Everything is understood in comparison. The higher the S&P 500 climbs, the more alarming warnings come from banks and investment firms, including Goldman Sachs and Morgan Stanley. Investors often draw parallels to the dot-com crisis and speculate about a bubble that is about to burst. However, the main difference between today's tech giants and the internet companies of the late 20th century is that the former are generating substantial profits.

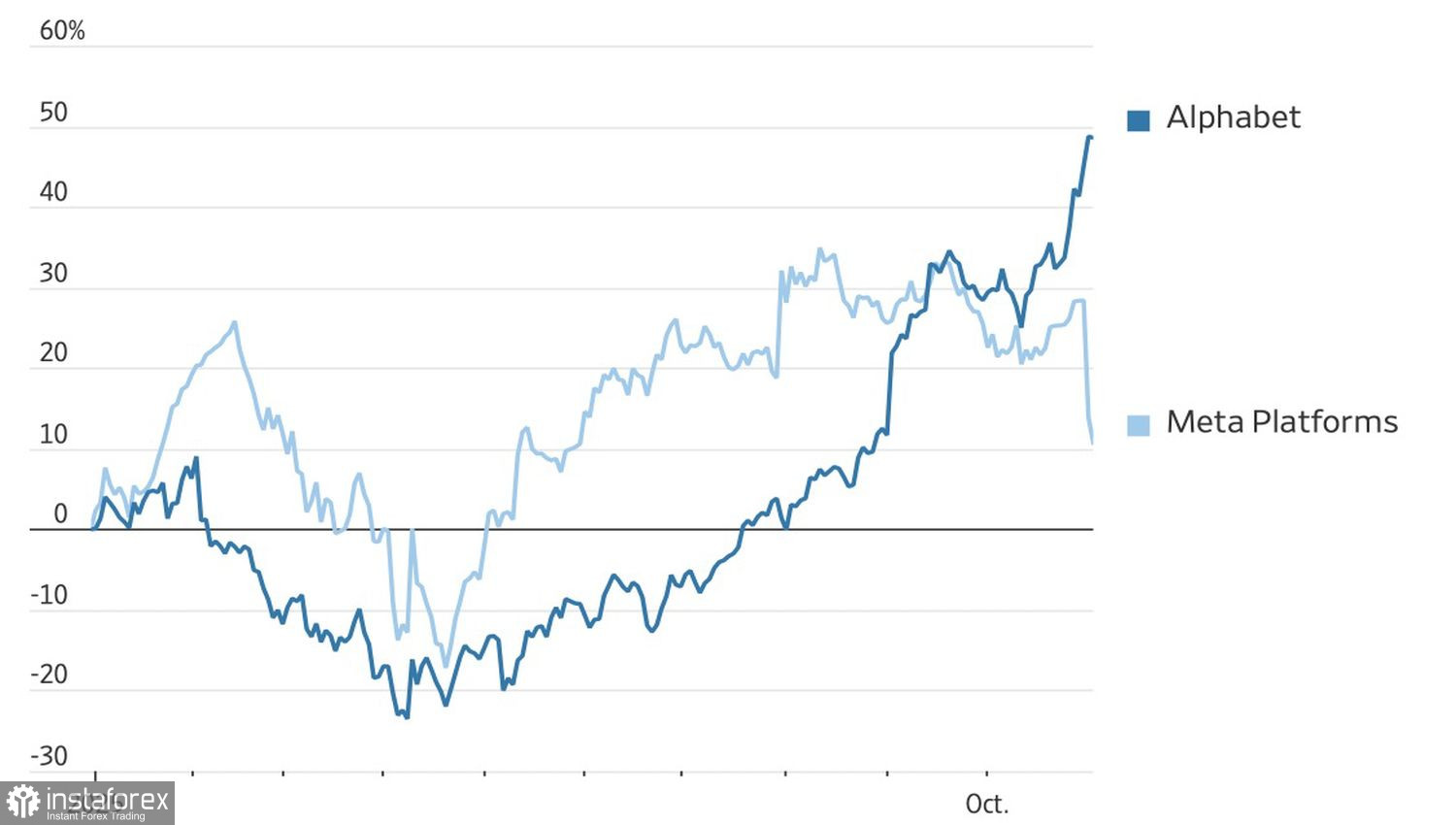

Investors are intently watching developments surrounding artificial intelligence and are buying the dips in the S&P 500. No one wants to wait for the current uptrend to end and a new one to start. The slightest pullback prompts an increase in the ranks of bulls. However, it must be acknowledged that the markets have become quite selective. They are concerned with the returns that companies will generate from colossal spending on AI technologies. It is no surprise that Meta Platforms' increase in capital expenditures led to a drop in its stock. In contrast, Alphabet's shares rose on news about how the company sells its services.

Dynamics of Alphabet and Meta Platforms stocks

The broad stock index benefitted from news of Amazon's multiyear $38 billion deal with OpenAI and Microsoft receiving permission to ship NVIDIA chips to Saudi Arabia. The S&P 500 is thriving amid one of the strongest earnings seasons seen in years. Around 60% of companies have reported their data, and most have exceeded profit forecasts.

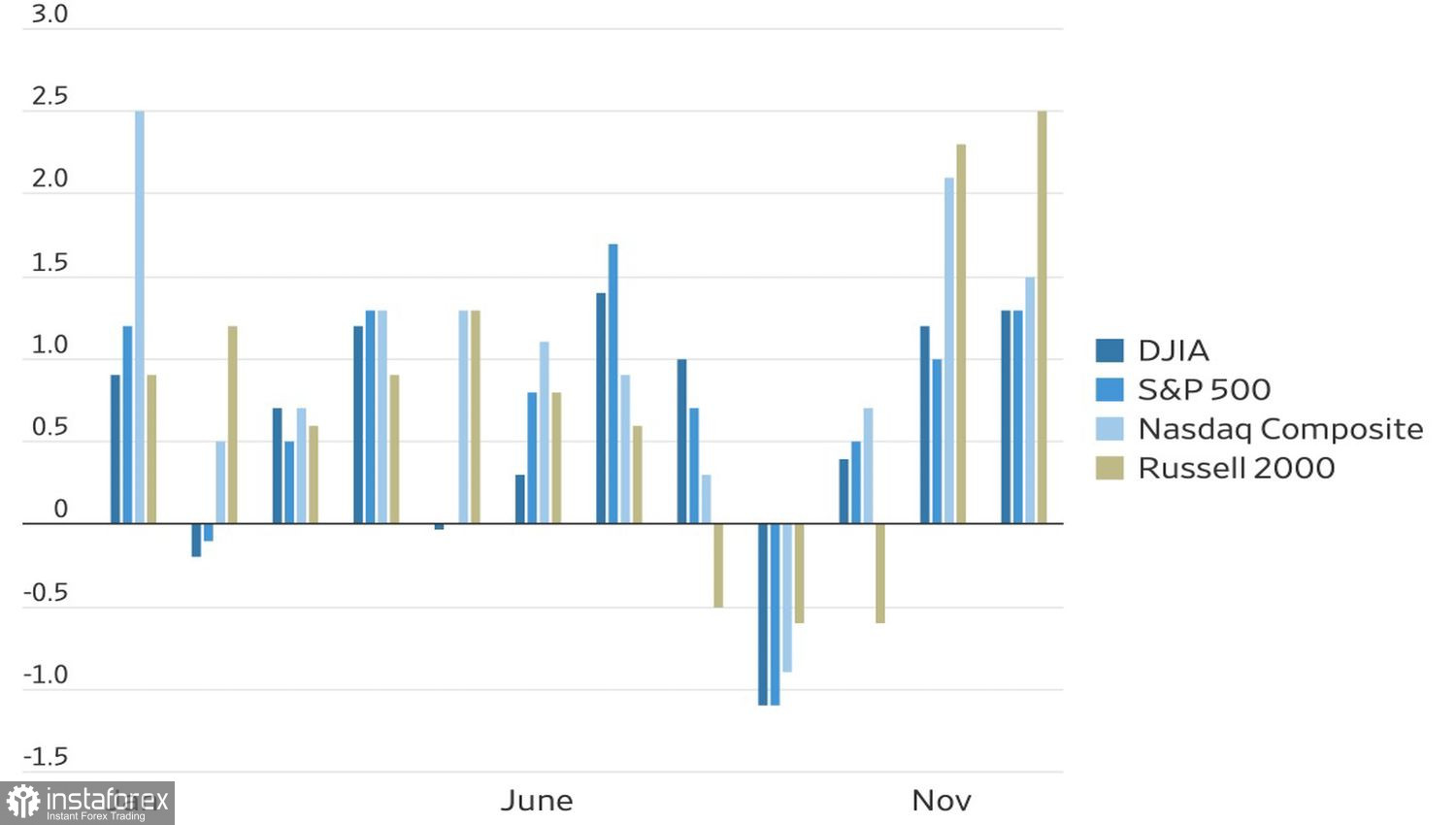

In addition, November is historically a strong month for the US stock market. From 1928 onwards, the broad stock index has averaged a gain of 1% in November. Some of its counterparts have performed even better.

Seasonal dynamics of S&P 500 and other US indices

It cannot be said that the sky over the S&P 500 is without clouds. The ISM manufacturing data disappointed investors, and several FOMC members expressed concerns about inflation. They opposed a federal funds rate cut, which is a worrying sign for the stock market. One of the drivers of its 40% rally from the April lows was the anticipation of a resumption and continuation of the monetary easing cycle. If this does not happen, investors may start to lock in profits.

According to Yardeni Research, there are too many bulls in the market. One unexpected event could mislead and trigger a wave of selling in the S&P 500. Will this event be the record-length government shutdown? Or the Supreme Court's ruling on the illegality of Donald Trump's tariffs? The President's loud statements that the whole world will laugh if tariffs are revoked are unlikely to impress the justices.

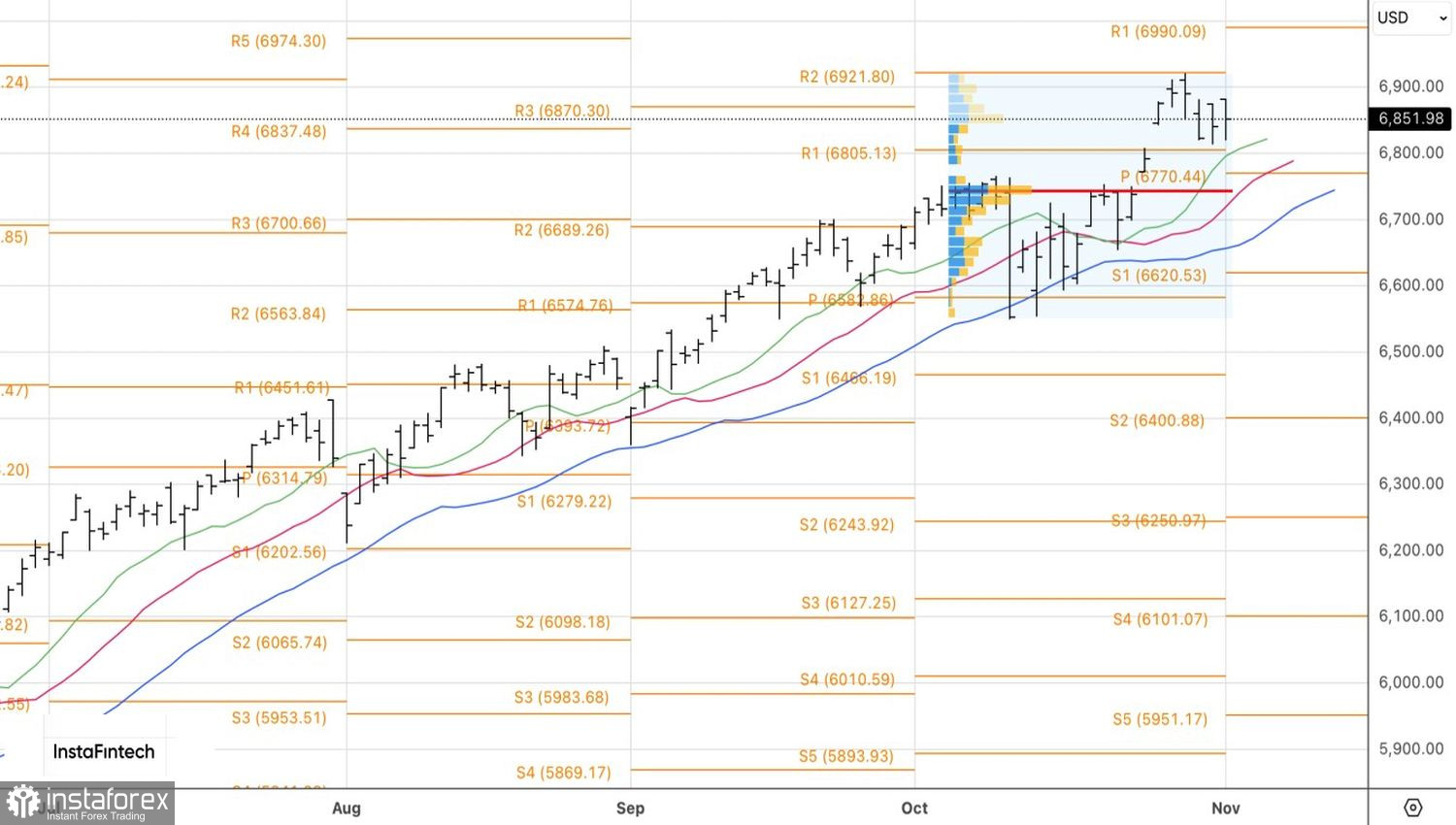

Technically, two candles with long lower shadows were formed on the daily chart of the S&P 500. These are signs of weakness among bears. The market continues to buy the dips, so pullbacks or a rise of the broad stock index above 6,875 will provide opportunities for opening long positions.