursday, the U.S. Senate rejected a Republican short-term funding bill for the tenth time, which was intended to end the ongoing government shutdown.

These factors, along with escalating trade tensions between the U.S. and China, are putting pressure on the dollar and the USD/CHF pair. Tensions between the two largest economies intensified after President Trump threatened to raise tariffs on Chinese goods to 100%, while China tightened export restrictions on rare earth metals. In addition, both countries earlier announced reciprocal port tariffs, raising fears of a potential full-scale trade war.

Another contributing factor — persistent geopolitical uncertainty — has reduced investor appetite for riskier assets, as reflected in stock market declines. As a result, demand for safe-haven assets such as the Swiss franc has increased, and the USD/CHF pair continues to retreat from last week's monthly high around 0.8075.

From a technical standpoint, oscillators on the daily chart remain negative, and the USD/CHF pair has fallen below the round level of 0.7900, marking a new October low and confirming its weakness. If prices return above the 0.7900 level and hold there, the pair could have a chance to halt the decline. Otherwise, the path of least resistance for spot prices remains to the downside.

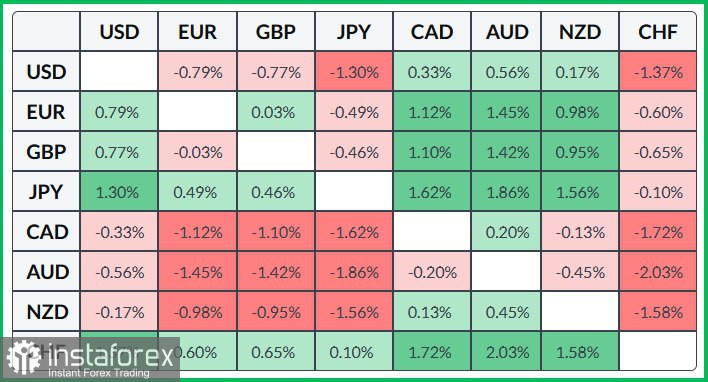

The table below shows changes in the U.S. dollar exchange rate against major currencies for the current week. The strongest performance was seen against the Australian dollar.