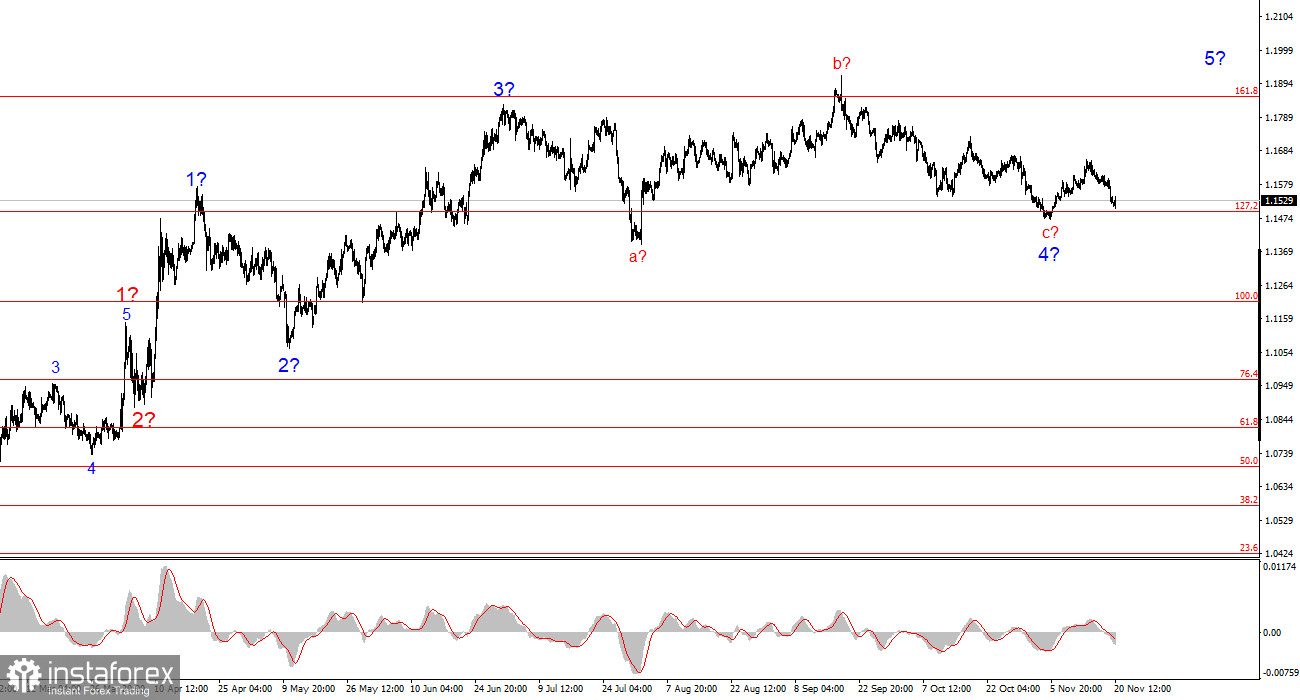

The wave pattern on the 4-hour chart for EUR/USD has transformed, but overall it remains quite clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure has become significantly more complex and extended since July 1. In my view, the instrument is in the process of forming corrective wave 4, which has taken on a non-standard shape. Within this wave we observe exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

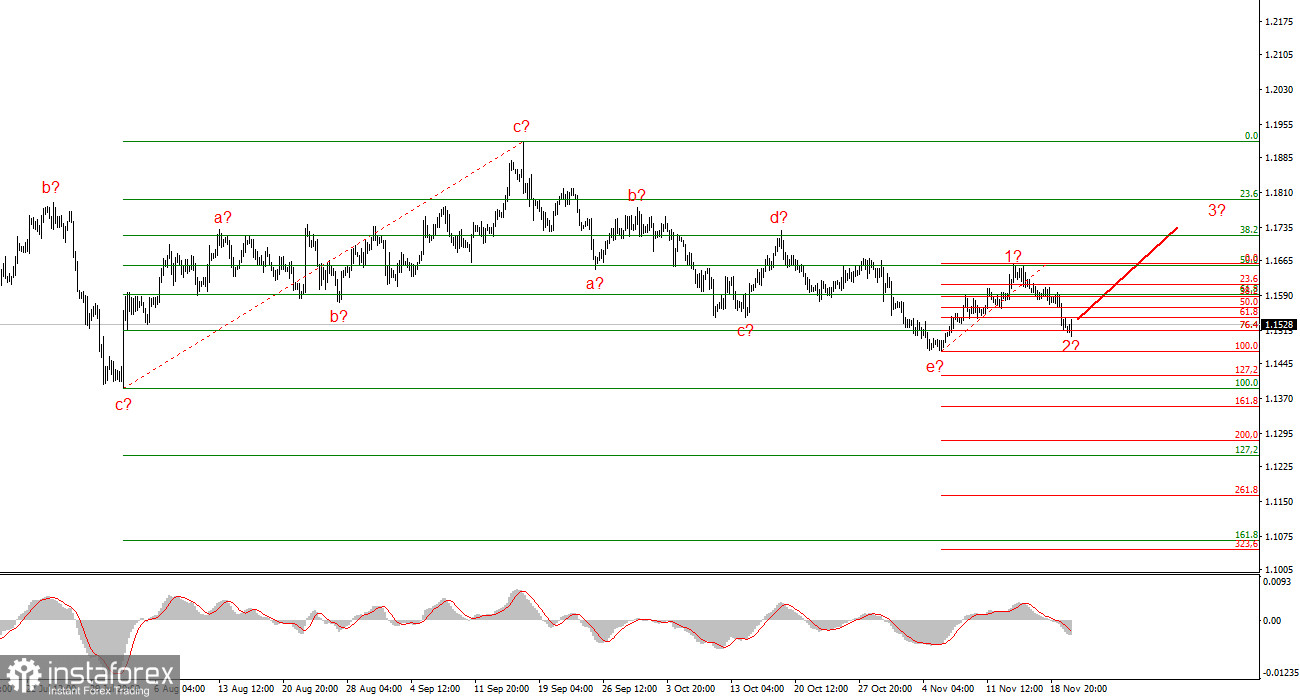

In my opinion, the formation of the upward trend segment is not yet complete, and its targets extend up to the 1.25 level. The series of waves a-b-c-d-e appears complete, and therefore I expect the formation of a new upward wave set in the coming weeks. We have seen the presumed wave 1 or a, and now the instrument is in the process of forming wave 2 or b. I expected the second wave to finish in the 38.2%–61.8% Fibonacci area of the first wave, but today the quotes dropped to 76.4%. Such a decline still allows for the formation of wave 3 or c.

The EUR/USD rate again remained almost unchanged during Thursday. As of the start of the U.S. session, the movement amplitude was about 20 basis points. A couple of hours ago, the U.S. released reports the market had been waiting for over a month. But as it turned out, not very eagerly—judging by the reaction. What kind of reaction is 40 points for two major reports?

Today's U.S. data was mixed. Payrolls for September came in at 119,000 versus the market expectation of 50,000. However, at the same time, the unemployment rate rose to 4.4%, which the market did not expect. So one report suggested the U.S. currency could continue strengthening, while the other strongly opposed it. As of now, market participants haven't decided which report is more important or what they mean together, so market movements remain minimal.

Unfortunately, the reports the market had been anticipating even more than the FOMC meeting are now outdated. Who cares about September data at the end of November? Today it also became known that the unemployment and labor market reports for October will not be released at all, so the next data will reflect the situation for November. The market will likely draw conclusions based on those numbers. The September payroll report significantly reduced the likelihood of a Fed rate cut in December, which is good for the dollar.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument is continuing to build an upward trend segment. Over the past few months, the market has taken a pause, but Donald Trump's policies and the Federal Reserve remain significant factors for the future decline of the U.S. currency. The targets of the current trend segment may extend up to the 1.25 level. At this time, the construction of an upward wave set may continue. I expect that from the current positions, the formation of the third wave of this set will begin, which may be either wave c or wave 3. In the coming days, I am considering long positions with targets around 1.1740, and an upward reversal of the MACD indicator will confirm this signal.

On a smaller scale, the entire upward trend segment is visible. The wave structure is not the most standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 in wave 3. However, such cases do occur. I remind you that it is best to identify clear structures on the chart rather than trying to label every single wave. Currently, the upward structure raises no doubts.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often indicate changes.

- If there is no confidence in what is happening in the market, it's better not to enter it.

- There can never be 100% certainty about the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.