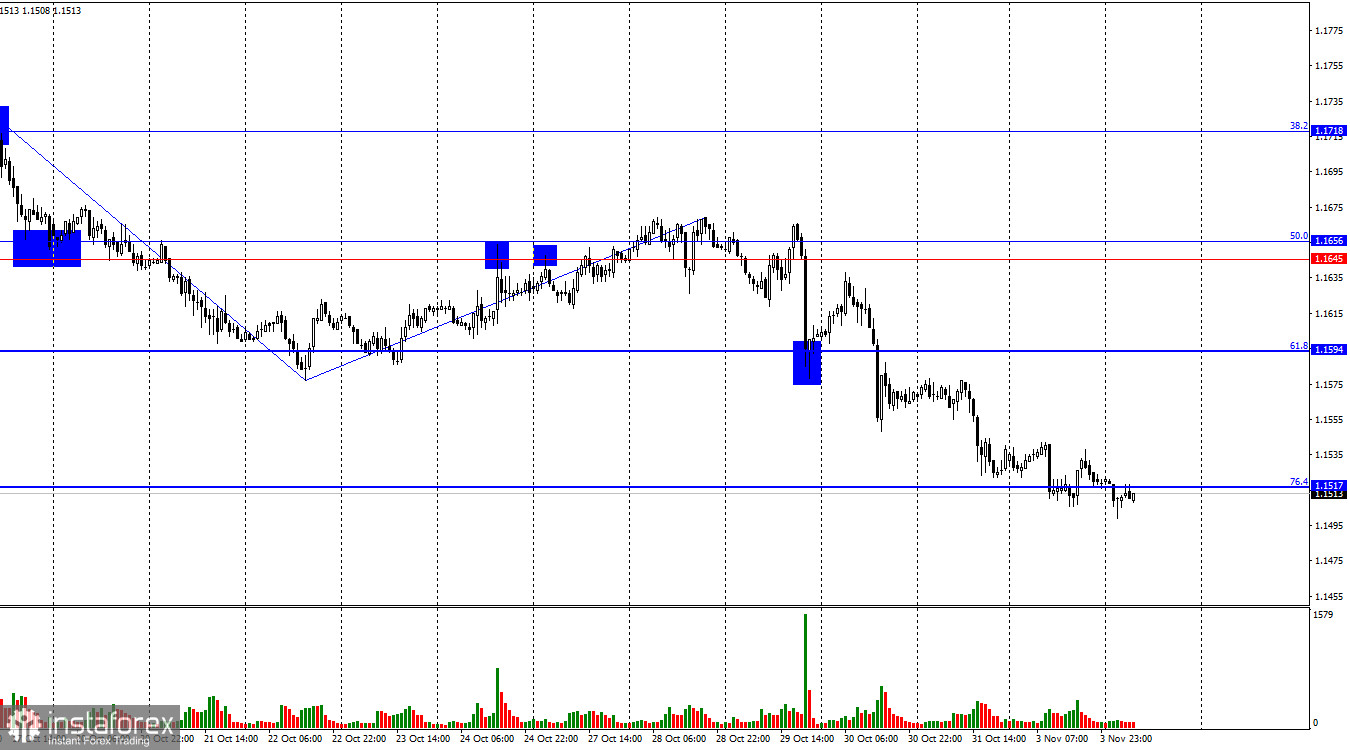

The wave structure on the hourly chart remains simple and clear. The last completed upward wave failed to break the high of the previous wave, while the most recent downward wave broke the previous low. Thus, the trend has once again turned bearish. Bullish traders once more failed to take advantage of opportunities for an advance, while the bears continue to attack largely on enthusiasm alone — without information support.

On Monday, many traders expected a "turning point." The U.S. dollar continues to strengthen for reasons unknown — the bulls are still absent, and the bears face no resistance. In the second half of the day, the U.S. ISM Manufacturing PMI was released, from which many traders expected another weak result — and therefore a natural decline in the U.S. dollar. The report indeed came in below expectations, but the bulls did not go on the offensive, confirming a "disconnect" between the news background and market movements. It's hard to say how long this situation will continue, but something is clearly not right in the market. Once again: the dollar strengthens almost daily, without any clear reason. This morning, ECB President Christine Lagarde is scheduled to speak, but I don't expect her to support the bulls. However, under current circumstances, it seems that the bulls are unwilling to attack regardless of the informational background. Thus, the problem lies not in the news, but in the bulls themselves.

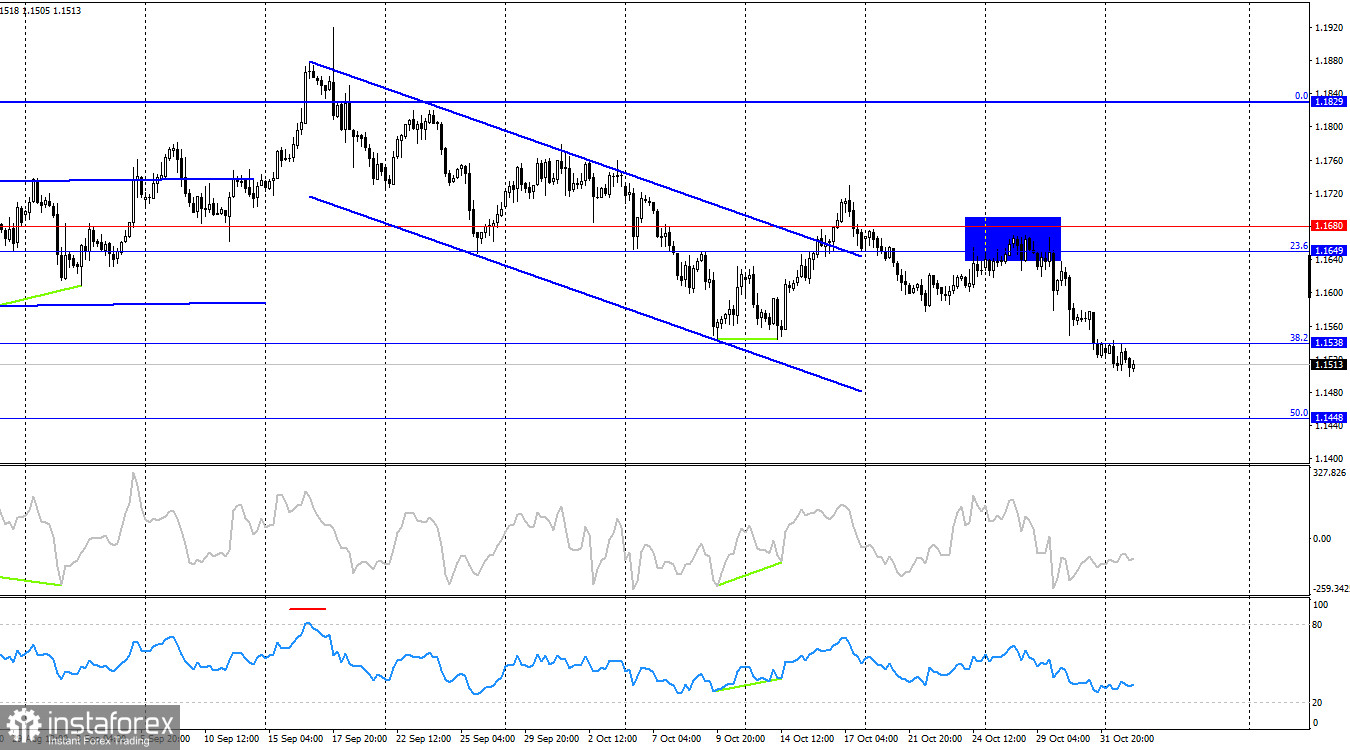

On the 4-hour chart, the pair rebounded from the resistance level of 1.1649–1.1680, turned in favor of the U.S. dollar, and consolidated below the 38.2% Fibonacci retracement level at 1.1538. Therefore, the downward movement may continue toward the next retracement level of 50.0% – 1.1448. A close above 1.1538 would favor the euro and some upward movement toward 1.1649–1.1680. No developing divergences are seen on any indicator today.

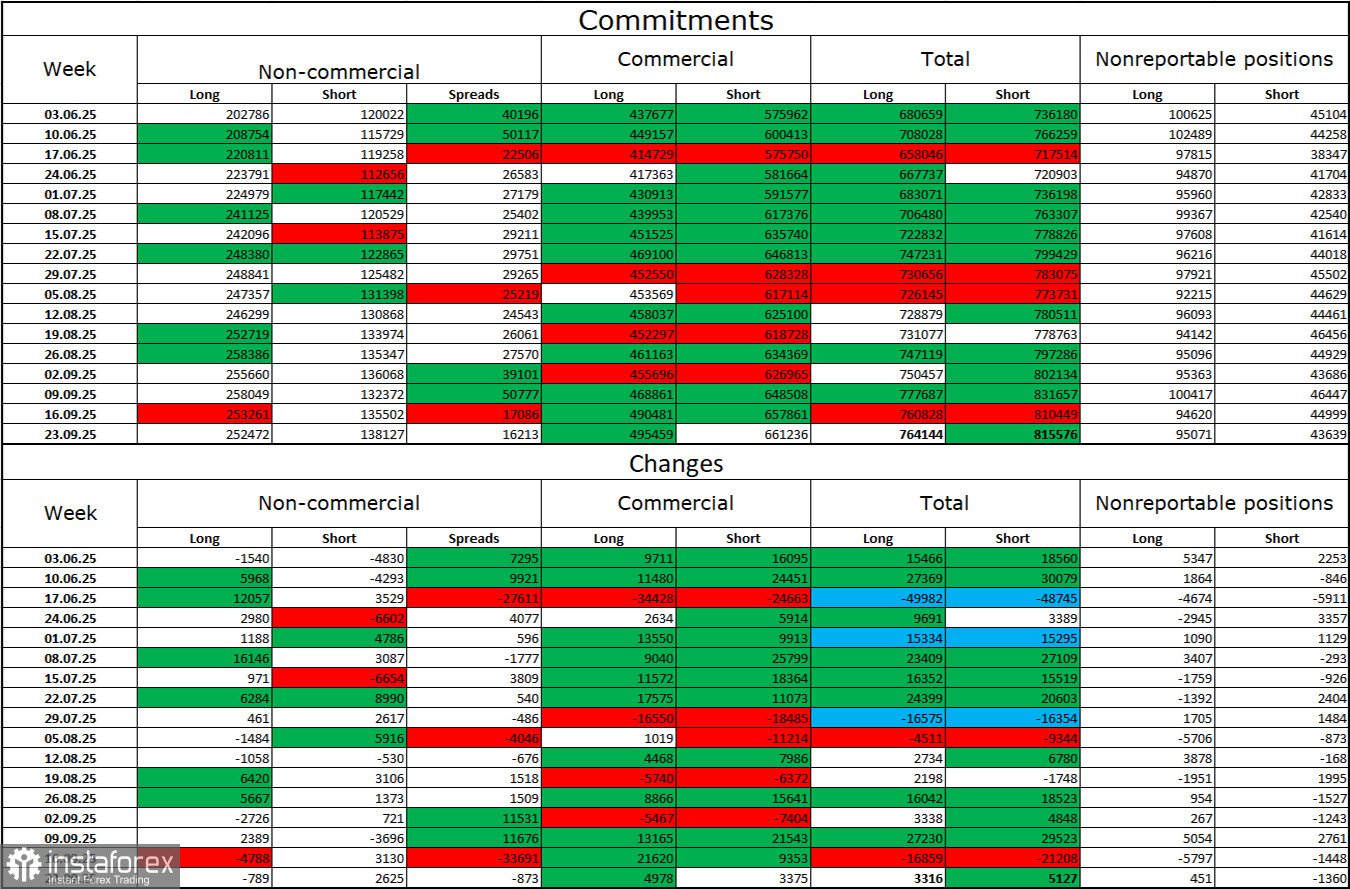

Commitments of Traders (COT) Report

During the last reporting week, professional traders closed 789 long positions and opened 2,625 short positions. No new COT reports have been published for over a month. The sentiment of the "Non-commercial" group remains bullish, thanks to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators is now 252,000, while short positions number 138,000 — nearly a twofold gap.

Also note the number of green cells in the table above — they indicate strong accumulation of long positions in the euro. In most cases, interest in the euro continues to rise, while interest in the dollar declines.

For thirty-three consecutive weeks, large players have been reducing their short positions and increasing their longs. Donald Trump's policies remain the most significant factor for traders, as they may cause numerous long-term, structural problems for the United States. Despite the signing of several major trade agreements, many key economic indicators continue to show weakness.

News Calendar for the U.S. and the Eurozone

- Eurozone – Speech by ECB President Christine Lagarde (07:40 UTC)

- Eurozone – Speech by ECB President Christine Lagarde (09:45 UTC)

For November 4, the economic events calendar includes only these two entries, neither of which is of particular interest. Thus, the informational background is likely to have a very weak or nonexistent influence on market sentiment on Tuesday.

EUR/USD Forecast and Trader Recommendations

Selling the pair was possible after a close below the 1.1645–1.1656 level on the hourly chart, with a target of 1.1594 — which has already been reached. New sales were possible after a close below 1.1594, targeting 1.1517 — this target has also been achieved. Today, I do not recommend opening new short positions, as the bears have already exceeded their targets by a wide margin. Buy positions may be considered if the price consolidates above 1.1517, with a target of 1.1594.

The Fibonacci grids are constructed between 1.1392–1.1919 on the hourly chart and 1.1066–1.1829 on the 4-hour chart.