Trade Analysis and Guidance for the British Pound

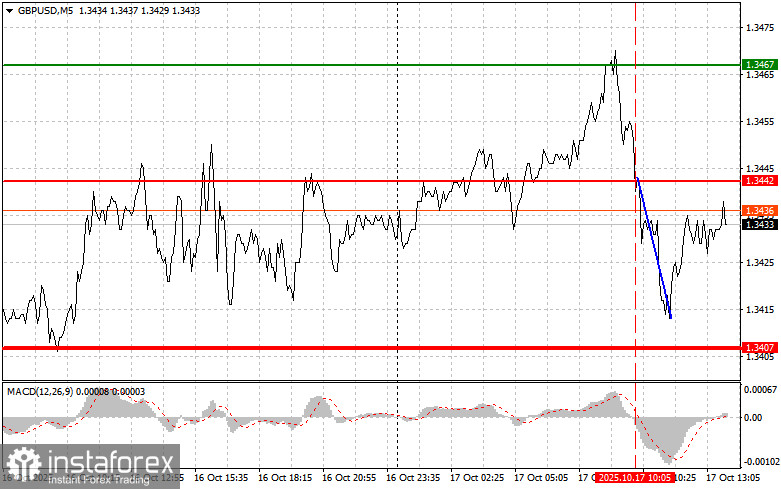

The price test at 1.3442 occurred when the MACD indicator had just started moving down from the zero line, confirming a valid entry point for selling the pound, which resulted in a drop of more than 30 points for the pair.

The market is now waiting for new hints from Alberto Musalem regarding the future of interest rates. His previous remarks were cautiously optimistic, but investors are hoping for clearer signals this time. Of particular importance will be his assessment of inflation persistence and labor market conditions. Any mention of a potential slowdown in U.S. economic growth could trigger a sell-off of the dollar.

The British pound, meanwhile, continues to walk a fine line, reacting sensitively to even minor shifts in trader sentiment. With no major U.S. statistics expected today, Musalem's speech may act as the key trigger for the next market move. A dovish tone will likely boost demand for the pound, while a hawkish one could extend the GBP/USD correction.

As for the intraday strategy, I'll be focusing primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the price reaches the 1.3445 entry point (green line on the chart), targeting a rise toward 1.3475 (thicker green line on the chart). Around 1.3475, I plan to exit long positions and open sell positions in the opposite direction, expecting a 30–35 point pullback from that level. A strong rise in the pound today is unlikely.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of 1.3425 while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger an upward reversal. A rise toward 1.3445 and 1.3475 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakout below 1.3425 (red line on the chart), which should lead to a rapid decline in the pair. The key target for sellers will be 1.3394, where I plan to exit short positions and immediately buy in the opposite direction, expecting a 20–25 point rebound from that level. The pound could drop sharply in the second half of the day.Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of 1.3445 while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.3425 and 1.3394 can then be expected.

Chart Legend

- Thin green line – Entry price where the trading instrument can be bought

- Thick green line – Suggested price for placing Take Profit or manually fixing profit, as further growth above this level is unlikely

- Thin red line – Entry price where the trading instrument can be sold

- Thick red line – Suggested price for placing Take Profit or manually fixing profit, as further decline below this level is unlikely

- MACD Indicator – When entering the market, it is crucial to monitor overbought and oversold zones

Important Notes for Beginner Traders

Beginner Forex traders should be very cautious when deciding to enter the market. Before the release of key fundamental reports, it's best to stay out of the market to avoid sudden price swings.

If you choose to trade during news events, always set stop-loss orders to minimize potential losses. Trading without stop-losses can quickly lead to the loss of your entire deposit, especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.