I would also like to point out that the latest ADP report was weak but still above market expectations and higher than the previous month. Therefore, one could theoretically even argue that the labor market is improving. Last week, the Federal Reserve lowered interest rates once again, so by the beginning of December, the labor market could be back on its feet. At that point, the question of a third consecutive policy easing will become critical. Then, most Fed governors will not only observe the dire state of the labor market, which has been largely shaped by Donald Trump and the AI boom, but will also take inflation into account.

To be fair, it should be noted that inflation in the U.S. is rising, but quite slowly. I believe that the rise in inflation itself does not imply another rate cut, but if the labor market continues to "please" us with negative readings, the Fed will have to implement another easing. Or will it?

Once again, I want to emphasize that Trump's immigration policy and the AI technology boom have primarily caused mass layoffs in the U.S. How, then, can a reduction in interest rates affect these two processes? AI technologies do not pay attention to the Fed's interest rates, and companies, aiming to save money, increasingly turn to artificial intelligence for help. If rates are cut several more times, what will change? Will companies suddenly stop optimizing their expenses?

Investments will undoubtedly increase, but AI is not standing still either. It is evolving and can handle an increasing number of human tasks over time. We should also separately mention Trump's immigration policy. It is well known that the U.S. is a country of immigrants. Therefore, it is immigrants who built it into what it is in the 21st century. Trump believes that America is for Americans, and even truck drivers (one of the most common professions for migrants) should be Americans. Mass deportations started, documents were denied, renewals were rejected, and existing ones were annulled. As a result, more than 1 million workers could leave America in the coming years. And how many will come to the U.S. for work under the current president?

Therefore, I believe the Fed's rate cut will not improve the labor market situation. It may improve it slightly, but will not solve the problem. I believe the Fed will eventually reach the same conclusion.

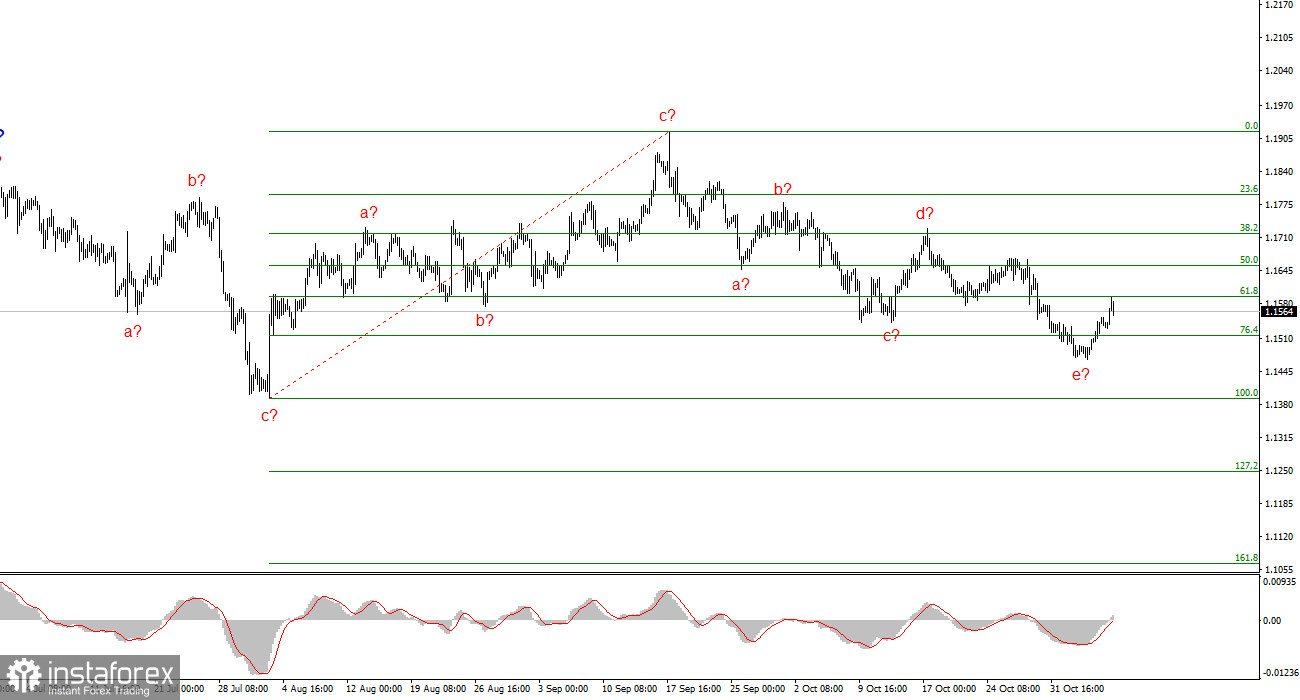

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, the instrument continues to form a bullish trend. Over the past few months, the market has paused, but both Donald Trump's policies and the Fed remain significant factors in the future decline of the American currency. The targets for the current segment of the trend could extend to the 25 figure. Currently, corrective wave 4 is being constructed, taking on a very complex, elongated shape. Its latest internal structure, a-b-c-d-e, is either nearing completion or has already been completed. Therefore, I am once again considering long positions, as all recent downward structures appear corrective.

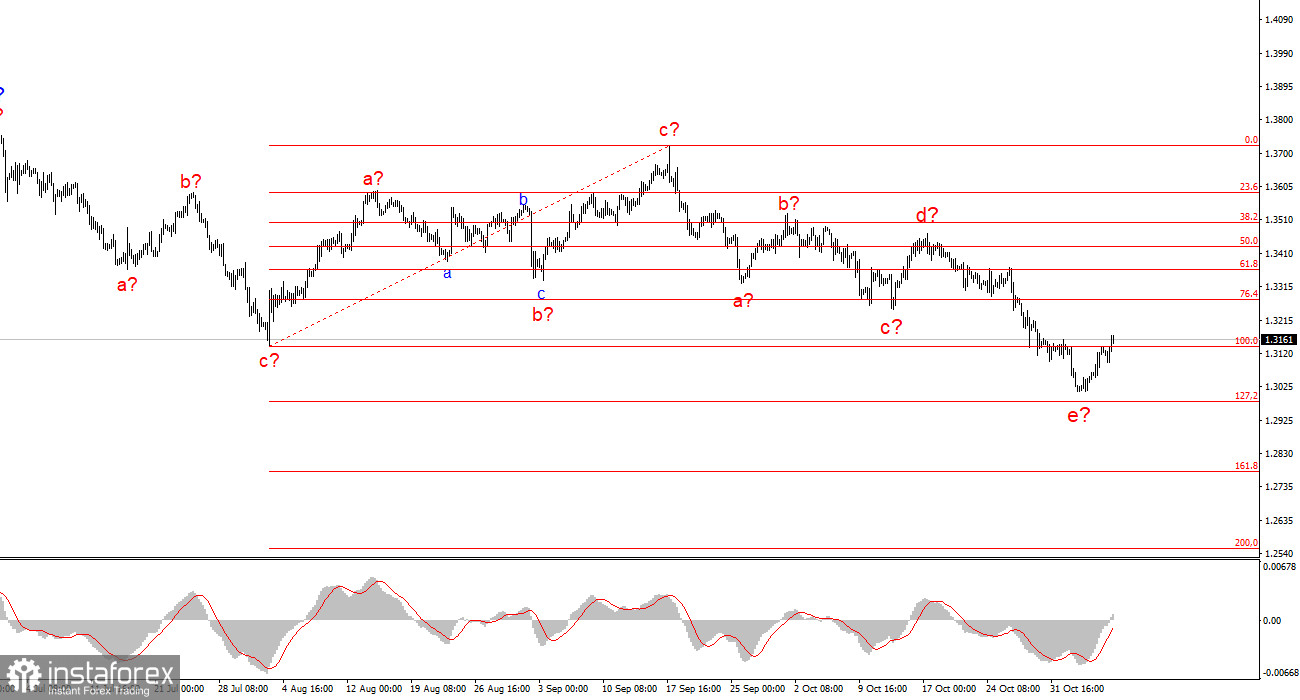

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 has taken a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in c of 4 is presumably nearing completion. I expect the main wave structure to resume its development with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often undergo changes.

- If there is no certainty about what is happening in the market, it is better not to enter it.

- There can never be 100% certainty about the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.