The NZD/USD pair continues its recovery from the monthly low. At the moment, spot prices are fluctuating within a familiar range and appear ready for further growth amid a favorable fundamental backdrop. A key factor is the easing of trade tensions between the United States and China — the world's two largest economies — which continues to support the Antipodean currencies, including the New Zealand dollar. In addition, on Sunday, senior officials from both countries agreed on the framework of a potential trade deal that will be discussed during the upcoming meeting between Donald Trump and Chinese President Xi Jinping later this week. This maintains a positive risk sentiment, which, combined with dovish expectations for the Federal Reserve, puts pressure on the safe-haven U.S. dollar and strengthens support for the NZD/USD pair.

According to CME Group's FedWatch Tool, traders have almost fully priced in a 25 basis point rate cut by the Federal Reserve on Wednesday. Another rate reduction is also expected in December. These expectations are reinforced by the latest U.S. consumer inflation data released on Friday, which for the second consecutive day kept the U.S. dollar under pressure — confirming a short-term bullish outlook for NZD/USD. However, bulls may refrain from aggressive action ahead of the two-day FOMC meeting, which begins on Tuesday.

In addition, the dovish outlook of the Reserve Bank of New Zealand (RBNZ) — suggesting further rate cuts may be necessary to bring inflation back to the 2% target over the medium term — could limit the pair's upside potential. Nevertheless, the factors listed above indicate that spot prices still have room for further short-term growth.

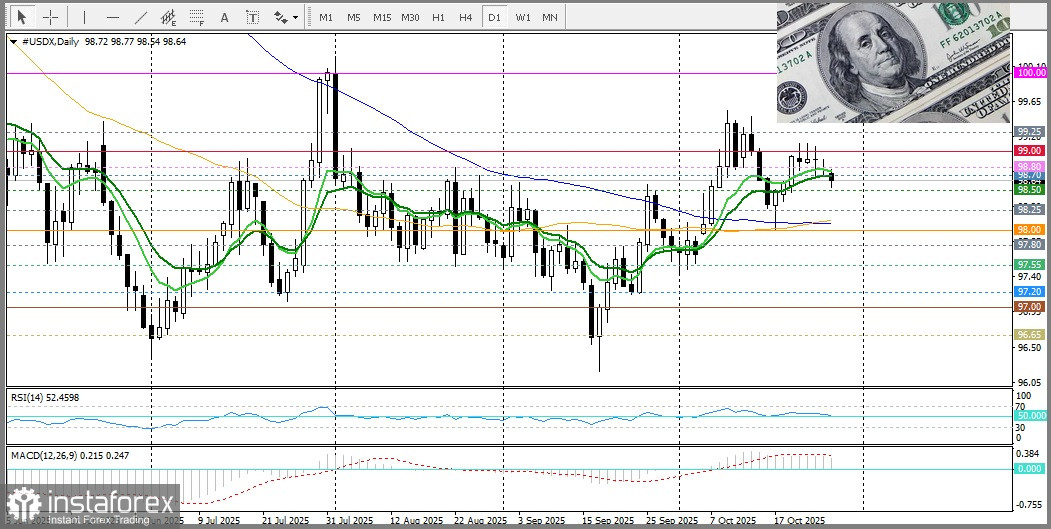

From a technical standpoint, the Relative Strength Index (RSI) is attempting to move into positive territory, confirming a bullish outlook. Another bullish signal is that the 9-day EMA is attempting to cross above the 14-day EMA. The nearest resistance for the pair lies at 0.5780, en route to the psychological level of 0.5800, while price support has formed near the confluence of the 9- and 14-day EMAs, just above the 0.5750 level.

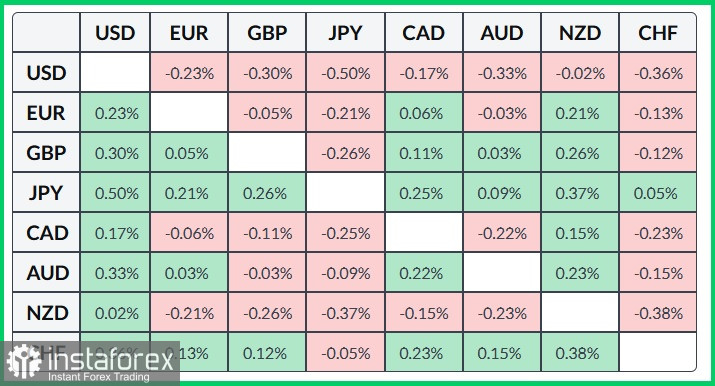

The table below shows the percentage change in the U.S. dollar's exchange rate against major currencies for the current week. In particular, the dollar has shown the greatest strength against the New Zealand dollar.