Trade negotiations between the U.S. and Canada have been halted. Many of my readers might assume that Ottawa and Washington failed to find common ground and meet each other's demands. However, the reason is much simpler and absurdly amusing. Donald Trump personally stopped the negotiations due to a commercial released in Canada, where Ronald Reagan criticizes tariffs. Trump explained his decision as follows: "Due to their outrageous behavior, all trade negotiations are canceled." Short and clear, and most importantly, substantive.

Now we know that Trump can be offended by any joke, and trade negotiations can be suspended over a commercial. What should we do with this information? I recommend looking at the bigger picture. If Trump can cancel trade negotiations over a joke that, in the grand scheme of things, has no real impact, then he can initiate a new trade war over a similar joke.

In my reviews, I have often mentioned that Trump does not need to look far for an excuse to exert new pressure on a trade opponent. Tomorrow, the U.S. president could announce that the Chinese do not respect George Washington, supported by a TikTok video from any Chinese citizen, and impose new tariffs and duties. What is the problem? Why can't this work? The main thing is to find or fabricate a justification; the rest is just a matter of technique.

Thus, I believe the current global trade situation is just the beginning of a Global Trade War. Trump will not stop; he will not calm down, and there is no one to stop him, as Republicans control both chambers of the U.S. Congress. This is why I believe that pressure on the Federal Reserve will not cease, and pressure on Russia will also persist. The only question that remains is how all of Trump's opponents will react.

China has already demonstrated that it will respond with a counterattack. The Fed ignores Trump, even though at least three members of the FOMC call for monetary easing at every meeting, citing a weak labor market and changing circumstances that require a lower "neutral rate." The market may continue to ignore obvious facts for another six months, but the dollar's fate is nonetheless clear. And yes, Trump himself wants the dollar to be cheaper.

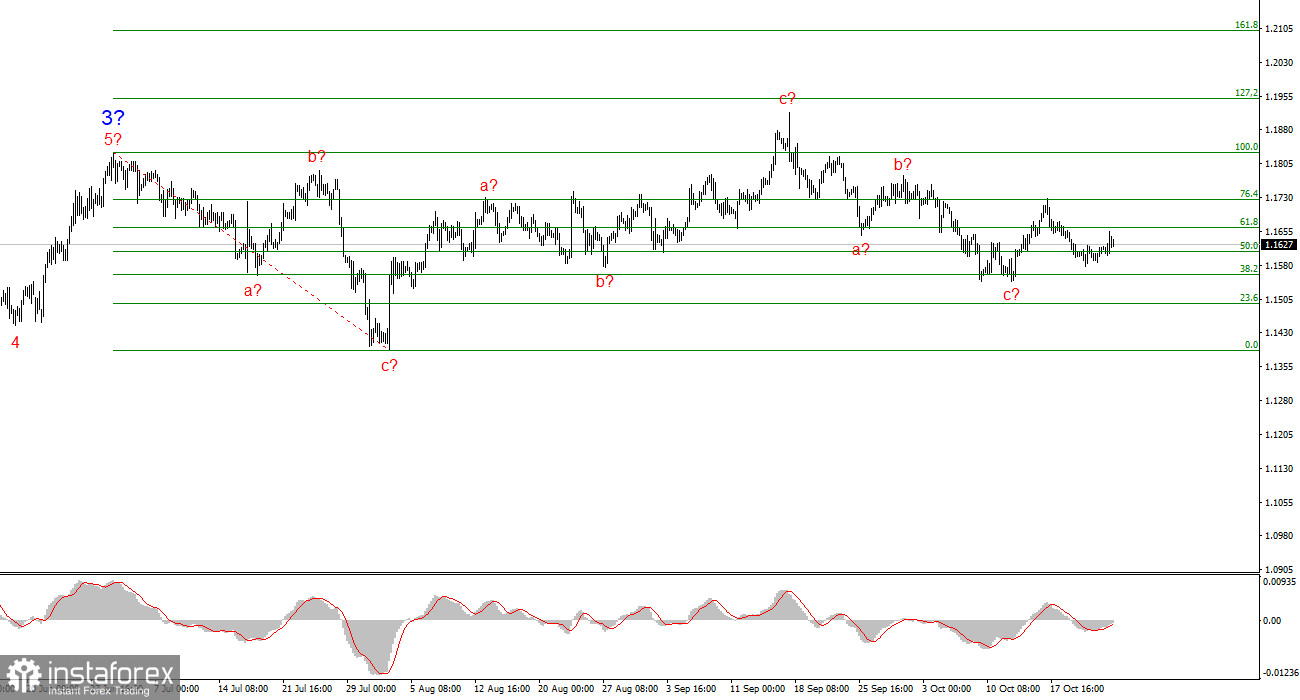

Wave Structure Analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Currently, the market is in a pause, but Trump's policies and the Fed's remain significant factors in the U.S. dollar's decline. The targets for the current trend segment could reach the 25 figure. We are presently observing the formation of corrective wave 4, which is taking on a very complex and elongated shape. Therefore, I continue to consider only long positions in the near future. I expect the euro to reach 1.2245 by the end of the year, which corresponds to 200.0% on the Fibonacci scale.

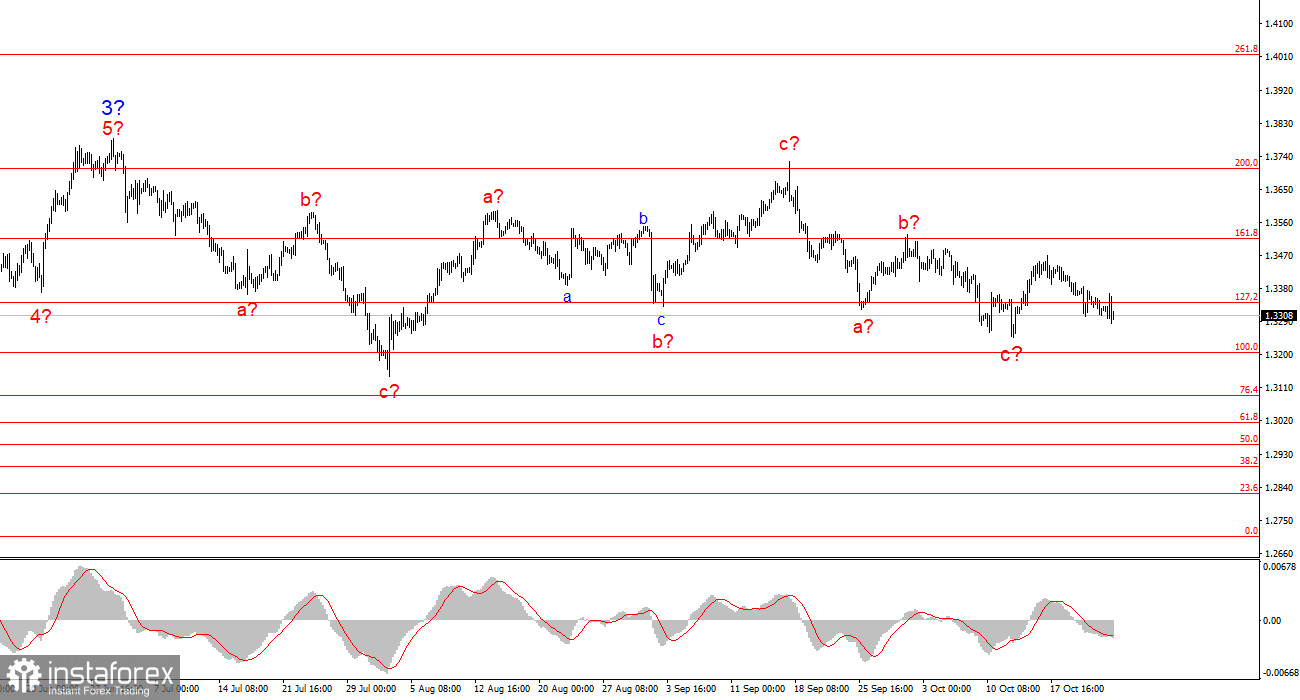

Wave Structure Analysis for GBP/USD:

The wave structure of GBP/USD has evolved. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is proving to be significantly more extended than that of wave 2. The next downward three-wave structure is presumed to be complete, but it could potentially complicate further. If that is indeed the case, the upward movement of the instrument within the global wave structure may resume, with initial targets around the 38 and 40 figures, although a correction is ongoing at this time.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often carry changes.

- If there is uncertainty in what is happening in the market, it is better not to enter.

- There can never be 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.