Trade analysis and recommendations for the euro

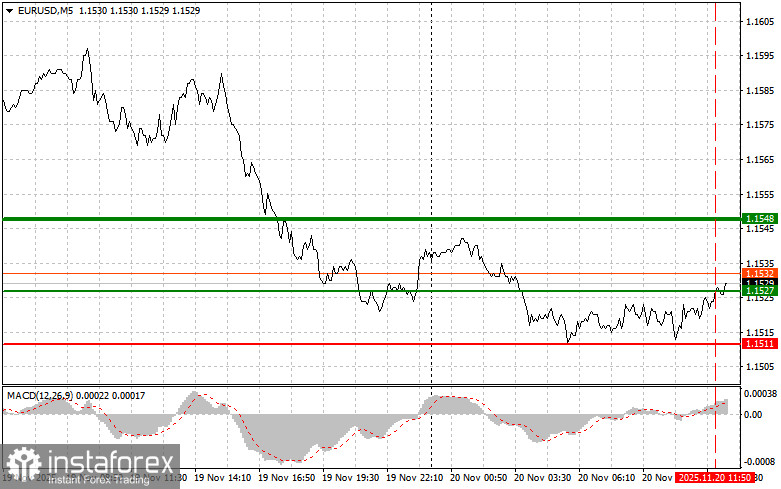

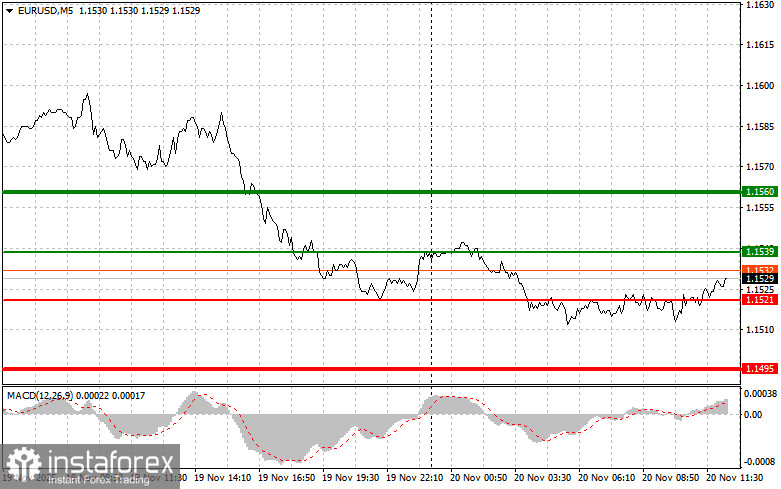

The test of the 1.1527 price level occurred at a moment when the MACD indicator had already risen significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro.

As a result of German economic statistics, the euro received a positive impulse, which allowed the pair to stabilize and even strengthen slightly against the dollar. However, it is too early to speak of a full recovery of the European currency after yesterday's sell-off. Everything will depend on the new data.

In the second half of the day, U.S. labor market data for September will be released. Particular attention will be paid not only to the actual numbers but also to the direction of the changes. Comparing them with previous periods will help determine how serious the consequences of the shutdown were and what direction the Federal Reserve should take next. In addition to unemployment and employment numbers, wage data will be especially important. Rising wages may indicate increasing inflation and push the Fed toward pausing rate hikes in December, which would strengthen the dollar.

As for the intraday strategy, I will rely mainly on scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible when the price reaches around 1.1539 (green line on the chart), with a target of rising to 1.1560. At 1.1560, I plan to exit the market and also sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. You can count on euro growth today only after weak U.S. labor market data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy the euro if the price twice tests the 1.1521 level at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. You can expect growth toward the opposite levels of 1.1539 and 1.1560.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.1521 level (red line on the chart). The target will be 1.1495, where I plan to exit and immediately buy in the opposite direction, expecting a movement of 20–25 points from this level. Pressure on the pair will return today in the event of strong U.S. statistics.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro if the price twice tests the 1.1539 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward 1.1521 and 1.1495 can be expected.

What the chart shows:

- Thin green line – entry price at which you may buy the asset

- Thick green line – approximate level for placing Take Profit or manually taking profit, since further growth above this mark is unlikely

- Thin red line – entry price at which you may sell the asset

- Thick red line – approximate level for placing Take Profit or manually taking profit, since further decline below this mark is unlikely

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones

Important

Beginner Forex traders must be extremely careful when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you may quickly lose your entire deposit—especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan like the one described above. Spontaneous decision-making based on the current market situation is, from the start, a losing strategy for an intraday trader.