With Donald Trump taking office for a second time, America has claimed to be setting a course to reduce spending, cut the budget deficit, and lower the national debt. In theory, that is. In practice, we are witnessing yet another "shutdown," caused by the ongoing lack of funding for federal agencies and the government. If there were no budget deficit, there would be no shutdown. It is clear that once again, Trump's administration cannot reach an agreement with the Democrats, but this is far from the only sign of unmet goals set by Trump.

I want to remind you again that Trump has repeatedly criticized the Biden administration (as well as many other presidents and Democrats in general) for excessive spending that has led to a constant increase in U.S. national debt. Under the banner of "Let's make the budget surplus, reduce the national debt, and restore America's greatness," Trump initiated a trade war intended to fill the state treasury with "free money." The trade war has been ongoing for six months now, with Trump announcing lucrative trade agreements almost every other day, which are either already signed or will inevitably be signed "in the near future," while the IMF continues to predict further growth in U.S. national debt.

According to the International Monetary Fund's forecasts, the U.S. budget deficit will exceed GDP by 7% every year until 2030. This excess will be the largest among all countries monitored by the IMF. Naturally, the IMF tracks not only African and Asian countries with weak economies. For example, the Fund predicts that the debt-to-GDP ratio will soon worsen in the U.S. compared to the crisis-stricken Italy and Greece. In other words, Italy and Greece have recognized their spending habits, realized they are spending more than they earn, and taken concrete measures to cut expenditures.

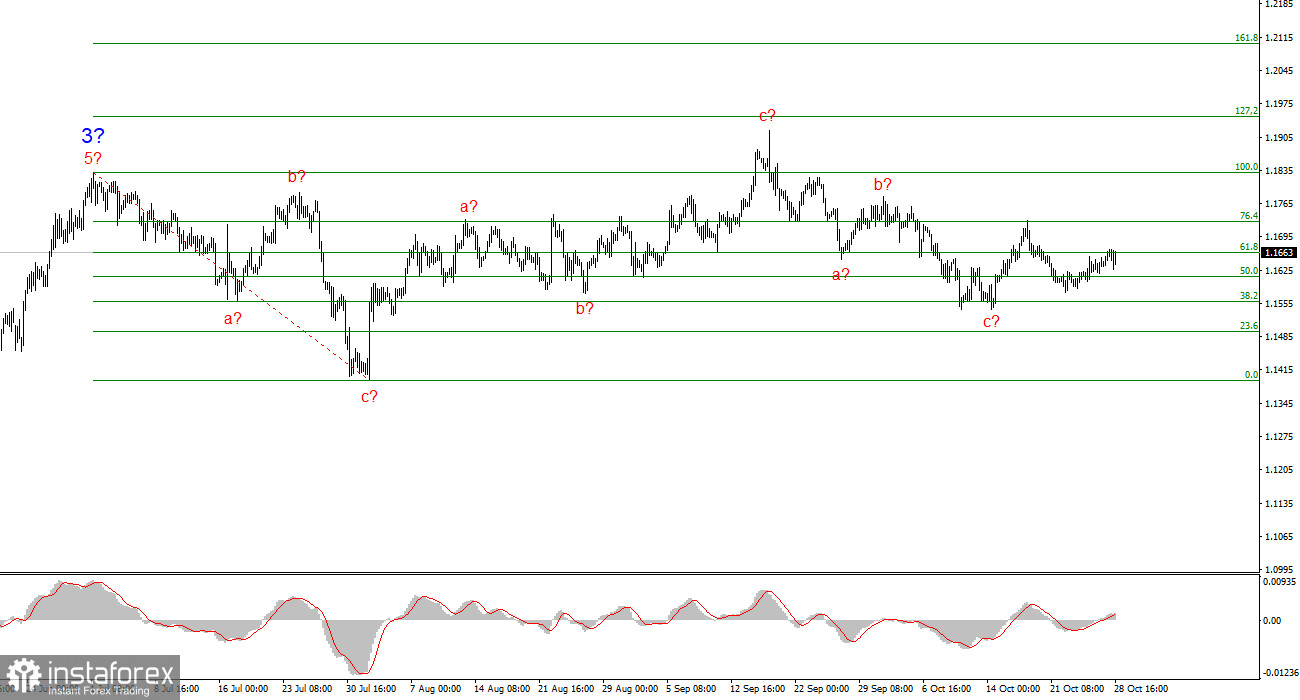

Wave Analysis of EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build its upward trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed remain significant factors in the U.S. dollar's decline. The targets for the current trend segment may reach the 25 figure. At this time, we can observe the formation of corrective wave 4, which is taking on a highly complex, elongated shape. Therefore, in the near future, I will still consider only buying. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

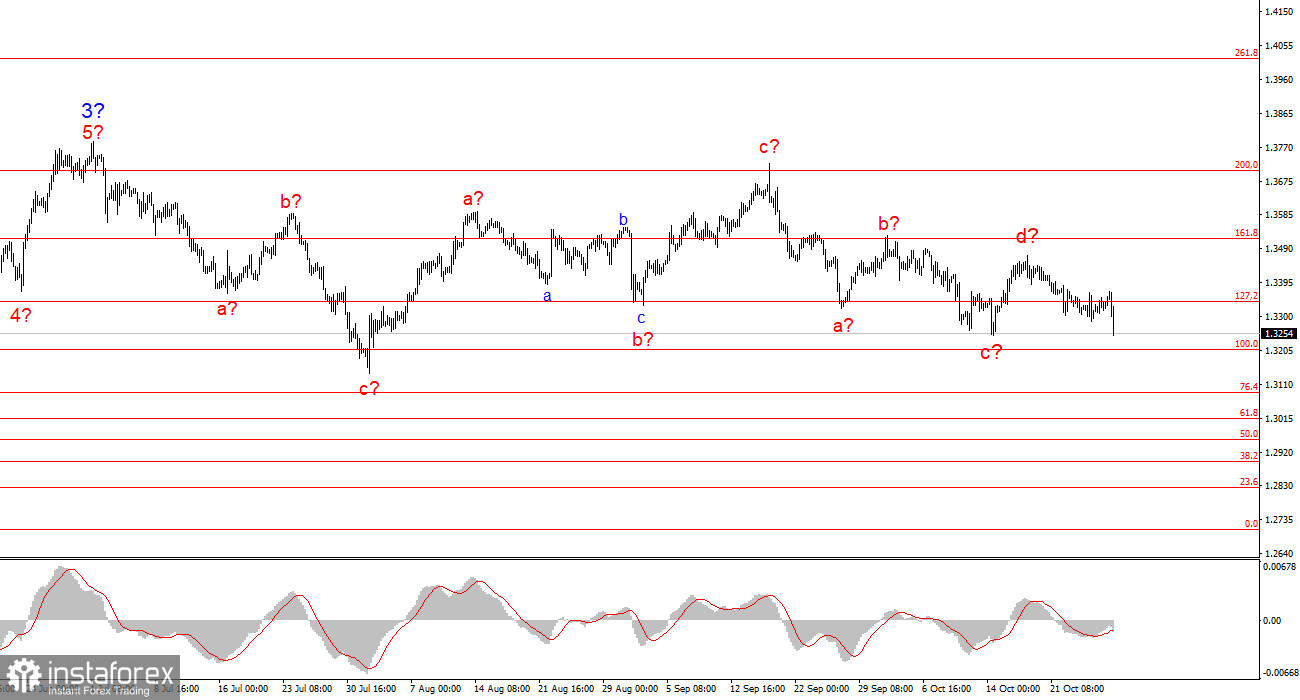

Wave Analysis of GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is significantly longer than that of wave 2. Another downward three-wave structure is presumed to be completed, but it could complicate further. If that is indeed the case, the instrument's upward movement within the global wave structure may resume with initial targets around the 38 and 40 figures, but a correction is ongoing at this time.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in market conditions, it is better not to enter the market.

- There can never be 100% certainty about the direction of movement. Always remember to use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.