The European Central Bank (ECB) was previously believed to have completed its interest rate-cutting cycle, but recent developments have introduced some doubt to that assumption.

On Monday, Bundesbank President Joachim Nagel commented, "We can remain in a wait-and-see mode on interest rates." No one was truly expecting further ECB cuts in the near term, as the market already believed the central bank had paused its policy tightening until at least mid-2026. So why the need for additional reassurance? Possibly because internal uncertainty has begun to grow, prompting Nagel to calm markets preemptively.

While the concerns remain indirect, they are accumulating. First, the anticipated fiscal stimulus in Germany appears to be delayed. If confirmed, this would likely lead to downward revisions of GDP forecasts. In France, a political crisis has taken on almost farcical proportions, with a revolving-door government formation effort followed by its collapse, and the parliament still unable to agree on a budget. These developments are raising doubts about the sustainability of French debt and the pace of economic growth in the eurozone.

Additionally, rising trade tensions between the United States and China, although indirectly, are also weighing on the euro area's economic outlook.

The ECB wants stability. However, recent monetary policy commentary suggests that the possibility of another rate cut cannot be ruled out. Notably, a growing number of Governing Council members now seem more concerned about downside risks for inflation rather than upward surprises.

These subtle but emerging shifts are eroding support for the euro and preventing it from establishing any sustainable upward trajectory. Conversely, the U.S. dollar is showing increasing signs of strength. The upcoming U.S. consumer inflation report (CPI) for September, due Friday, is highly anticipated. Forecasts call for a slight uptick to 3.1% year-over-year, with the core index expected to remain steady at 3.1%.

This report is crucial for gauging the impact of new tariffs on inflation. Markets currently expect the Federal Reserve to lower interest rates at the end of the month. Should CPI data surprise to the upside, it would shift market expectations for monetary policy and give the dollar further support.

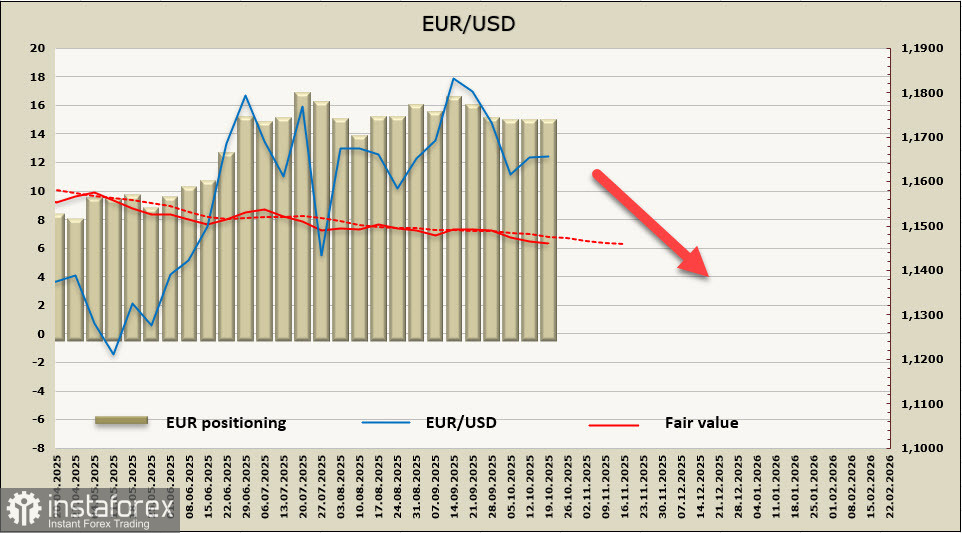

The ongoing U.S. government shutdown has halted the publication of CFTC data, making it more difficult to track positioning and sentiment in the currency markets. So far, estimates based on available information show no indication of a bullish reversal in EUR/USD.

Technically, the pair found temporary support at 1.1540 before staging a mild bounce. This move is viewed as corrective. The outlook remains bearish for EUR/USD, with the first downside target at 1.1540, followed by the recent local low of 1.1390. Longer-term, a decline toward 1.1250 remains in focus. However, given the current deficiency of hard fundamental data, confidence in this forecast is somewhat reduced.