Trade Analysis and Guidance on Trading the Euro

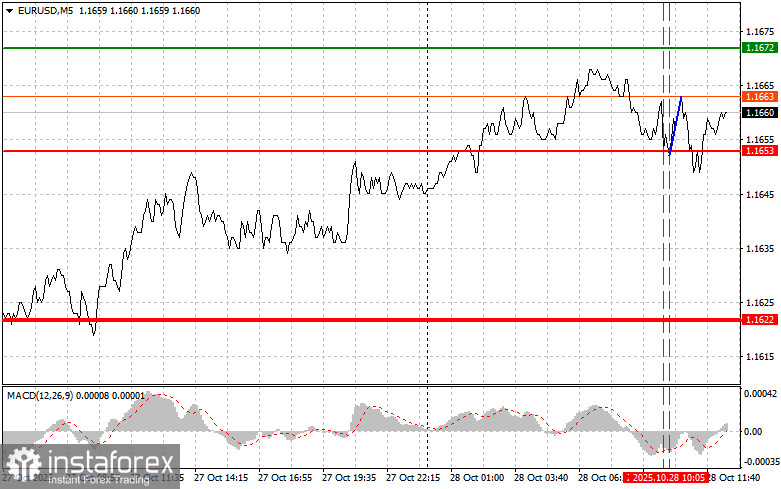

The price test at 1.1653 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. The second test of 1.1653 happened when MACD was in the oversold area, allowing the buy scenario No. 2 to play out. As a result, the pair rose by only about 10 points.

The euro lost value, but the decline was short-lived following news that the German consumer climate index came in below analysts' expectations. This unexpected outcome caused concern among investors, who began to suspect a potential slowdown in economic growth in the eurozone. Experts emphasize that falling consumer confidence can seriously affect domestic demand, which is one of the key drivers of economic activity. Already, there are signs that consumers are delaying purchases in hopes of improved economic conditions.

Today, data will also be released on U.S. consumer confidence, as well as reports on the housing price index and the Richmond Fed manufacturing index. If consumer confidence shows a decline, it could indicate rising household concerns about the future pace of economic growth. In an environment of uncertainty — driven by geopolitical factors, changes in central bank monetary policy, and slowing inflationary pressures — consumers tend to be more cautious with spending. This phenomenon could negatively impact the market as demand for goods and services decreases.

In addition, the S&P/Case-Shiller Home Price Index, which tracks housing price dynamics, may provide valuable clues about the state of the real estate market. Falling home prices could signal slowing demand caused by high interest rates. It is also worth keeping an eye on the manufacturing index: if the Richmond Fed manufacturing index shows deterioration, it could indicate slowing industrial activity and a lack of growth in the sector — further worrying investors and putting pressure on the U.S. dollar.

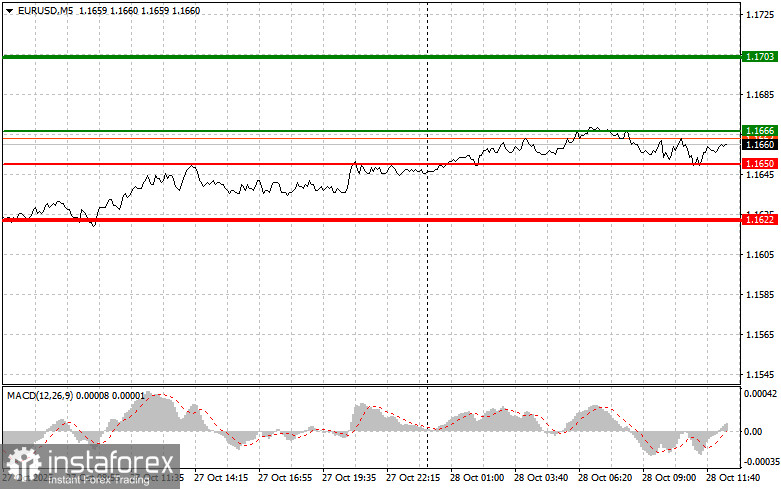

As for the intraday trading strategy, I will rely primarily on the execution of Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Buy the euro today upon reaching the 1.1666 level (green line on the chart) with a target of 1.1703. At 1.1703, I plan to exit the market and open a sell position in the opposite direction, expecting a move of 30–35 points from the entry point. Today's potential euro growth will likely be driven by a weaker dollar.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of the 1.1650 level while the MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. You can then expect growth toward 1.1666 and 1.1703.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.1650 level (red line on the chart) with a target of 1.1622, where I will exit the market and immediately open a buy position in the opposite direction (expecting a 20–25 point rebound from the level). Selling pressure on the pair could return at any moment today.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of the 1.1666 level while the MACD is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. You can expect a decline toward 1.1650 and 1.1622.

Chart Legend

- Thin green line – entry price for potential buy positions

- Thick green line – projected Take Profit level or price zone to fix profit manually, since further growth above this level is unlikely

- Thin red line – entry price for potential sell positions

- Thick red line – projected Take Profit level or price zone to fix profit manually, since further decline below this level is unlikely

- MACD Indicator – when entering the market, rely on overbought and oversold zones.

Important Note for Beginner Forex Traders

Beginners should be extremely cautious when deciding to enter the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly — especially if you ignore money management and trade large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one provided above. Making spontaneous trading decisions based on the current market situation is a losing strategy for any intraday trader.