Trade Analysis and Advice on Trading the British Pound

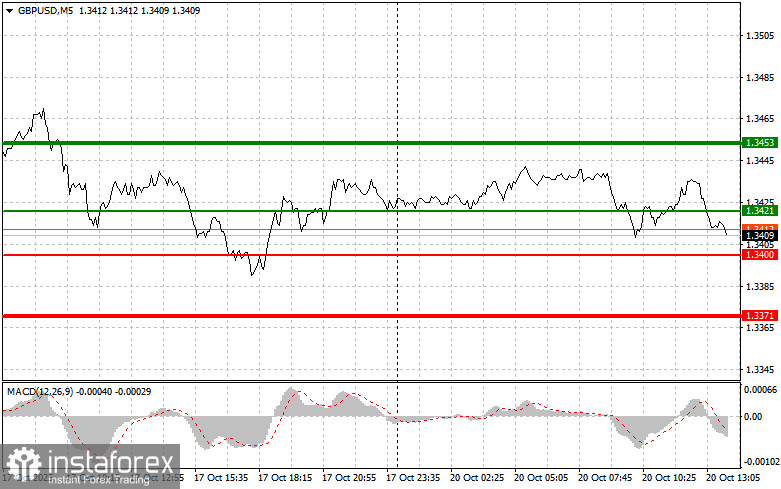

The price test at 1.3416 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. The second test of this price coincided with the moment when the MACD indicator was in the oversold zone, allowing Scenario #2 (buy) to play out, resulting in a 20-point rise.

During the U.S. session, only the Leading Economic Index will be released, so we are unlikely to see any major changes in the balance of power in the GBP/USD pair. Nevertheless, it would be unwise to underestimate the impact of this macroeconomic release. The Leading Economic Index itself is a complex, aggregated measure that reflects a comprehensive picture of U.S. economic activity. It consolidates data from various sectors — from the labor market to construction and consumer sentiment. A careful analysis of the index's components can provide valuable insight into potential shifts in Federal Reserve economic policy. However, major movements in GBP/USD are unlikely, as traders remain focused on developments surrounding the U.S.–China trade dispute.

As for the intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today when the price reaches the 1.3421 entry point (green line on the chart), targeting 1.3453 (thicker green line on the chart). Around 1.3453, I will close buy positions and open sales in the opposite direction (expecting a 30–35 point move back from that level). A strong rise in the pound today is unlikely.Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3400 price level, at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels of 1.3421 and 1.3453 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the price breaks below 1.3400 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3371, where I will exit short positions and immediately open buys in the opposite direction (expecting a 20–25 point rebound from that level). The pound could experience a significant drop in the second half of the day.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3421 price level, when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3400 and 1.3371 can be expected.

Chart Explanation

- Thin green line – the entry price where the trading instrument can be bought.

- Thick green line – the estimated price level for placing a Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin red line – the entry price where the trading instrument can be sold.

- Thick red line – the estimated price level for placing a Take Profit or manually fixing profits, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important Note

Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't apply money management principles and trade with large volumes.

And remember, for successful trading, you must have a clear trading plan, such as the one outlined above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.