Analysis of Macroeconomic Reports:

There are virtually no macroeconomic reports scheduled for Wednesday. An inflation report will be released in Germany as a second estimate for October, but it is important to note that second estimates are inherently much less significant than first estimates, and deviations from the first estimate are quite rare. In any case, inflation in the Eurozone (and especially in a single country) has almost no impact on the European Central Bank's monetary policy at this time. Inflation in the Eurozone has stabilized around the 2% mark, which is what the central bank aimed to achieve.

Analysis of Fundamental Events:

There are quite a few fundamental events scheduled for Wednesday, but almost all are of little interest. In the Eurozone, ECB representatives Luis de Guindos and Isabel Schnabel will give speeches, but the market currently has no questions for them. The ECB clearly indicated a week ago that no changes in monetary policy are expected in the near future. In the UK, the Bank of England's Chief Economist, Huw Pill, will speak, which could be interesting, as the latest meeting of the British central bank ended with a "borderline decision" to maintain the key rate at its previous level. In the US, speeches will take place from Federal Reserve members Raphael Bostic, Stephen Miran, and Michael Barr.

General Conclusions:

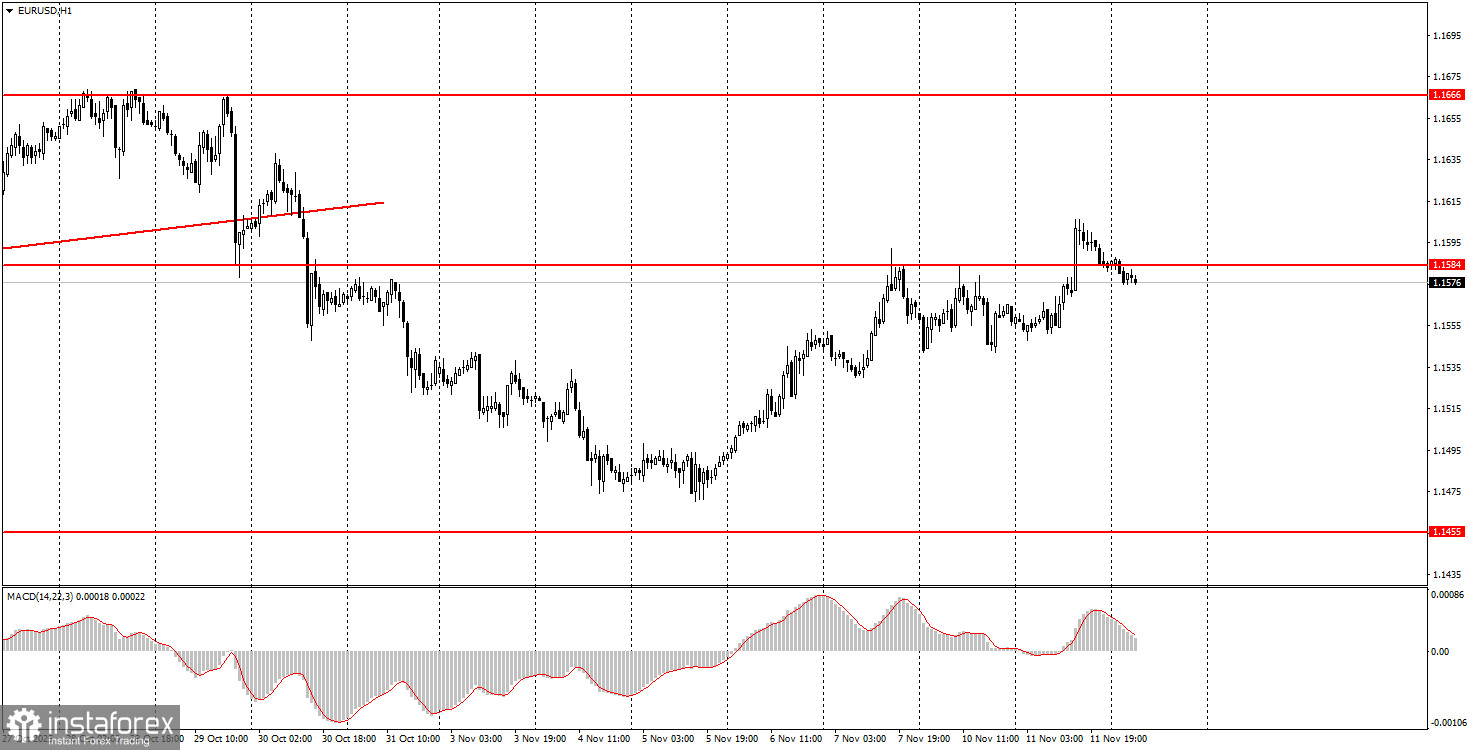

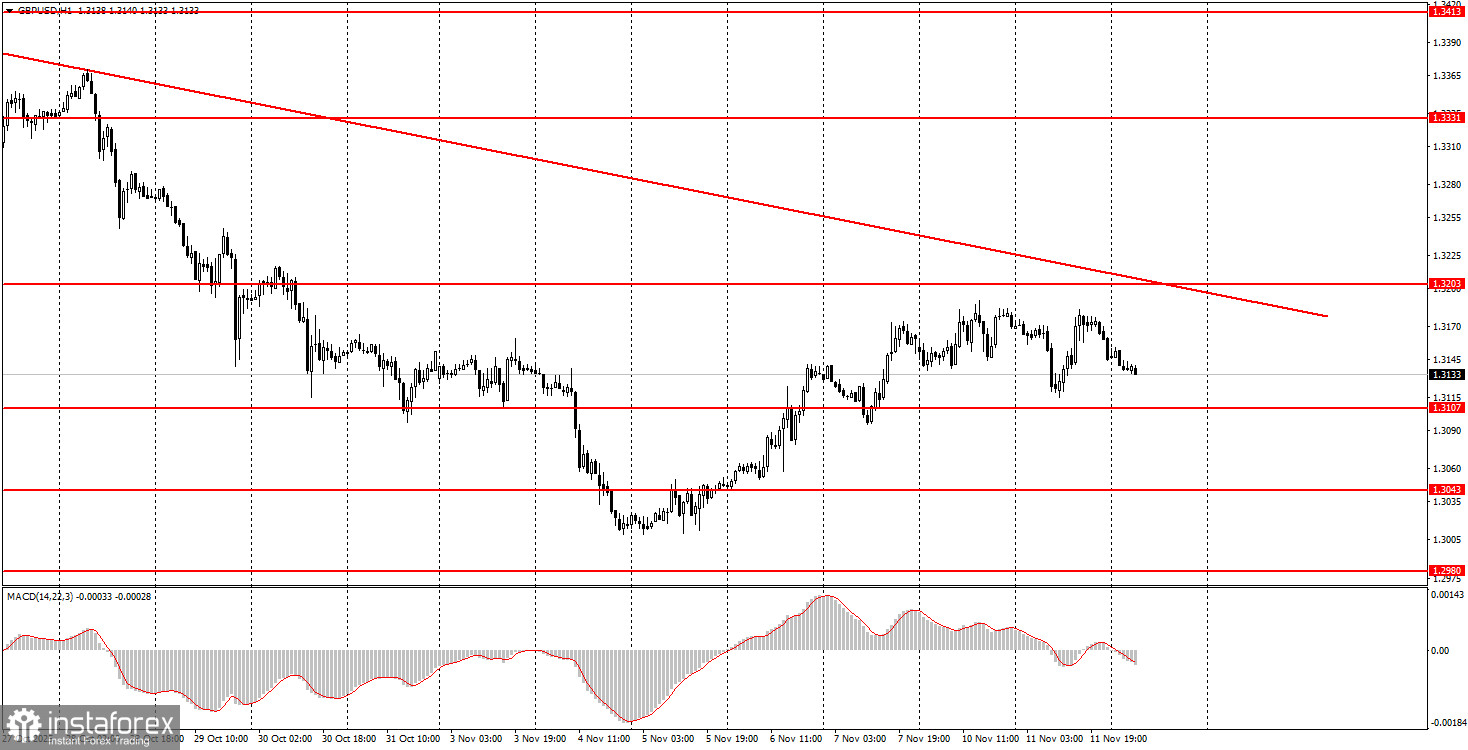

During the third trading day of the week, both currency pairs may attempt to continue moving upward. New long positions for the euro will become relevant upon a rebound from the area of 1.1571-1.1584, targeting 1.1655. New longs for the pound will become possible upon a price rebound from the area of 1.3096-1.3107. The growth of both currency pairs in recent days has been weak and unstable, so novice traders may also consider short positions.

Key Principles of My Trading System:

- The strength of the signal is considered based on the time taken to form the signal (bounce or breach of a level). The less time taken, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can create numerous false signals or may not form them at all. In any case, it's best to stop trading at the first signs of a flat.

- Trading deals are opened during the period between the start of the European session and the middle of the American session, after which all deals should be closed manually.

- On the hourly timeframe, it is preferable to trade based on signals from the MACD indicator only when there is good volatility and a trend that is confirmed by a trend line or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be treated as an area of support or resistance.

- After a 15-20-pip move in the right direction, a Stop Loss should be set to breakeven.

What the Charts Show:

- Support and resistance price levels are targets for opening buy or sell positions. Take Profit levels can be placed around them.

- Red lines indicate trend channels or trend lines, reflecting the current trend and indicating the preferred trading direction.

- The MACD indicator (14,22,3) — histogram and signal line — is a supplementary indicator that can also be used as a source of signals.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.