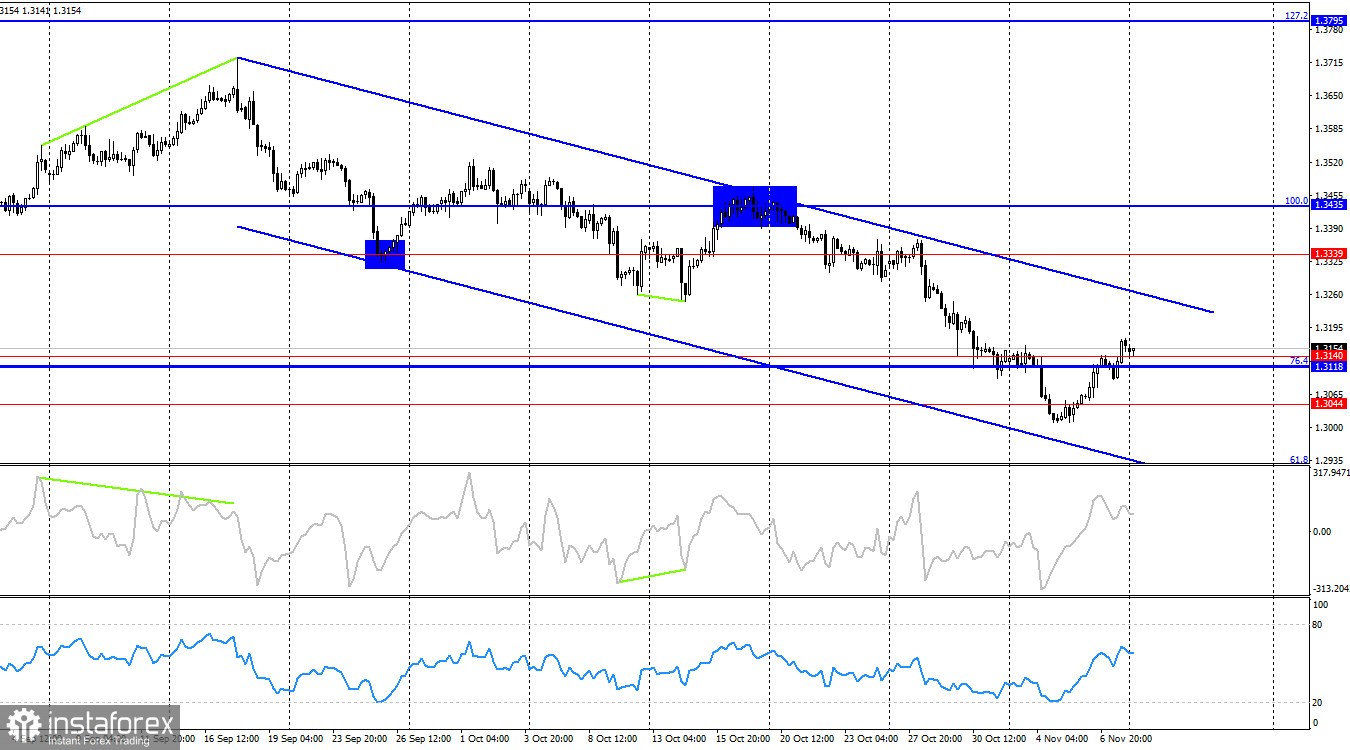

The wave structure remains bearish. The last upward wave did not break the previous peak, while the last downward wave (which developed over three weeks) broke the previous low. Although the recent news background has been negative for the U.S. dollar, bullish traders have not taken advantage of the opportunities for an advance. To complete the "bearish" trend, the pair must rise above 1.3470 or form two consecutive bullish waves.

On Friday, bullish traders continued their offensive, and in the second half of the day their efforts were supported by the University of Michigan Consumer Sentiment Index, which fell from 53.6 to 50.3 in November (market expectations were 53.2). The actual figure came in much worse than forecast, providing additional support to the pound. On Monday morning, it became known that the U.S. government shutdown could end soon, but the bears showed little enthusiasm about it. It's worth noting that in recent weeks, the U.S. dollar has been rising, which doesn't quite align with a government shutdown and the suspension of many federal agencies. Since the dollar rose during the shutdown, it may now fall as it ends.

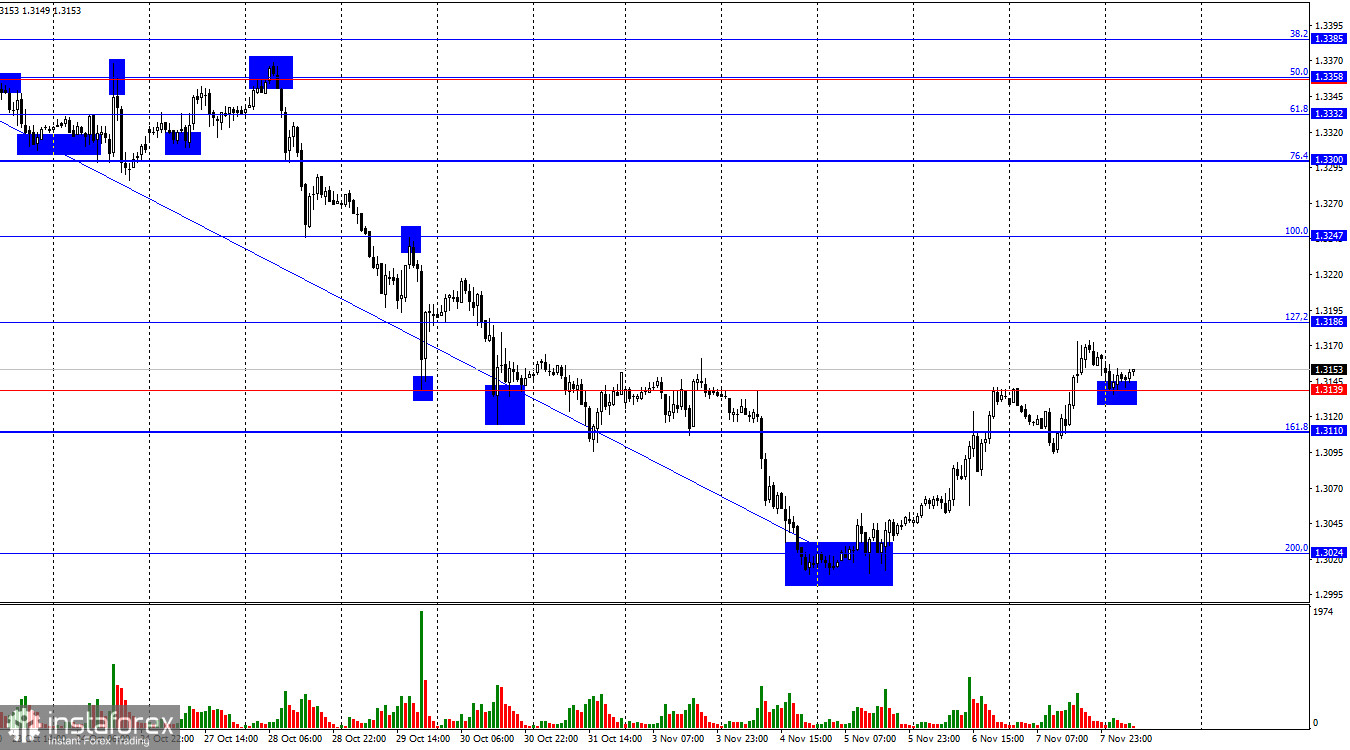

In my opinion, bullish traders have found support in the 1.3110–1.3139 level, and their key task now is to defend it. After a prolonged decline, the bulls are beginning to gain some footing. Since there will be no major economic news today, the bears are unlikely to launch a new attack.

On the 4-hour chart, the pair continues to move downward within a downward trend channel. If a new bullish trend is beginning now, we will gradually receive confirmation. I would start considering a stronger rally in the pound after a close above the channel. A consolidation above 1.3140 would allow for expectations of continued growth. No emerging divergences are currently observed.

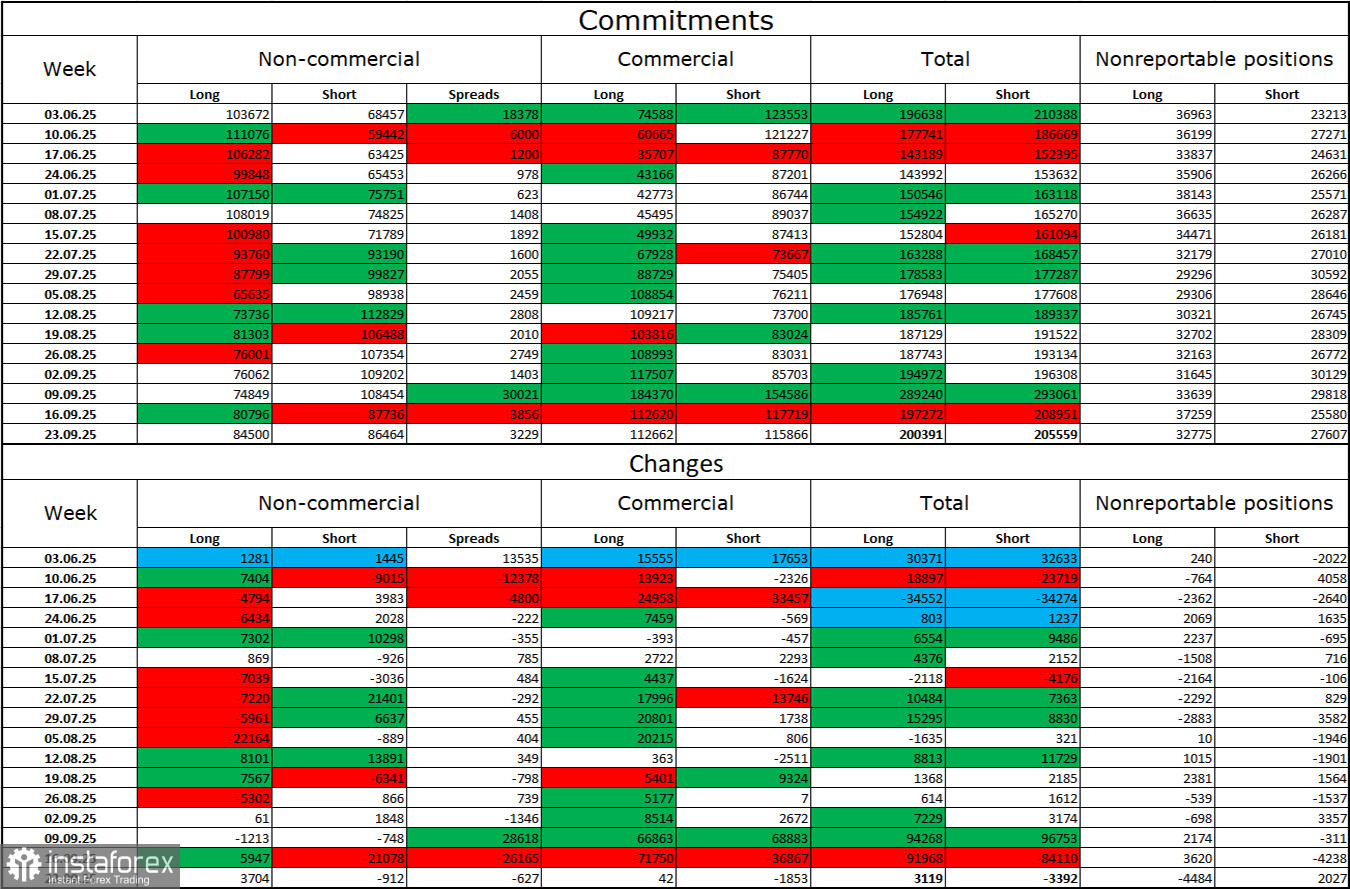

Commitments of Traders (COT) Report:

The sentiment of the Non-commercial category became more bullish in the latest reporting week (though that data is already about six weeks old). The number of long positions held by speculators increased by 3,704, while short positions decreased by 912. The current gap between long and short positions is approximately 85,000 vs. 86,000, indicating that bulls are again tipping the balance in their favor.

In my view, the pound still faces downside risks, but the U.S. dollar is gradually losing strength month by month. Previously, traders worried about Donald Trump's protectionist policies, uncertain about their consequences; now they may be concerned about the results of those policies — a potential recession, the continuous introduction of new tariffs, and Trump's conflict with the Federal Reserve, which could lead to the politicization of the regulator. Thus, the British pound currently looks less risky than the U.S. dollar.

News Calendar for the U.S. and the U.K.:

November 10 — The economic calendar contains no scheduled events. The news background will not influence market sentiment on Monday.

Forecast for GBP/USD and Trading Recommendations:

Sell positions can be considered if the pair closes below the 1.3110–1.3139 level on the hourly chart, targeting 1.3024. Buy positions could be opened upon a rebound from the 1.3024 level on the hourly chart. Targets: 1.3110 and 1.3186. The first target has already been reached, so long positions can remain open toward the second target.

Fibonacci grids are built between 1.3247–1.3470 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.