Trade Analysis and Guidance for the European Currency

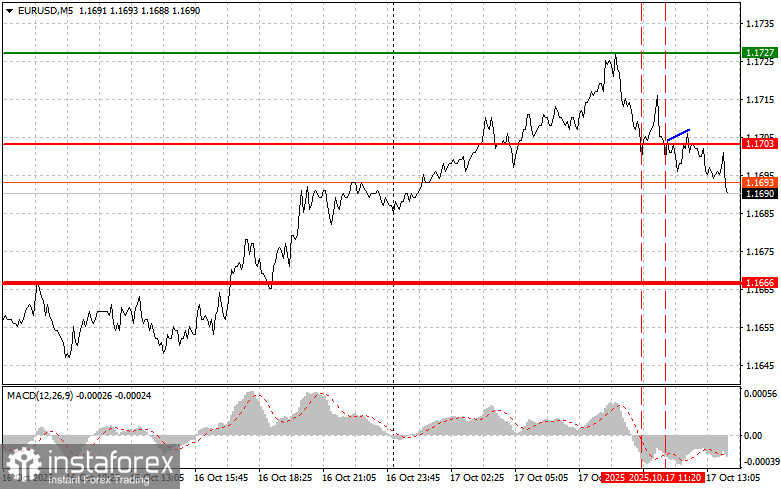

The price test at 1.1703 occurred when the MACD indicator had already moved well below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. The second test of 1.1703 coincided with the MACD being in the oversold area, which allowed Scenario #2 (buy) to play out — but the pair failed to achieve a strong upward move.

In the second half of the day, only a speech by FOMC member Alberto Musalem is expected. The market is holding its breath, awaiting Musalem's comments regarding the future trajectory of the Federal Reserve's monetary policy. Investors are eager to hear his view on inflation prospects. His remarks may shed light on how likely further aggressive rate cuts are — and when they might occur.

At the same time, the geopolitical front remains tense. Any sharp statement by Donald Trump regarding China risks sparking a new wave of trade war concerns. It's also important to remember that such comments can act as a catalyst for moves in the currency market — and the dollar is unlikely to benefit from them.

As for the intraday strategy, I'll be focusing primarily on Scenarios #1 and #2 below.

Buy Signal

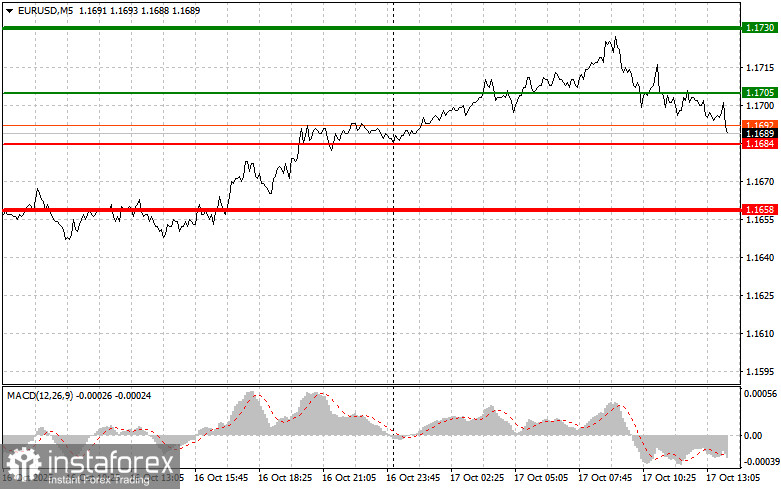

Scenario #1: Today, buying the euro is possible when the price reaches around 1.1705 (green line on the chart), targeting a rise toward 1.1730. At 1.1730, I plan to exit the market and also open a sell position in the opposite direction, expecting a move of 30–35 points from the entry point. A bullish euro scenario today will be more likely only if the Fed representatives take a dovish stance.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if the price tests 1.1684 twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. A rise toward 1.1705 and 1.1730 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro once the price reaches 1.1684 (red line on the chart). The target will be 1.1658, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20–25 point rebound from that level. Downward pressure on the pair may increase significantly today.Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro if the price tests 1.1705 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.1684 and 1.1658 can then be expected.

Chart Legend

- Thin green line – Entry price for buying the trading instrument

- Thick green line – Suggested price to place Take Profit or manually lock in profit, since further growth above this level is unlikely

- Thin red line – Entry price for selling the trading instrument

- Thick red line – Suggested price to place Take Profit or manually lock in profit, since further decline below this level is unlikely

- MACD Indicator – When entering the market, it is crucial to monitor overbought and oversold zones

Important Notes for Beginner Traders

Forex beginners should be very cautious when deciding to enter the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings.

If you choose to trade during news releases, always set stop-loss orders to minimize potential losses. Trading without stop-losses can quickly deplete your entire deposit, especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.