Continuing the comparison between Italy, Greece, and the U.S., the IMF also notes that the national debt of the former two countries will decrease due to strict control over spending and taxes. The U.S. Congressional Budget Office agrees, stating that the country's national debt will not only grow until 2030 but also in the subsequent decades. It is clear that Donald Trump will not be in power in ten years, but the fact remains that there are currently no signs of a budget deficit reduction that could lead to a decrease in U.S. national debt.

In America, the Trump administration has achieved significant reductions in spending and increases in revenue through import tariffs. However, this statement comes from Joseph Lavorgna, an economic advisor to the U.S. Secretary of the Treasury. It is worth mentioning that there is very little objectivity in the statements of nearly all Republican government officials. Trump follows a strategy reminiscent of George Orwell's "Ministry of Truth." In other words, the real figures can be completely different, but Trump and his team present their own numbers in interviews. For instance, Trump has repeatedly claimed that the trade agreements have already brought hundreds of billions of dollars to America. However, it remains unclear where these hundreds of billions are if the national debt continues to grow.

Based on everything said above, I believe the U.S. national debt will not decrease, which is very negative for investment purposes. By 2025, America will be much less attractive to foreign investors, even as key stock indices continue to rise. The explanation for this is straightforward— the American economy is flooded with money that needs to be invested amid the resurgence of inflation. Therefore, the U.S. stock market is not growing due to economic optimism but out of necessity.

The American currency is currently in demand, despite the constant stream of negativity from the U.S. However, it is still evident on higher charts that any decline is merely a corrective wave or a segment of the trend. Consequently, I continue to expect the correction for both instruments to be completed and the upward trend segment to resume.

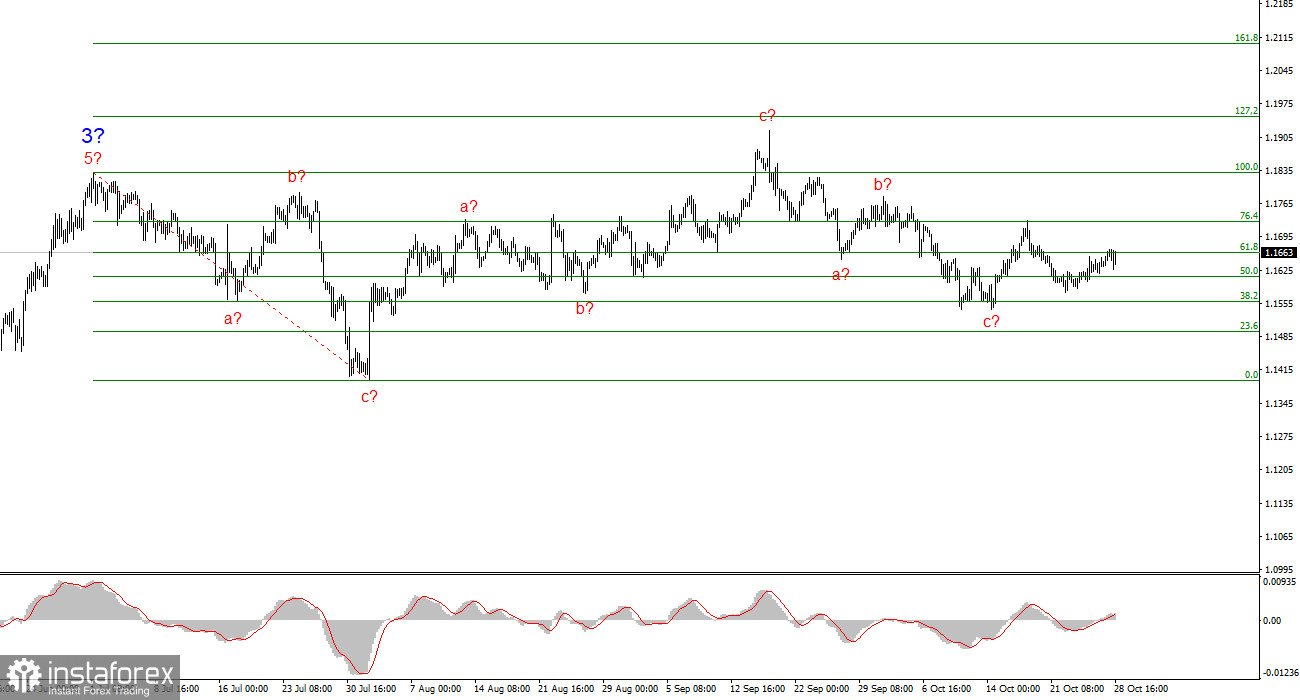

Wave Analysis of EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build its upward trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed remain significant factors in the U.S. dollar's decline. The targets for the current trend segment may reach the 25 figure. At this time, we can observe the formation of corrective wave 4, which is taking on a highly complex, elongated shape. Therefore, in the near future, I will still consider only buying. By the end of the year, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

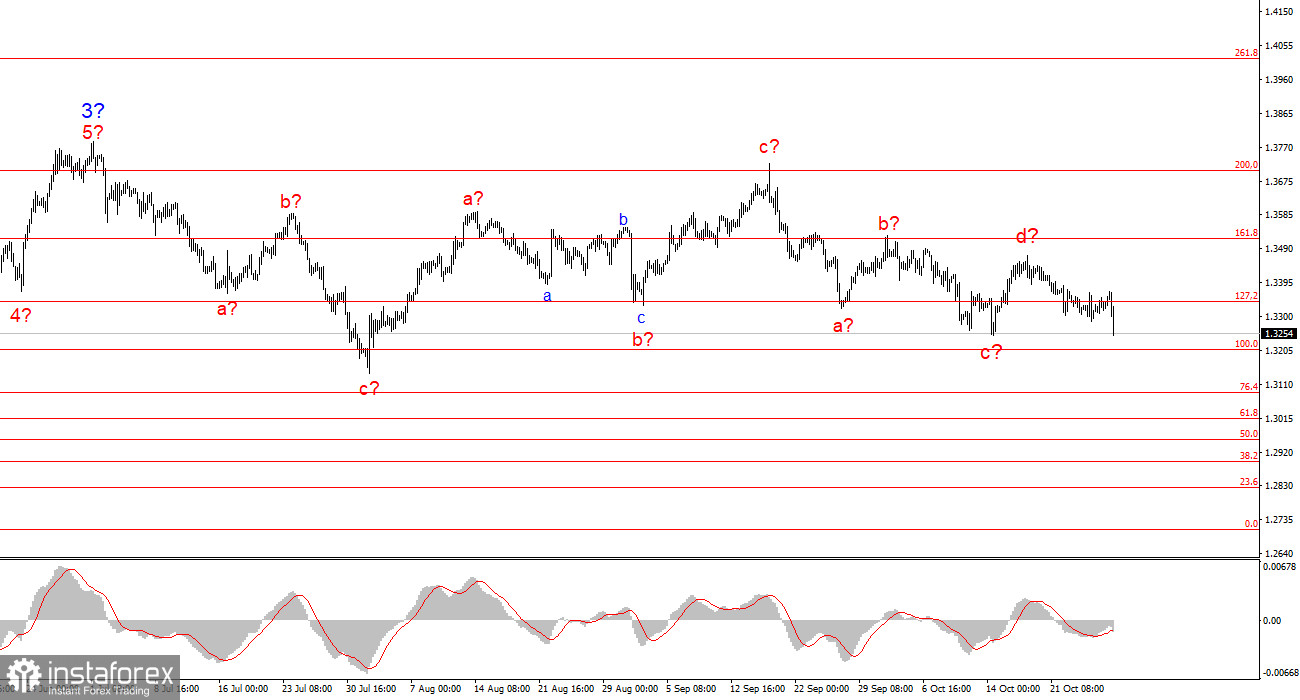

Wave Analysis of GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with an upward impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is significantly longer than that of wave 2. Another downward three-wave structure is presumed to be completed, but it could complicate further. If that is indeed the case, the instrument's upward movement within the global wave structure may resume with initial targets around the 38 and 40 figures, but a correction is ongoing at this time.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in market conditions, it is better not to enter the market.

- There can never be 100% certainty about the direction of movement. Always remember to use stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.