Bitcoin fell below $86,000 yesterday, and it still seems far from the limit. Ethereum also dropped to around $2,800 and shows no signs of a significant upward trend.

Meanwhile, panic continues in the cryptocurrency market, which is only being exacerbated by active selling in the US stock market, and discussions about where the bottom of this cycle will be are increasing.

Another liquidation of buyers totaling nearly $1 billion vividly characterizes the current market situation. The fact that Bitcoin will have difficulty returning to the $100,000 level indicates that the bullish cycle, which peaked in early autumn last year, is over. Many experts suggest the current decline could reach $56,000. However, given the significant players involved in the market, it is unlikely that we will see such a deep correction. Levels around $75,000 to $70,000 will become reality. Their renewal could happen as early as mid-December, provided that the Federal Reserve abandons further plans to lower rates and stimulate the economy.

It is essential to understand that any forecasts, even the most well-founded, can be adjusted due to unforeseen events or abrupt changes in investor sentiment. Regulation of cryptocurrencies, geopolitical tensions, technological breakthroughs, or large-scale exchange hacks can all significantly impact the price of Bitcoin and other cryptocurrencies. Therefore, despite pessimistic expectations for a recovery by mid-December, investors should exercise caution and avoid making impulsive decisions. Diversifying the portfolio, moderate use of leverage, and constant monitoring of news and analytics are key factors for successful trading in the cryptocurrency market.

Regarding the intraday strategy for the cryptocurrency market, I will continue to act based on any significant drops in Bitcoin and Ethereum, anticipating continued bullish market development in the medium term, which has not disappeared.

For short-term trading, the strategy and conditions are outlined below.

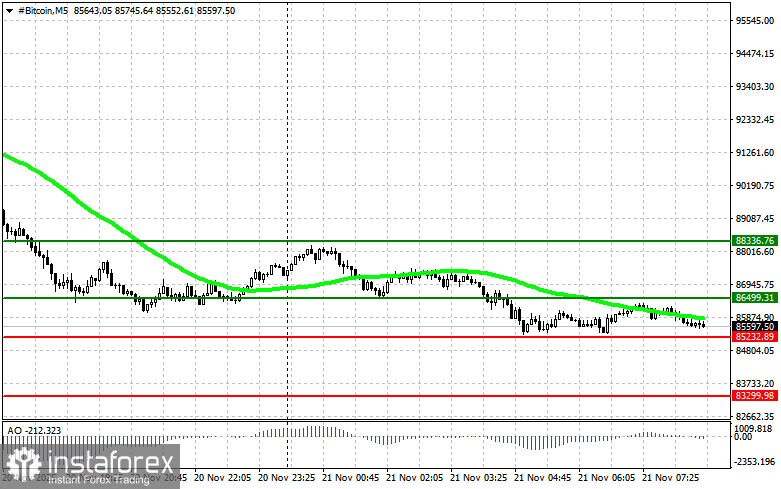

Bitcoin

Buy Scenario

- Scenario #1: I will buy Bitcoin today if it reaches an entry point around $86,500, with a target of $88,300. Around $88,300, I will exit my purchases and sell immediately on the rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: I can buy Bitcoin from the lower boundary of $85,200 if there is no market reaction to its breakout back toward levels of $86,500 and $88,300.

Sell Scenario

- Scenario #1: I will sell Bitcoin today when it reaches an entry point around $85,200, aiming for a decline to $83,300. Near $83,300, I will exit my sales and buy immediately on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: I can sell Bitcoin from the upper boundary of $86,500 if there is no market reaction to its breakout back toward levels of $85,200 and $83,300.

Ethereum

Buy Scenario

- Scenario #1: I will buy Ethereum today if it reaches an entry point around $2,821, with a target of $2,891. Around $2,891, I will exit my purchases and sell immediately on the rebound. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: I can buy Ethereum from the lower boundary of $2,765 if there is no market reaction to its breakout back toward levels of $2,821 and $2,891.

Sell Scenario

- Scenario #1: I will sell Ethereum today when it reaches an entry point around $2,765, aiming for a decline to the level of $2,702. Near $2,702, I will exit my sales and buy immediately on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: I can sell Ethereum from the upper boundary of $2,821 if there is no market reaction to its breakout back toward levels of $2,765 and $2,702.