Trade Analysis and Advice on Trading the European Currency

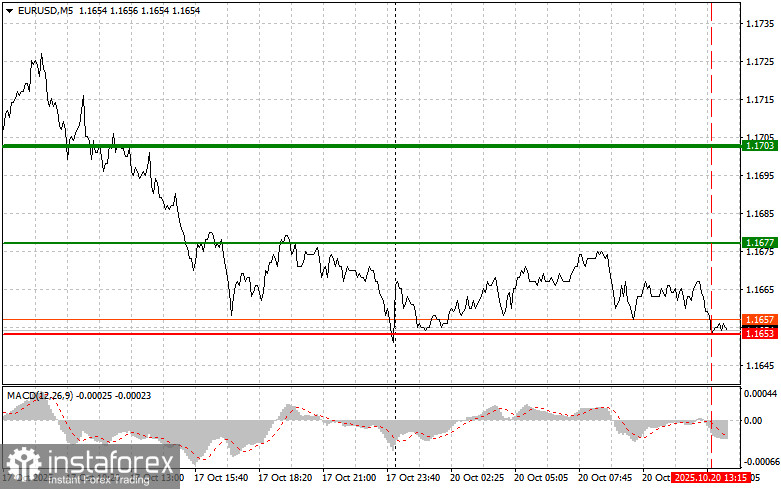

The price test at 1.1653 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

The Producer Price Index (PPI) in Germany fell by 0.1%, which was worse than economists' forecasts, prompting a decline in the euro. This seemingly minor figure conceals a complex set of problems, signaling a slowdown in economic activity in Europe's largest economy. A drop in producer prices, though potentially beneficial for consumers in the short term, may indicate weaker demand and fewer production orders—heralding a period of economic stagnation. The euro's fall in response to this data reflects traders' concerns about the outlook for the German economy and, by extension, the broader European economy.

In the second half of the day, attention will shift to the publication of the U.S. Leading Economic Index, though sharp market movements are not expected. Nevertheless, the details should not be ignored. The market reacts subtly to even the smallest changes, building complex strategies based on seemingly insignificant data. It's important to understand that the Leading Indicators Index is a composite of various metrics—from durable goods demand to consumer sentiment. Therefore, a superficial analysis of the final index value can lead to erroneous conclusions. If the data come out strong, pressure on the euro will likely persist. Also, the easing of trade tensions between the U.S. and China makes the dollar a more attractive asset.

As for the intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

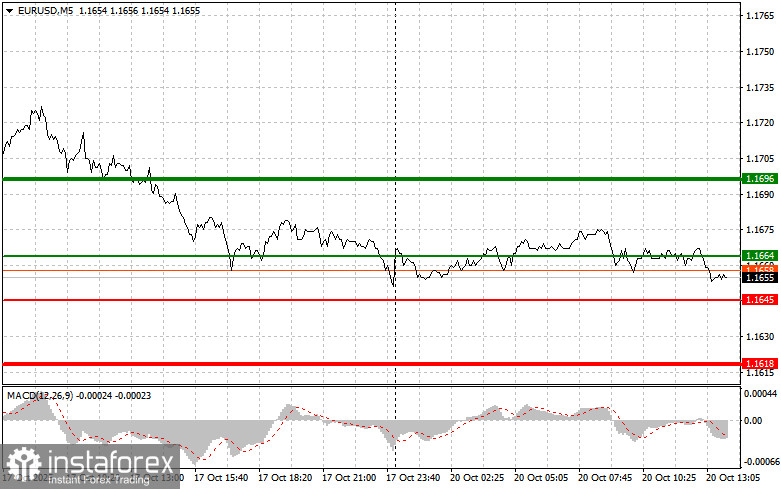

Scenario #1: Buy the euro today if the price reaches around 1.1664 (green line on the chart), with a target of 1.1696. At 1.1696, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. Expect euro growth today only if U.S. data come out weak.Important! Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1645 price level at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward reversal. Growth toward the opposite levels of 1.1664 and 1.1696 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1645 (red line on the chart). The target will be 1.1618, where I intend to exit the market and buy in the opposite direction (expecting a 20–25 point move from that level). Downward pressure on the pair may increase significantly today, as trade risks have eased considerably, restoring demand for the dollar.

Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to move downward from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1664 price level, at a time when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.1645 and 1.1618 can be expected.

Chart Explanation

- Thin green line – entry price where buying the instrument is possible

- Thick green line – estimated price where Take Profit can be set, or profits can be taken manually, since further growth above this level is unlikely

- Thin red line – entry price where selling the instrument is possible

- Thick red line – estimated price where Take Profit can be set, or profits can be taken manually, since further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider the overbought and oversold zones.

Important Note

Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of key fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, you must have a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.