With great difficulty, the EUR/USD and GBP/USD pairs have reversed by the end of the week, and this reversal may mark the start of a new bullish trend segment. It should be noted that both instruments have recently formed five-wave corrective structures a-b-c-d-e, which appear to be completed. Are there reasons for the U.S. currency to decline? Yes, and there are plenty.

In this review, I will not cover all the reasons why the U.S. dollar should have been setting new lows long ago. I will focus only on one of the main reasons: the Federal Reserve's inflationary monetary policy. The last Fed meeting took place, and as a result, the American currency continued to strengthen despite a second consecutive policy easing. Many economists wrote that the Fed did not announce a third consecutive round of easing at the last meeting of the year, which led to a strengthening of the American currency. However, I want to point out that this logic is not entirely correct. For the market to be disappointed by the lack of promises to lower rates again, it must first have priced in this easing. And when could the market have accounted for three consecutive easings if, in the short term, the dollar had been rising (for more than a month) and, in the long term, it had been moving sideways (for several months)?

Moreover, the U.S. continues to face a government shutdown, and, fundamentally, no one can accurately say the condition of the U.S. labor market at the moment. Individual companies provide their reports indicating that things are very bad, but these are private reports, and the same ADP report does not consider certain sectors of the economy. Therefore, all data that has come to the market can be regarded as incomplete or unreliable.

Conclusions can only be drawn based on official reports from the Bureau of Labor Statistics regarding unemployment and payrolls. However, these reports have not been released since early September. Thus, I would refrain from making any bold conclusions. The market can certainly still anticipate five consecutive rounds of easing (nothing is stopping it), but objective reality indicates that the Fed will not rush to ease or make premature decisions. In fact, Jerome Powell mentions this in nearly every speech. If market participants do not perceive this information, that is their problem, not the Fed's.

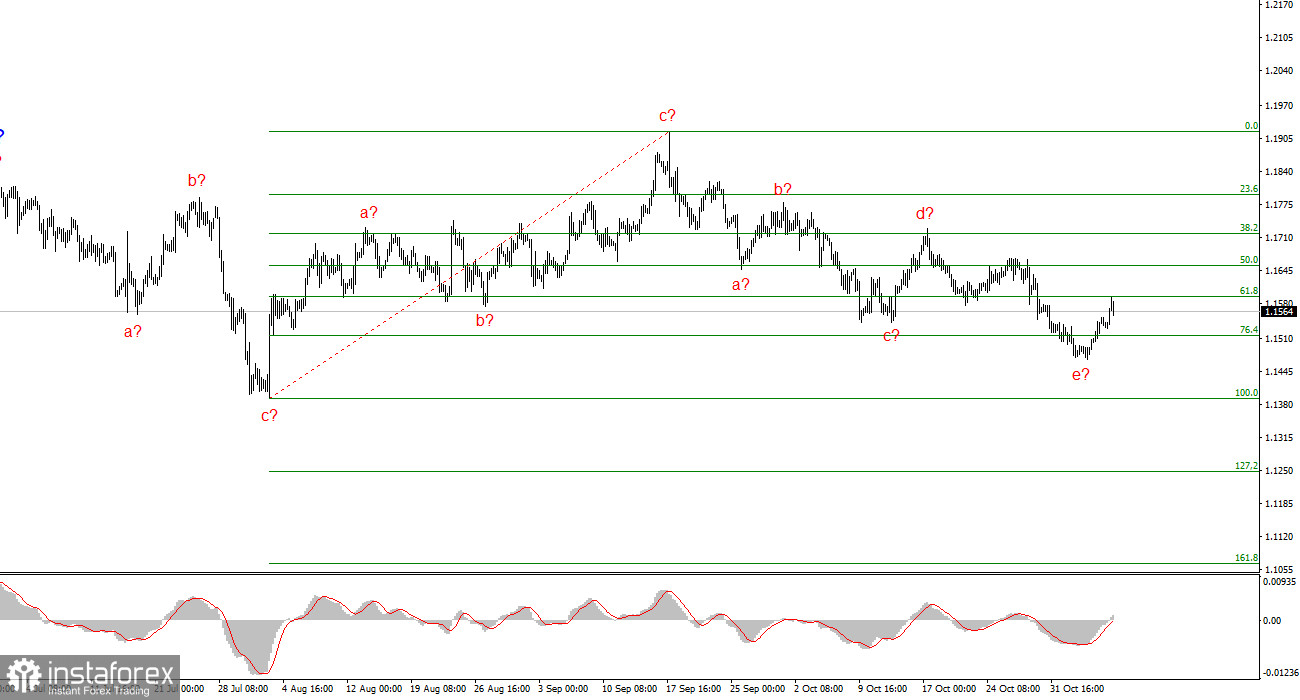

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, the instrument continues to form a bullish trend. Over the past few months, the market has paused, but both Donald Trump's policies and the Fed remain significant factors in the future decline of the American currency. The targets for the current segment of the trend could extend to the 25 figure. Currently, corrective wave 4 is being constructed, taking on a very complex, elongated shape. Its latest internal structure, a-b-c-d-e, is either nearing completion or has already been completed. Therefore, I am once again considering long positions, as all recent downward structures appear corrective.

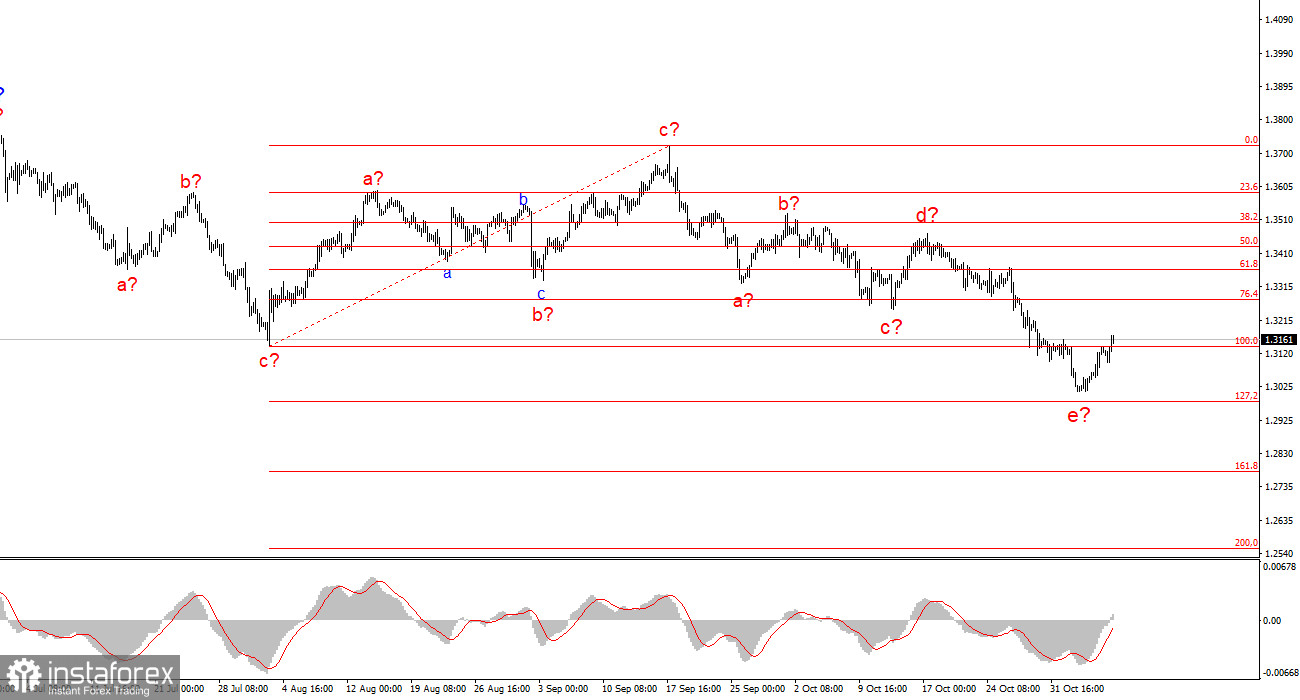

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 has taken a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in c of 4 is presumably nearing completion. I expect the main wave structure to resume its development with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often undergo changes.

- If there is no certainty about what is happening in the market, it is better not to enter it.

- There can never be 100% certainty about the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.