The U.S. dollar is currently the main puzzle for the entire currency market. In October, demand for U.S. currency has gradually increased, complicating the wave structure across both analyzed instruments. However, not only the initial wave structure may become complex, but also the already-complex, corrected structure. This is because the demand for the dollar continues to rise, in full contradiction to the news backdrop.

Given this, I can immediately say that my readers can expect one movement next week, while actually seeing something entirely different. For instance, almost all market participants currently expect the Federal Reserve to lower interest rates. The U.S. central bank's meeting next week will involve making this very decision. Should we anticipate a decline in the U.S. currency? Logically, yes. But in recent weeks, the news backdrop has repeatedly sought to undermine demand for the U.S. currency. However, it is not the news that decides where the dollar will move, but the market participants. If market participants are buying U.S. currency, its value rises, even when the news suggests the opposite.

The most interesting event will be the Fed meeting. Following the release of the inflation report for the U.S. in September, there are no longer any doubts — the interest rate will be cut by 25 basis points. It is likely to occur in both October and December. However, the market barely reacted on Friday to the weaker inflation growth, even though it was clear what opportunities this opened up for the FOMC.

No further significant events in America are anticipated, apart from political ones. However, even these issues are not eliciting any market response. In October, Trump imposed a series of new import tariffs, which garnered little attention. The market shows no interest in the ongoing "shutdown" or the escalating trade war between China and the U.S.

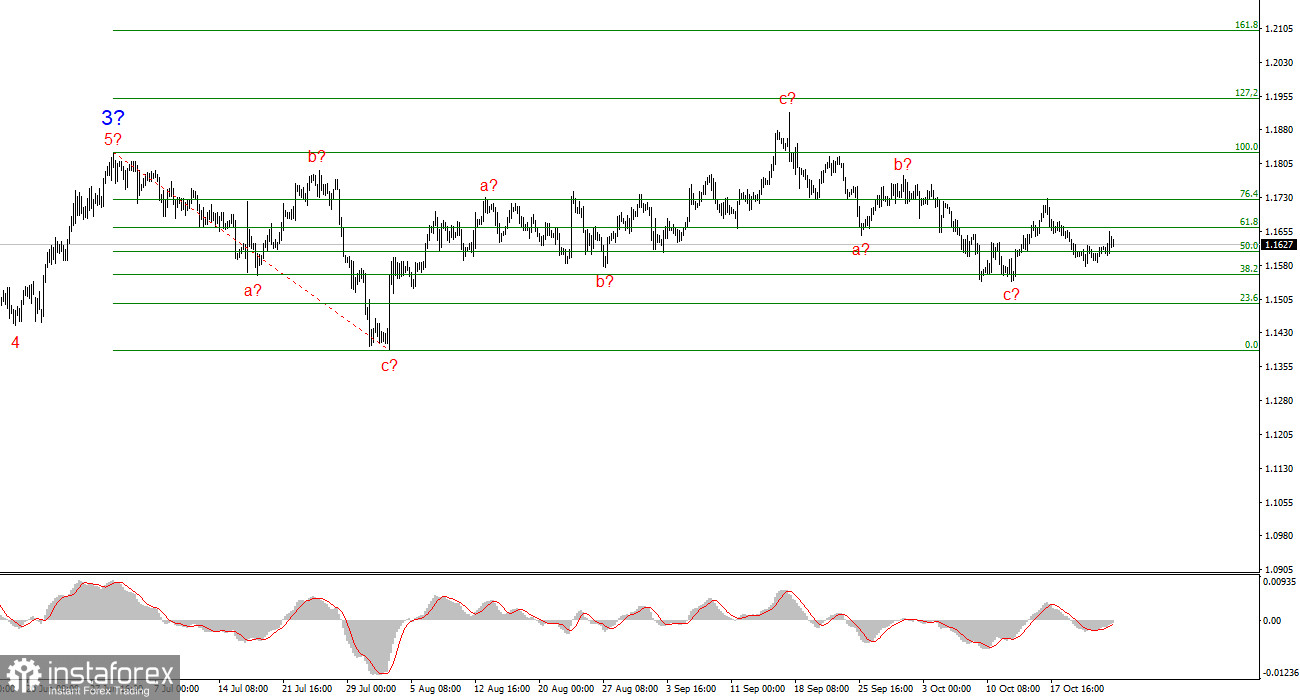

Wave Structure Analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues building an upward trend segment. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the U.S. dollar's decline. The targets for the current trend segment could reach up to the 25 figure. We are currently observing the formation of corrective wave 4, which is taking on a highly complex, elongated form. Therefore, I continue to consider only long positions for the near future. I expect the euro to reach 1.2245 by the end of the year, which corresponds to 200.0% on the Fibonacci.

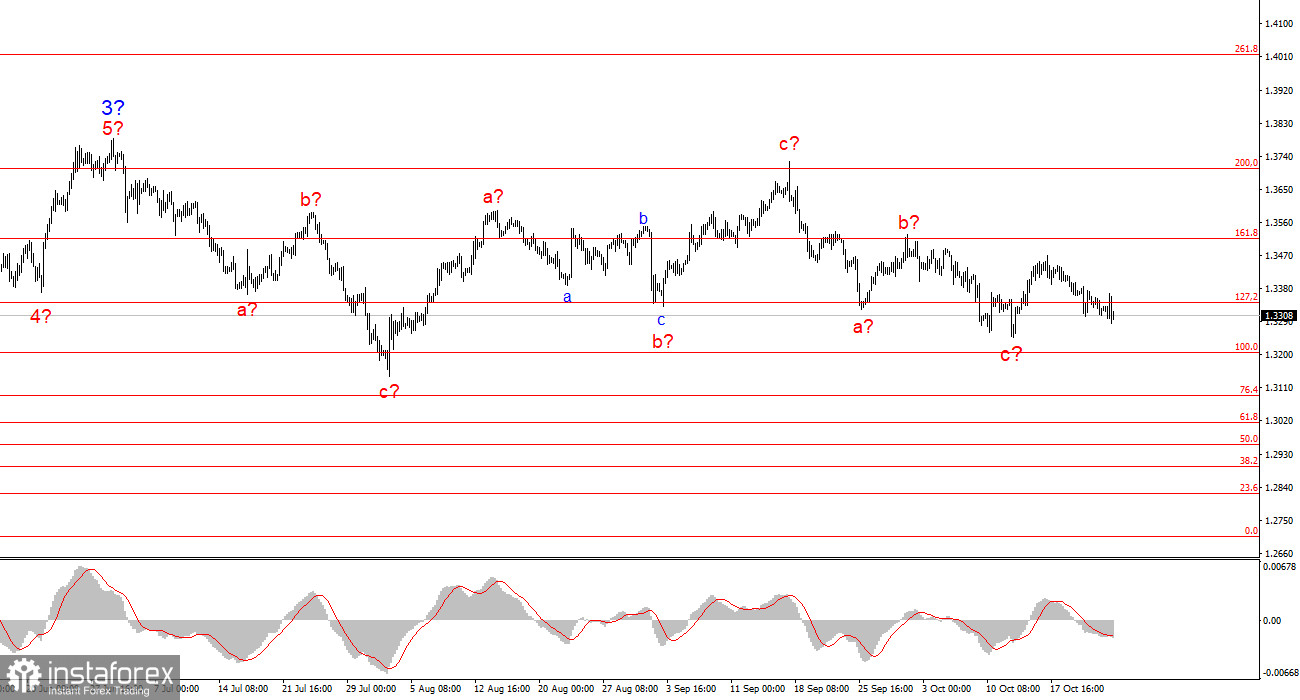

Wave Structure Analysis for GBP/USD:

The wave structure of GBP/USD has evolved. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is far more extended than that of wave 2. The next downward three-wave structure is presumed complete, but it could potentially be further complicated. If that is indeed the case, the upward movement of the instrument within the global wave structure may resume, with initial targets around the 38 and 40 figures, although the correction is ongoing at this time.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often carry changes.

- If there is uncertainty in what is happening in the market, it is better not to enter.

- There can never be 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.