Has the time for a breather and correction arrived?

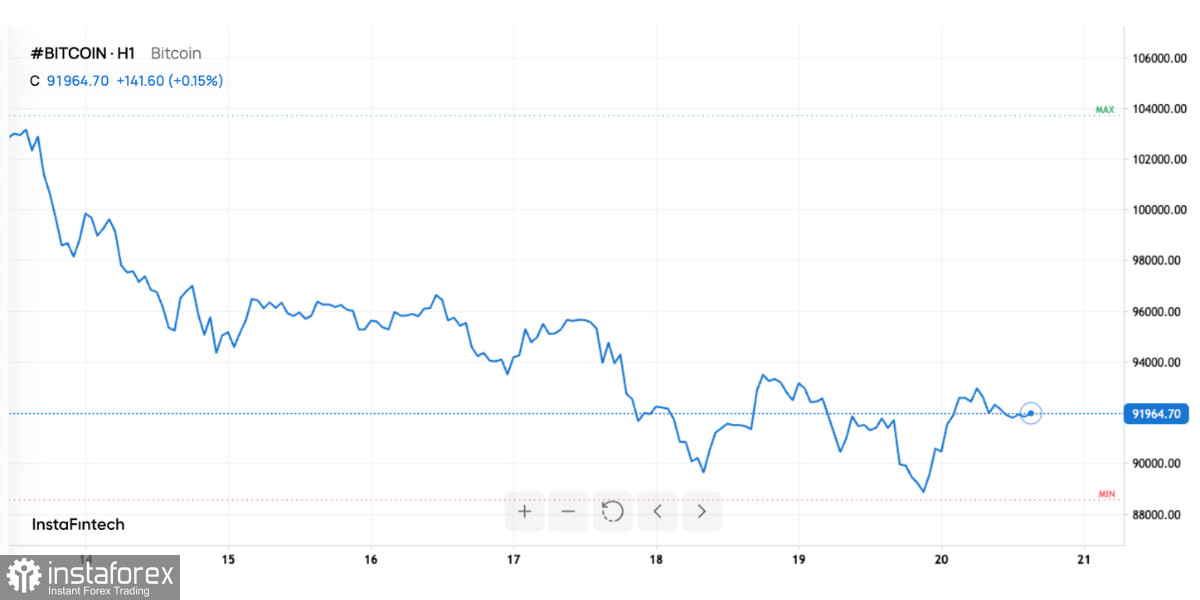

After an impressive rally, Bitcoin closes out November 2025 on a more restrained and cautious note. Just last October, it reached an all-time high of over $126,000, while today it trades in the $92,000–95,000 range. This represents a fall of approximately 30% from its peak in just a few weeks.

In tandem, the cryptocurrency market has evaporated over $1 trillion in capitalization. Essentially, the market has erased nearly all its gains for the year in one swift move, pushing Bitcoin down to a six-month low and negating its annual returns.

This is no longer merely a "healthy correction." It represents a full reassessment of expectations, a nervous breakdown, and a test of endurance for everyone who considered Bitcoin to be the new gold and an eternal winner.

Market sentiment: frightening, painful, but not for everyone

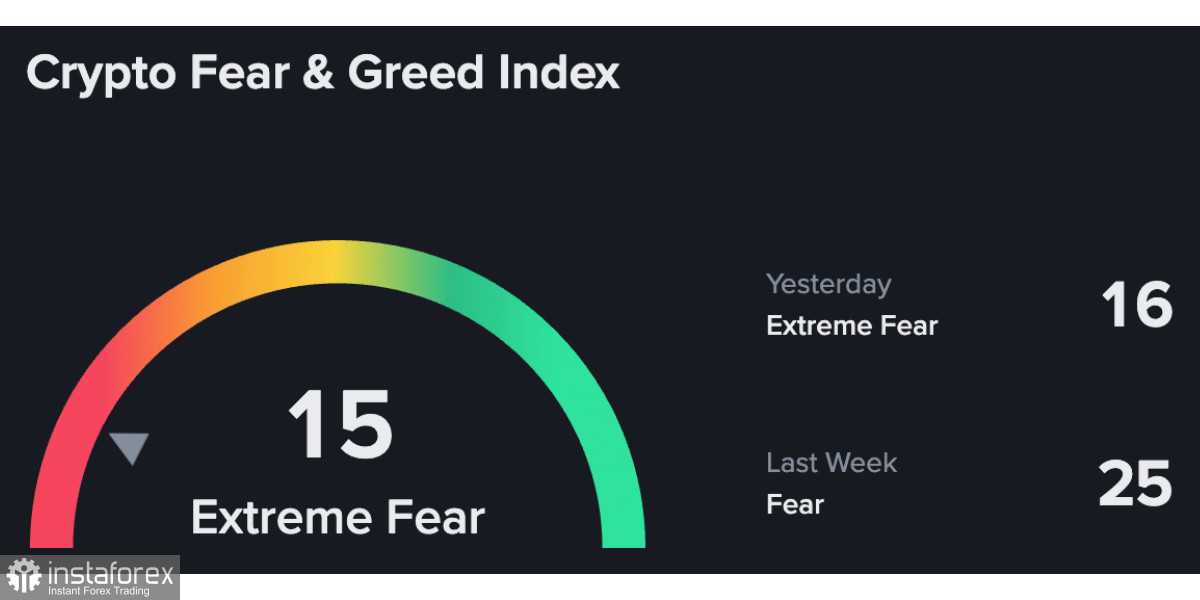

Current market quotes do frighten crypto investors, but the broader context is even more critical. Sentiments are at an all-time low.

The Bitcoin "fear and greed" index has plummeted to around 15 points — a zone of extreme fear. The market has psychologically broken down: just a month ago, discussions were centered around new targets above $130,000–140,000, and now the main topic is how to avoid further drops of tens of percent.

Money confirms this trend. In the past month, spot products and Bitcoin ETFs experienced outflows of about $2.3 billion — nearly a record monthly result. Some of the larger players are simply exiting their positions or cutting back, locking in profits and reducing risk.

However, the picture isn't black and white. Short-term and more nervous investors are indeed leaving. But long-term institutional participants, judging by the data, are not fleeing en masse. They are more likely to be hitting the pause button rather than initiating a sell-off: there are no mass forced exits visible, and positions in large portfolios are generally being maintained. For them, this is an unpleasant but workable correction in the context of a long-term idea.

Another important point is how the market's perception of Bitcoin has changed. More analysts are openly stating that, based on its behavior, Bitcoin is becoming less like digital gold and more akin to a high-risk tech stock. The correlation with the technology sector, especially companies related to artificial intelligence, is strengthening. When the AI hype cools off or bond yields rise, Bitcoin also feels the pressure. In other words, it is becoming less of a pure safe haven and increasingly moving in rhythm with risk assets.

Technical signals: clearly bearish indicators

The charts have revealed a classic "death cross," where the average price over the last 50 days falls below the 200-day average. This is a straightforward but widely used signal, traditionally interpreted as an indication of a prolonged bearish trend rather than a short pullback.

Key support levels that once held the market and served as a foundation for new growth impulses have broken downward. This has intensified selling: many algorithms and systematic traders operate based on such levels. As a result, the pace of decline has accelerated, and the news backdrop has only added fuel to the fire.

Paradoxically, long-term forecasts on the future horizon from some experts have barely changed. Medium-term models still feature levels of $110,000–115,000 and above, while some scenarios for the next few years project even higher estimates. The logic is straightforward: the halving effect is ahead, Bitcoin's deep integration through ETFs, softer regulation in the US, and increasing interest from corporations and government entities. But all these arguments apply to time horizons of years, not weeks or months.

Currently, the market is operating in a different mode: overload, fear, and a desire to weather the storm.

2025: from euphoria to nervous phase

To understand where we are now, it is important to recall how 2025 unfolded for Bitcoin. It was a year characterized by strong political and regulatory triggers.

At the beginning of the year, the new US administration took several bold steps. A Strategic Bitcoin Reserve was announced, along with a separate stockpile of digital assets, and leaders of the crypto industry were invited to the White House to discuss the rules of the game. The market interpreted this as a signal of legitimization. With such political support, Bitcoin maintained a strong position in high ranges, albeit with volatility.

Simultaneously, tough tariff policies, trade conflicts, and growing global instability were putting pressure on traditional markets, yet Bitcoin looked like an alternative in this context. In May, it confidently broke the $110,000 level for the first time, and over the summer, it set a new record above $123,000, eventually hitting an all-time high around $126,173 in October.

Several drivers contributed to this. A mass institutional influx began through ETFs, with major corporations and funds announcing billion-dollar purchases. Large private companies publicized multi-billion dollar plans to invest in BTC, with several entities from Japan and the US formally adopting "Bitcoin on the balance sheet" strategies. This created a sense that "the train had already left the station," prompting new players to enter at increasingly higher prices.

Moreover, the regulatory environment appeared favorable: the US was discussing laws aimed at providing clearer rules for the crypto market, and new appointments to key posts in regulatory bodies were seen as steps toward a more friendly policy.

However, the situation changed sharply in the fall. First, the Fed lowered rates by 25 basis points, which sparked short-term optimism: cheap money is a boon for risk assets. But the subsequent rhetoric from the central bank was cautious, with no hints of a swift cycle of cuts. The market began to oscillate violently: every signal triggered spikes, while every cautious comment led to pullbacks.

Then came another blow — 100% tariffs on Chinese imports, a new wave of trade war, and the largest cascade of liquidations on crypto exchanges in a long time. In a single day, positions for approximately 1.6 million traders were liquidated, totaling over $19 billion. This was a telling moment: there were too many leverages and overheated positions, and the market experienced an immediate crash among margin players.

By November, another factor emerged — a record monthly outflow from Bitcoin ETFs exceeding $2.33 billion, symbolizing a shift in sentiment among some large investors. Concurrently, discussions about budget issues in the US, a potential new government shutdown, and political chaos intensified. All this made risk assets, including Bitcoin, less attractive.

Where Bitcoin stands now and what it means

As of November 20, 2025, Bitcoin is trading around $92,000–94,000. This is about a third lower than its all-time high and close to the lows of the past six months.

The market is clearly scared; significant technical levels have been breached, sentiment indices are in the red zone, and outflows from ETFs indicate that some smart money has shifted to cash or moved to other segments.

However, it is crucial to understand that Bitcoin does not appear to be a "dead" asset. It has not disappeared from the radar of major players. On the contrary, by 2025, it has firmly established itself as a part of the larger financial system: a strategic reserve is emerging at the state level, corporations are integrating BTC into their strategies, and legislators are discussing relevant acts.

The market is currently experiencing a phase of intense recalibration of expectations. After a year in which crypto seemed invincible, it has had to confront reality: political risk, regulatory swings, a high proportion of leveraged positions, and dependency on global rates and sentiments in the stock market.

The current picture of Bitcoin: a clash of two narratives The first narrative describes a nervous present: a drop of nearly 30%, a trillion-dollar capital loss, fear, outflows, a "death cross," and a sense that the market is fatigued from the rally. The second narrative is a long-term story: halving, institutionalization, political recognition, and Bitcoin's incorporation into the strategies of governments and corporations.

In the short term, fear is prevailing. In the long run, if infrastructure and institutional interest continue to develop, Bitcoin stands a chance of returning to growth.

But the main takeaway for investors now is simple: Bitcoin is no longer seen as a "risk-free fairy tale." It is a mature, volatile asset tied to politics and macroeconomics, capable of delivering records — and just as swiftly taking them back. It should be viewed not as a mythical "digital dream" but as a fully-fledged, albeit very nervous, element of a portfolio that is undergoing one of the most significant tests it has faced in recent years.