Analysis of Macroeconomic Reports:

Several macroeconomic reports are scheduled for Thursday. While some of these reports may not provoke any significant market reaction, the sheer volume means responses should be anticipated. In Germany, important reports will be released, including unemployment figures, the number of claims for unemployment benefits, third-quarter GDP (first estimate), and inflation data. In the Eurozone, third-quarter GDP will also be published. In both cases, minimal economic growth rates are anticipated, but the market has long been accustomed to such figures. Notably, there are no significant events scheduled for today in the US or the UK.

Analysis of Fundamental Events:

General Conclusions:

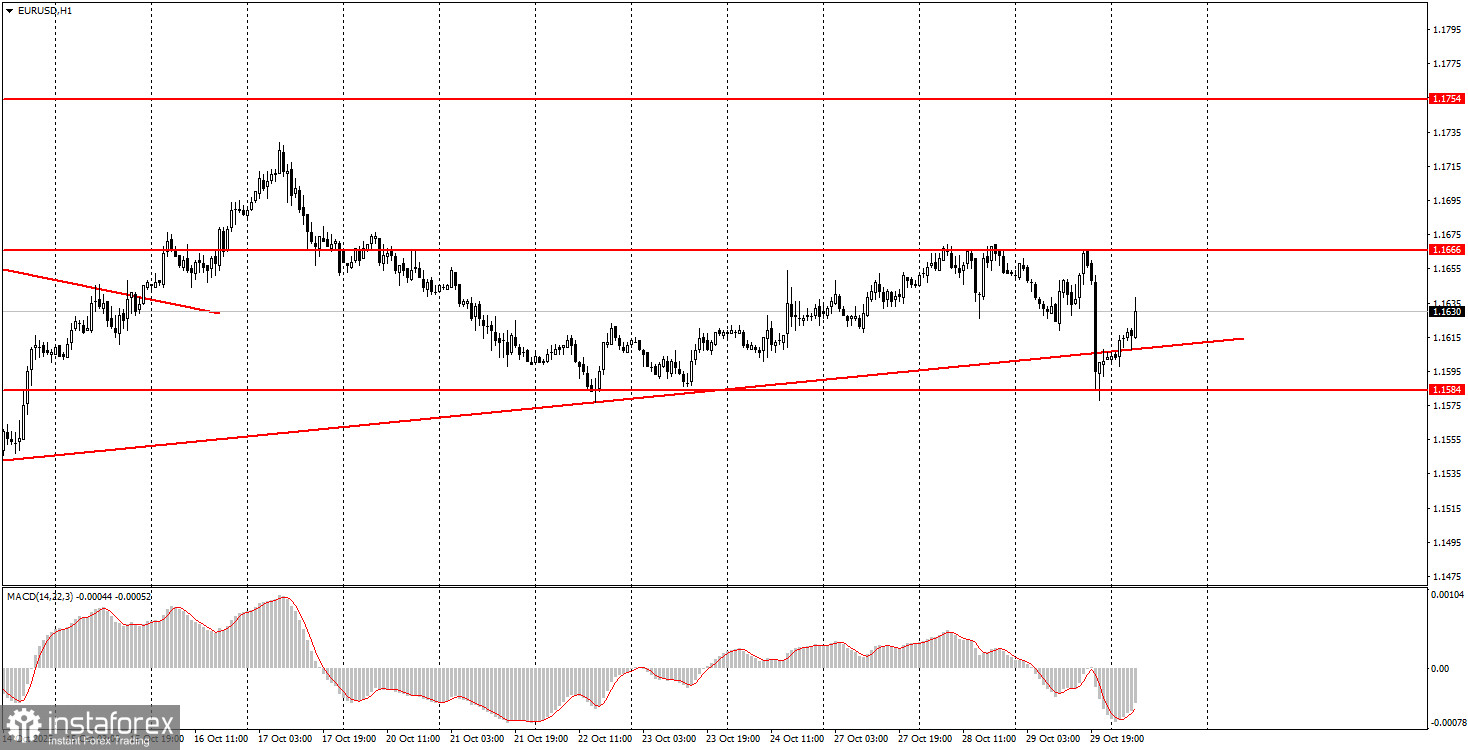

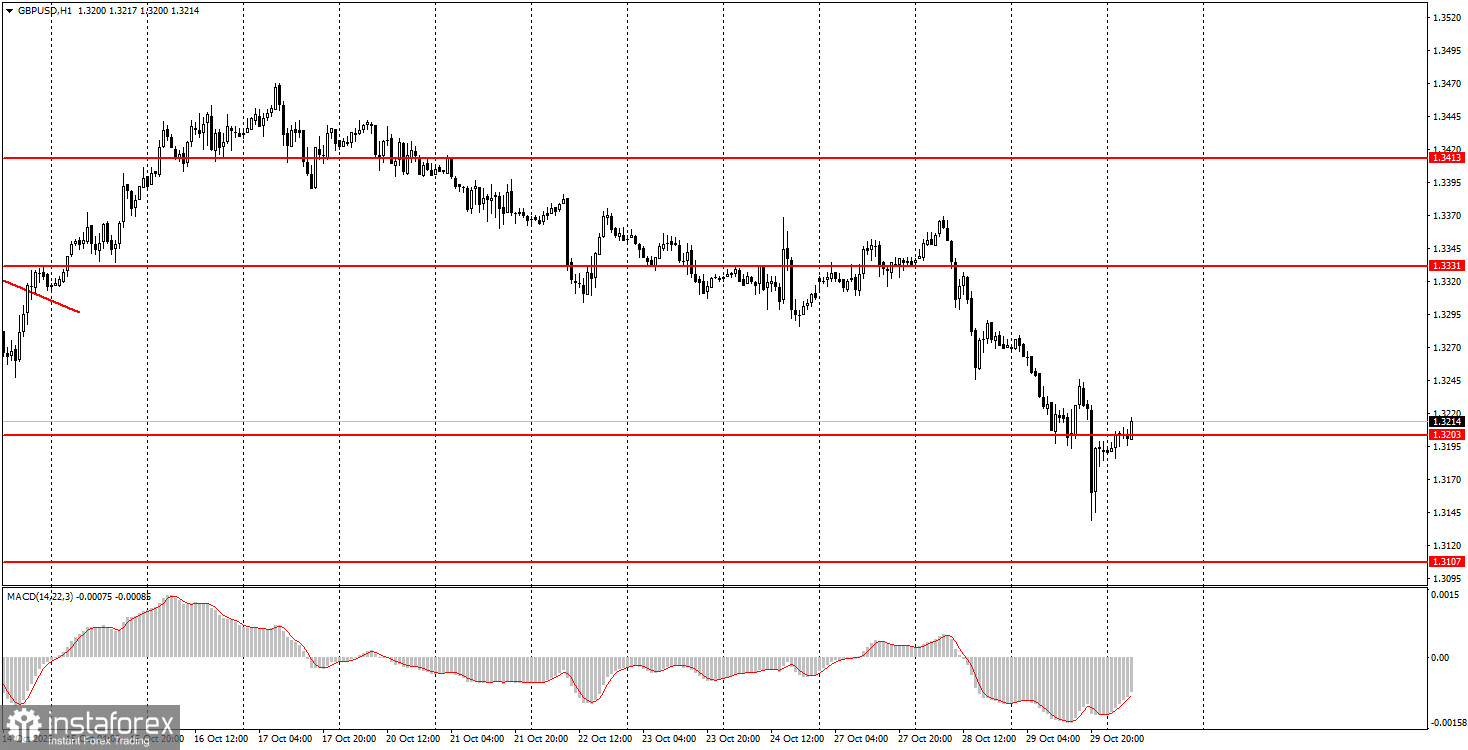

During the penultimate trading day of the week, both currency pairs may trade chaotically once more. There will be enough macroeconomic data today to prevent the market from remaining stagnant, along with the bonus of the ECB meeting and Lagarde's speech. The euro remains in a flat state on the hourly timeframe, so traders can trade from the boundaries of this flat, specifically the areas of 1.1571-1.1584 and 1.1655-1.1666. For the British pound, there is an excellent trading area at 1.3203-1.3211, where the price currently resides.

Core Principles of the Trading System:

- The strength of a signal is assessed by the time it took for the signal to form (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can produce numerous false signals or no signals at all. However, at the first signs of a flat, it is better to stop trading.

- Trades should be opened during the time frame between the start of the European session and the middle of the American session, and all trades should be closed manually after that.

- On the hourly timeframe, trading signals from the MACD indicator should ideally be traded only in the presence of strong volatility and a trend confirmed by a trendline or a trending channel.

- If two levels are too close to each other (from 5 to 20 pips), they should be considered as an area of support or resistance.

- After the price moves 15-20 pips in the right direction, a Stop Loss should be set to breakeven.

What's on the Charts:

- Support and Resistance Levels: Levels that serve as targets when opening buy or sell positions. Take Profit levels can also be placed near these levels.

- Red Lines: Channels or trend lines that display the current trend and indicate the preferred direction for trading.

- MACD Indicator (14,22,3): The histogram and signal line serve as a supplementary indicator that can also be used to generate signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, trading should be approached with maximum caution, or one should exit the market to avoid sharp price reversals against the preceding movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and proper money management are the keys to long-term success in trading.