Today, the EUR/USD pair paused its decline around the key psychological level of 1.1500, after falling throughout last week due to the strengthening of the U.S. dollar. Last week, during the press conference following the Federal Reserve meeting, Fed Chair Jerome Powell emphasized that the likelihood of another rate cut in December is extremely low. He also noted that policymakers may need to take a wait-and-see approach until official reports resume.

According to CME FedWatch Tool data, traders in federal funds futures now price in a 65% probability of a December rate cut — significantly lower than the 94% probability a week earlier.

However, the U.S. dollar may face challenges, as traders remain cautious amid the prolonged U.S. government shutdown, which could heighten economic concerns. The shutdown has now entered its sixth week, and there is no easy resolution in sight due to a congressional deadlock over a Republican funding bill. Meanwhile, federal employees across the country remain unpaid, adding to uncertainty in the economy.

On the opposite side of the EUR/USD pair, the euro may find support from market expectations that the European Central Bank (ECB) will not raise rates this year.

At its October monetary policy meeting last week, the ECB left interest rates unchanged for the third consecutive time, as expected, emphasizing that the inflation outlook remains generally stable, the economy continues to grow, and uncertainty persists. Early data indicated a slight decrease in eurozone inflation toward the ECB's 2% target, while Q3 GDP growth exceeded forecasts. In addition, October business surveys pointed to improving overall sentiment.

ECB member Francois Villeroy de Galhau stated that following the October policy decision, the central bank is in a favorable position. However, he added that this situation is not final. Similarly, Latvian Central Bank Governor Martins Kazaks said that inflation and growth risks in the eurozone have become more balanced. Kazaks also stressed that the ECB will respond as needed but should avoid hasty moves.

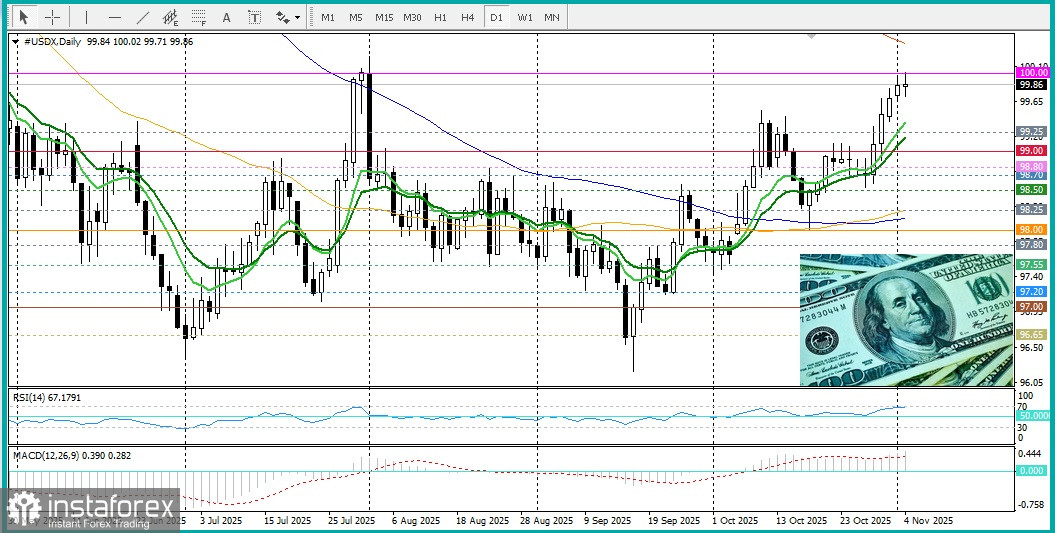

From a technical perspective, oscillators on the daily chart remain negative, confirming a bearish outlook. However, if prices manage to break above the nearest resistance at 1.1540, followed by the 9-day EMA resistance near 1.1570, and move toward the psychological level of 1.1600, the bulls may get a chance to improve their position. For now, however, the path of least resistance for the pair remains downward.